Shares of Global Health -- the operator of Medanta hospital chain -- have been under pressure for three straight sessions, falling over 13 percent despite reporting strong Q4 earnings. Analysts are concerned about the hospital chain's slow margin expansion due to ongoing capital expenditure and the stock's high valuations after the recent rise.

On May 22, Global Health stock slipped over 7 percent to Rs 1,240.45 on the NSE. Despite this drop, the stock has risen over 113 percent in the past year, allowing investors to secure partial profits.

Slower near-term margin expansion expected for long-term growth

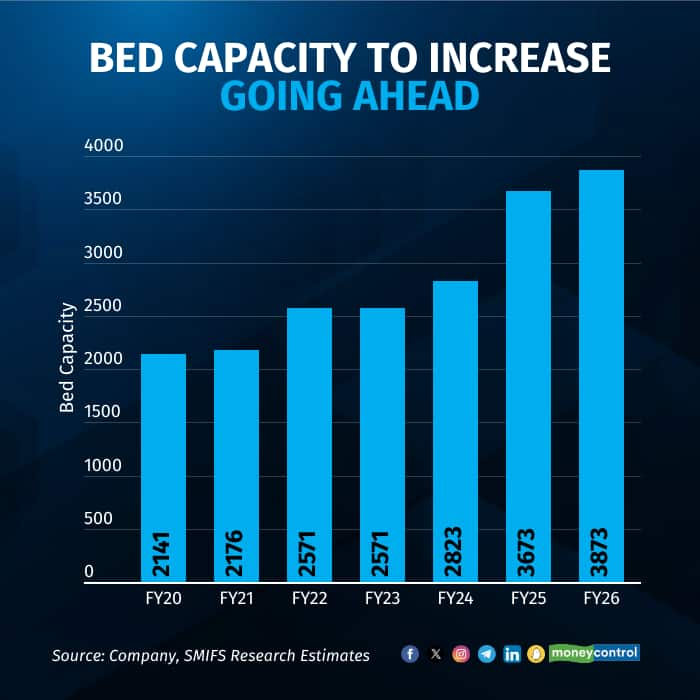

Global Health's margin expansion is likely to remain sluggish in the coming years due to the capital expenditure at its newly launched Patna and Lucknow hospitals. The company has plans to invest an additional Rs 1,000-1,200 crore in capex over the next two-three years for adding 1,650 beds. This is on top of the capex of Rs 303.5 crore and Rs 99.5 crore allocated for the company's Noida hospital in FY24.

Global Health capex is aimed at adding beds and increasing capacity to secure long-term growth drivers, but it will put some pressure on the near-term margin growth, said Kripashankar Maurya, AVP at Choice Broking.

Global Health's margin profile will remain impacted because of this ongoing expansion, delays in receiving final approvals for new facilities, and the lack of planned tariff hikes in the coming year, said Maurya.

He expects Global Health's EBITDA margin to expand slightly, reaching 24.8 percent in FY25 and 25.4 percent in FY26, compared to 24.4 percent in FY24.

High valuations limit upside potential

Global Health's share price has more than doubled in one year due to expectations of strong growth in the hospital sector, its expansion into new markets such as Lucknow and Patna, and aggressive bed additions. Improving ARPOBs (Average Revenue Per Occupied Bed) also contributed to the increase.

Analysts say that the current valuations of the scrip completely factor in its growth prospects, leaving little room for more upside. Due to this limited upside, brokerage SMIFS downgraded its rating on Global Health stock to 'reduce', with a price target of Rs 1,458.

Long-term growth levers still intact

The company's expansion into areas like the NCR market through Noida, along with those in underpenetrated areas like Lucknow, Patna and Indore are expected to drive earnings growth in the long-term.

Continuous bed additions in existing as well as newer hospitals are driving increased footfalls for the company. On that account, Motilal Oswal Financial Services believes earnings growth for Medanta will be largely driven by an increasing number of patients seeking treatment and a moderate increase in realisation per patient. "This provides robust visibility for earnings growth of 22 percent CAGR over FY 24-26," MOFSL said.

Global Health reported healthy earnings for the January-March quarter. In Q4, the company posted a 25 percent on year growth in its consolidated profit to Rs 127 crore while its revenue grew over 21 percent to Rs 3,350 crore.

EBITDA margin, however, contracted 40 basis points on year to 23.6 percent, largely dragged by higher than expected employee and other expenses.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.