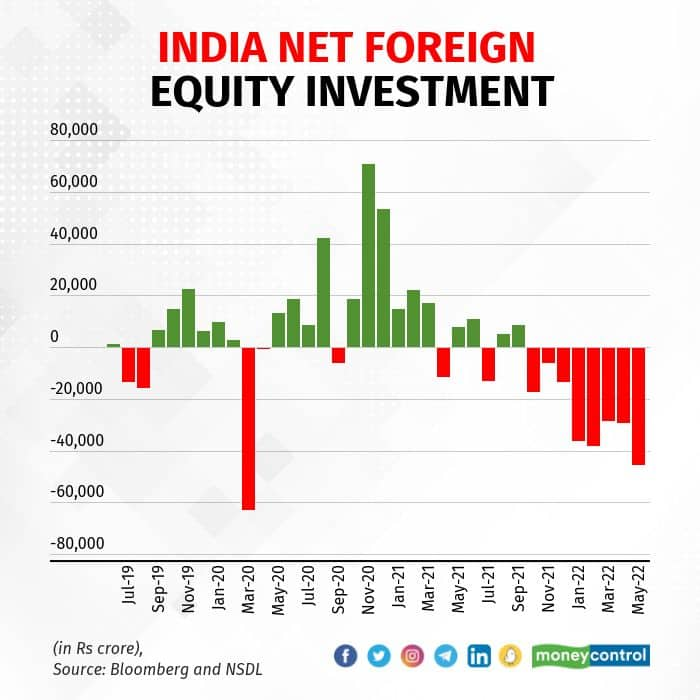

The incessant selling by foreign portfolio investors in India reached new heights in May as monthly net outflows touched Rs 45,276 crore, the second biggest single-month outflow since March 2020, data on National Securities Depository Limited's website showed.

In March 2020, when the COVID-19 pandemic triggered a nation-wide lockdown, foreign investors net sold domestic stocks worth Rs 62,000 crore.

May also marks the eighth consecutive month of net selling from foreign investors in Indian stocks, also one of the longest ever streaks of selling seen on record.

The sharp selling from foreign investors saw the benchmark Nifty 50 and BSE-Sensex index fall more than 3 percent in the month, which made it the worst performance from the indices in May since 2012.

The selling from foreign investors comes amid rising bets of US Federal Reserve raising interest rates too aggressively to contain inflation and risking a recession in the US economy. Further, the ongoing war in Eastern Europe and lockdowns in China have exacerbated global supply chain issues.

In April, the International Monetary Fund slashed global GDP growth rate forecast to 3.6 percent for 2022 as compared to earlier estimate of 4.4 percent. In 2021, global economy expanded at the rate of 6.1 percent, which was one of the fastest growth seen since the Second World War.

Financial services and information technology companies bore the brunt of the selling pressure from foreign investors. As of May 15, FPIs had net sold financials and IT stocks worth a combined 18,500 crore, data on National Securities Depository Limited showed.

Brokerage firm Phillips Capital, however, is hopeful that the trend of foreign selling may wane in the coming months as slowing global and US growth forces the US Federal Reserve to ease its monetary policy tightening spree.

“We also expect FII outflows from India to taper from hereon and continue to foresee a likelihood of less hawkish monetary policies across globe (including India) than being anticipated currently,” Phillips Capital said in a note.

The brokerage firm expects the Indian stock market and economy to withstand any global slowdown and remain an outperformer in 2022. Despite the record selling from foreign investors, Indian stocks have fallen less than most developed and developing economy markets so far this year.

Strong buying from domestic mutual funds and retail investors have provided a cushion for absorbing the significant foreign investors-led selling in the market, analysts said. Domestic mutual funds have net bought local stocks worth Rs 92,580 crore in 2022.Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.