November 07, 2022 / 16:03 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities

Although, markets witnessed a roller-coaster ride in intra-day session, key indices maintained their upward bias on the back of firm global cues. Another positive factor has been the strengthening in rupee level against the dollar, which if continues could further bolster foreign institutional investor buying into local shares. Technically, the Nifty is holding a higher bottom formation but at the same time it is consistently taking resistance near 18260 levels. In addition, on daily charts, the index has formed a Doji candlestick formation which is indicating indecisiveness between the bulls and bears. For trend following traders 18050 and 18000 would act as key support levels. If the index trades above 18050, it could hit 18300-18350 levels. On the flip side, below 18050, Nifty could retest the level of 17950-17900.

November 07, 2022 / 16:01 IST

Avinash Pathak, Research Analyst at LKP Securities

FMCGsector remains cautiously optimistic in near term as prices of some commodity items ease and expect this to percolate to improvement in gross margins in the second half of H2FY23. Further with better monsoon and crop harvest, rural demand is expected to gradually improve leading to better volumes.

November 07, 2022 / 15:59 IST

Vinod Nair, Head of Research at Geojit Financial Services

The domestic market battled to find a clear direction but it ended up making gains. Losses in pharmaceutical companies were offset by buying in PSU banks, auto, and metal equities. PSU banks took the lead in the rally as major sector players announced solid results. Fall in oil prices as China disputed rumours of lifting Covid restrictions and stronger US jobs data showed that the US economy is expanding, helped market. However, investors will await US inflation data for market direction as there aren't many domestic clues left as the corporate earnings season is drawing to close with a negative bias.

November 07, 2022 / 15:55 IST

Deepak Jasani, Head of Retail Research, HDFC Securities

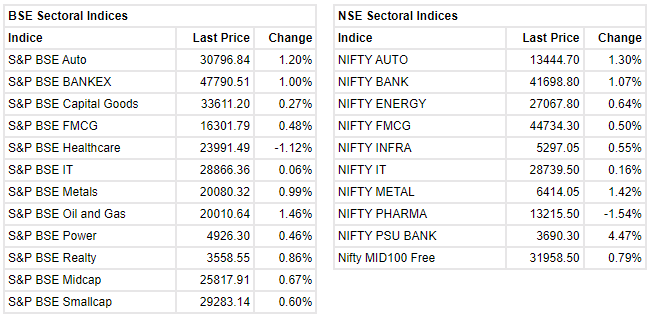

Volumes on the NSE were higher than recent averages. Among sectors, Metals, Auto, Oil & Gas and Realty rose the most while Healthcare and Consumer Durables fell the most. Broad market indices outperformed the Nifty rising 0.64-0.69 percenteven as the advance decline ratio rose to 1.50:1.

Nifty recovered well from the intra day lows to close again in the positive. It could now face resistance from the 18,287-18,322 band after a break on Tuesday while 18,090 could offer support in the near term.

November 07, 2022 / 15:47 IST

Mohammed Imran, Research Analyst at Sharekhan by BNP Paribas

Oil has struggled to find direction in recent sessions, with lacklustre trading volumes rendering futures especially susceptible to macro market moves. The October crude oil imports rose in China to be around 10.5 mbpd from 9.79 mbpd of September, indicating recovery in demand from the largest energy importing nation of the world. With lack of economic data today, the volumes remains thin and hence we expect the sideways, directionless movement for the day. WTI December faces resistance around $95/bbl, while $88 remains the strong support.

November 07, 2022 / 15:45 IST

Rupak De, Senior Technical Analyst at LKP Securities

The benchmark Nifty remained volatile during the session before closing with a gain. On the daily chart, the index has remained above the previous swing high, suggesting ongoing uptrend. The momentum indicator RSI is in positive crossover. Over the short term, the trend may remain bullish, with a potential to reach towards 18300/18600. On the lower end, support is placed at 18000.

November 07, 2022 / 15:35 IST

Rupee At Close: Rupee ends at 81.92/$ against Friday’s close of 82.44/$

November 07, 2022 / 15:32 IST

Markets At Close

Sensex up 234.79 points or 0.39 percentat 61,185.15. Nifty up 82.60 points or 0.46 percentat 18,199.80. About 1994 shares advanced, 1465 shares declined, and 185 shares were unchanged.

November 07, 2022 / 15:14 IST

Greenply Ind Q2FY23

-Net profit down 26 percent at Rs 23.6 crore vs Rs 31.9 crore

-Revenue up 14.4 percent at Rs 494.7 crore vs Rs 432.4 crore

-EBITDA down 1.8 percent at Rs 48.8 crore vs Rs 49.7 crore

-Margin at 9.9 percentvs 11.5 percent

November 07, 2022 / 14:57 IST

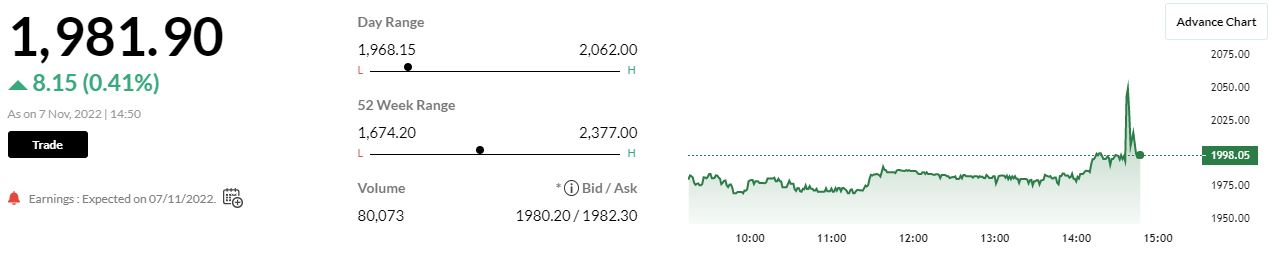

Mold-Tek Packaging Q2

: Net profit up 10.2 percentat Rs 19.4 crore against Rs 17.6 crore YoY. Revenue rose 14.5 percent YoY at Rs 182.6 crore against Rs 159.5 crore. EBITDA rose 67 percentto Rs 34.1 crore and margin came in at 18.7 percent. The stock was trading at Rs 936.95, down Rs 0.10, or 0.01 percent on BSE. It has touched an intraday high of Rs 961.55 and an intraday low of Rs 925.40.

November 07, 2022 / 14:51 IST

Vinati Organics Q2

-Net profit grew 14.6 percent YoYat Rs 116 crore against Rs 101.2 crore

-Revenue up 11.9 percentYoY at Rs 566.3 crore against Rs 506.3 crore

-Margin at 26.2 percentvs 35.9 percent

November 07, 2022 / 14:41 IST

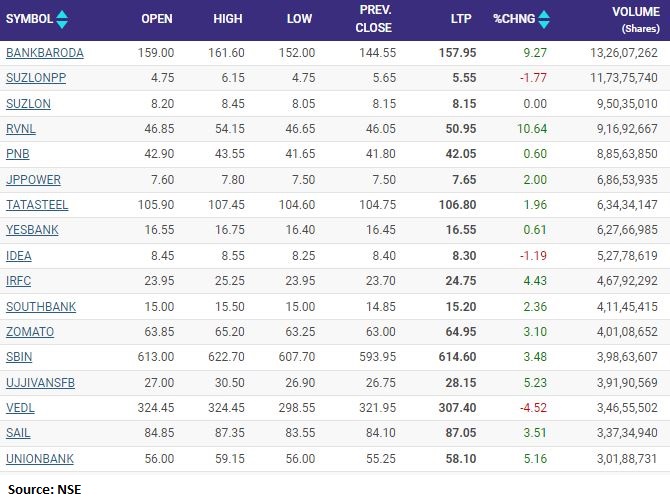

Most active stocks on NSE in terms of volumes

November 07, 2022 / 14:33 IST

Inox Green Energy Services fixes IPO price band at Rs 61-65 a share

:

Inox Green Energy Services, the subsidiary of Inox Wind, has fixed a price band at Rs 61-65 a share for its initial public offering (IPO) that opens for subscription on November 11. The 30th public issue of 2022 will close on November 15. Anchor book will opened on November 10. The Rs 740-crore IPO comprises a fresh issue of Rs 370 crore and an offer for sale of sales worth Rs 370 crore by promoter Inox Wind.