September 13, 2022 / 16:09 IST

Sugandha

Sachdeva, Vice President - Commodity and Currency Research, Religare Broking The Indian rupee has perked up by around 0.45 percent, appreciating on the back of strong portfolio inflows, as well as the recent slide witnessed in the dollar index from two-decade highs. The greenback has reversed course amid expectations of a cool-off in inflation and eventual softening of Fed’s aggressive policy stance. There are a lot of concerns about the faltering global economic backdrop, but domestic equities are cruising higher amid improving risk sentiments which supports an appreciation bias for the domestic currency.

Besides, stable oil prices are further aiding the outlook for the domestic currency. However, as per the latest data, headline retail inflation has inched higher to 7 percent in August as compared to a reading of 6.71 percent in July-a five-month low which is capping gains in the local currency to a certain extent. Looking ahead, we foresee some resistance for the rupee-dollar exchange rate at the 79 mark, while a breach of the same would pave the way for the 78.50 mark in the coming days.

September 13, 2022 / 16:05 IST

Vinod Nair, Head of Research, Geojit Financial Services

Positive indicators from the domestic economy, such as FII inflow, improving macro-parameters and decreased inflation, were the key factors for the current surge in the Indian market. However, global markets have recently joined the rally ahead of the release of US inflation data, as the market expects a further ease in inflation, which would help the Fed take a less hawkish stance.

Although the domestic CPI at 7 percent indicates a rising inflation trend due to increased food prices, core inflation of 5.9 percent offers some solace. The policy decisions made by the RBI and Fed at their upcoming policy meetings will drive the market going ahead.

September 13, 2022 / 15:55 IST

Kunal Shah, Senior Technical Analyst, LKP Securities

Nifty surpassed the psychological mark of 18,000 and managed to close above it indicating the continuation of the ongoing momentum. The lower end support stands at the 17,900-17,875 zone and as long as the mentioned support is held, it remains in a buy mode. The immediate resistance on the upside is at 18,100 and once taken out will open the room for 18,400-18,500 on the upside.

The Bank Nifty index witnessed a gap up opening and sustained the level throughout the day which confirms the strength. The index immediate hurdle is placed at 41,000 where the highest open interest is built up on the call side and once breached will see a sharp short covering towards 41,500-41,800 levels.

September 13, 2022 / 15:52 IST

Deepak

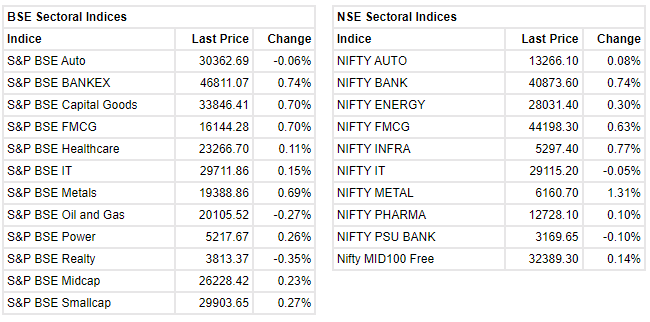

Jasani, Head of Retail Research, HDFC Securities Nifty rose for the fourth consecutive session on Sept 13 aided by positive global cues. Among sectors, metals, banks, capital goods and FMCG indices rose the most while Oil & Gas and Realty indices fell the most. Advance decline ratio was just above 1:1.

Nifty breached the 17,992 resistance with a gap-up. It will need to build on to the gains for the upward momentum to continue. The broader markets seem a bit tired. The US CPI number due in the evening and the US market reaction to the number may influence the opening of our markets tomorrow. Nifty could face resistance at 18,115 (and 18,308 later) while 17,968 could offer support in the near term.

September 13, 2022 / 15:49 IST

Mohit Nigam, Head - PMS, Hem Securities

Indian equity benchmarks continued gaining momentum in late afternoon session on sustained buying activities. Sentiments remained upbeat even after India’s retail inflation rate rose to 7 percent from 6.7 percent in the previous month.

On the technical front, key resistance level for Nifty is 18,200and on the downside 17,800 can act as strong support. Key resistance and support levels for Bank Nifty are 41,500 and 39,500 respectively.

September 13, 2022 / 15:48 IST

10-year bond yield slips to 7.11 percent versus previous day’s 7.18 percent, despite higher CPI number

September 13, 2022 / 15:46 IST

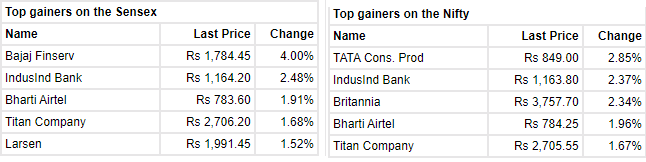

Take a look at the top gainers on Nifty and Sensex

September 13, 2022 / 15:39 IST

Rupee At Close | Rupee ends at 79.15/$ versus Monday’s close of 79.52/$

September 13, 2022 / 15:36 IST

Markets close at 5-month high

Sensexended the day 451.03 points higher at 60,566.16. Nifty gained 130.50 points to close above 18,000. About 1776 shares advanced, 1600 shares declined, and 101 shares were unchanged. Both indices ended at five-month highs.

Among sectors, metals were the biggest gainers with Vedanta surging 3 percent while Jindal Steel and Hindalco adding over a percent each. FMCG stocks also led the rally with Britannia and Tata Consumer Products surging 2.5 percent, among the top Nifty gainers. Reversing Monday's rally, IT stocks ended the day lower as TCS, HCL Tech and Tech Mahindra ended the day in red.

September 13, 2022 / 15:11 IST

Dairy stocks under pressure after a virus kills over 57 thousand cattle

ParagMilk Foods lost 1.1 percent,DodlaDairy dropped 1 percent, Heritage Foods fell 1.61 percent,UmangDairies erased 3.3 percent,HatsunAgro down 0.1 percent. According to latest reports, about 57,000 cows have died due to Lumpy Virus across the country. Out of these, a maximum of 37 thousand deaths have been registered in Rajasthan. The virus has spread in 6-7 states including Gujarat, Rajasthan, Punjab, Haryana, and Uttar Pradesh.

September 13, 2022 / 14:27 IST

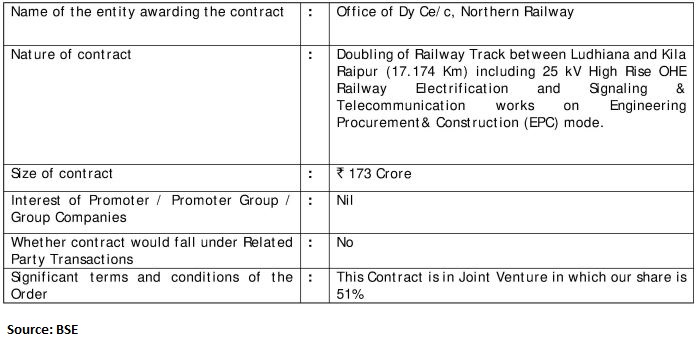

GPT Infraprojects bags order valued at Rs 173 crore

September 13, 2022 / 14:24 IST

Indian rupee can take care of itself, says CEA Anantha Nageswaran

Indian authorities are not "defending" the rupee as it can take care of itself, Chief Economic Adviser V Anantha Nageswaran has said. "I think India isn't defending the rupee. India is just making sure that the market forces and the economic fundamentals direct the rupee in a particular direction and making sure that it is happening smoothly and gradually," the government's top economist said on September 13 while speaking at the 15th Mindmine Summit. "I don't think Indian fundamentals are such that we need to defend the rupee. The rupee can take care of itself," he added.