Taking Stock | Market Closes At Fresh Record Highs With Nifty Above 13,850; Metals Outshine

The Nifty Metal index and PSU Bank rose more than 2 percent and Nifty Bank index added 1 percent, while some selling was seen in pharma names.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 83,216.28 | -94.73 | -0.11% |

| Nifty 50 | 25,492.30 | -17.40 | -0.07% |

| Nifty Bank | 57,876.80 | 322.55 | +0.56% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Shriram Finance | 816.35 | 23.85 | +3.01% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Bharti Airtel | 2,001.20 | -93.70 | -4.47% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Metal | 10426.80 | 144.90 | +1.41% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Infra | 9393.60 | -95.20 | -1.00% |

Indian rupeeendedmarginallyhigherat 73.57 per dollar,amidbuying seen in the domestic equity market.It opened flat at 73.52 per dollar against Thursday's close of 73.54 and trade in the range of 73.46-.73.61.

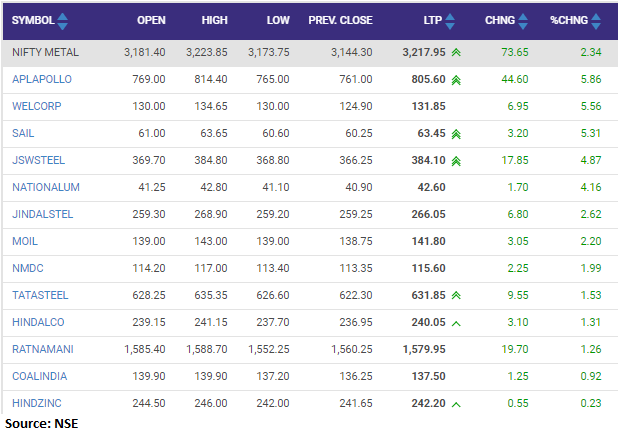

Markets started the week on a buoyant note and posted decent gains led by positive global cues. The optimism over the news that the US President has signed the stimulus package triggered healthy buying in the equity markets. Besides, participants also took note of the beginning of the vaccine drive in various parts of the world. Consequently, the Nifty index settled around the day’s high at 13,883 levels. The broader markets too witnessed healthy buying interest with Midcap and Smallcap ending higher by 0.8% and 1.5% respectively. On the sector front, all the indices ended with gains wherein Metal, Realty and Consumer Durables were the top outperformers.

We’re mirroring the global markets and indications are in favour of prevailing up move to continue and Nifty can test another milestone of 14,000 mark soon. On the domestic front, Auto sales numbers and PMI data would be actively tracked by participants ahead. Meanwhile, we suggest maintaining a positive yet cautious stance and avoiding contrarian trades.

We are poised to hit 13900 and then 14000 but we might face some resistance around the present levels of the Nifty. There could be about of selling pressure between 13850-13950. We have good support at 13550-13600 and any corrective wave can be utilised to buy into this upward rally.

Index managed to hold its bullish stream and managed to close a day on a positive note for the fourth consecutive session. The index has decisively crossed 13800 zone which was a good hurdle and managed to close above the same hinting fresh doors are open for 14k mark on the higher side if managed to hold above 13800 zone, good support for the index is still placed at 13820-13770 zone and resistance is coming near 13900-14000 zone.

Benchmark indices closed at fresh record highs with Nifty above 13,850 supported by the metal and financials.

At close, the Sensex was up 380.21 points or 0.81% at 47,353.75, and the Nifty was up 123.90 points or 0.90% at 13,873.20. About 1990 shares have advanced, 965 shares declined, and 177 shares are unchanged.

Tata Motors, JSW Steel, HDFC Life, Titan and SBI Life Insurance were among major gainers on the Nifty, while losers were Sun Pharma, HUL, Shree Cements, Britannia Industries and Cipla.

Except pharma, all other sectoral indices were trading in the green. BSE Midcap and Smallcap ended with 0.8-1.5 percent gains.

The market witnessed a lackluster movement and lack of momentum. It stayed in the range between the level of 13800-13880. 13750-13780 would be a support zone. As the market has sustained over the crucial level of 13750, we can expect the volatility to expand, which could lead to an upside projection till the levels of 13990. The momentum indicators like RSI, MACD indicating a positive outlook to continue and market breadth to improve further.

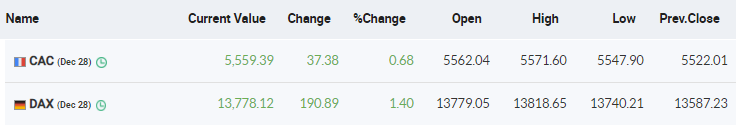

European shares gained on Monday after Britain and the European Union signed a long awaited trade deal, while a bumper U.S. stimulus package boosted investor sentiment for riskier global assets.

U.S. President Donald Trump on Sunday signed into law a $2.3 trillion pandemic aid and spending package, restoring unemployment benefits to millions of Americans and averting a federal government shutdown in a crisis of his own making.

Oil prices edged higher on Monday after U.S. President Donald Trump signed a $2.3 trillion coronavirus aid and spending package, although lingering worries about near-term demand weighed on the market.

Lupin launched Meloxicam Capsules, 5 mg, and 10 mg, having received an approval from the United States Food and Drug Administration. Meloxicam Capsules is the generic equivalent of Vivlodex Capsules of Zyla Life Sciences US, Inc., and indicated for management of osteoarthritis (OA) pain.