September 17, 2021 / 16:36 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities

Bullish momentum continued today and both benchmark indices touched fresh highs but investors showed signs of nervousness as the market witnessed a late bout of profit-taking towards the closing stages.

Technically, benchmarkNifty maintained uptrend continuation formation which is broadly positive but due to temporary overbought situation, bulls may prefer to take a cautious stance near the 17,800 resistance level.

For Nifty, 17,700 would be the immediate resistance level traders will have to look at, and below the same, the correction wave is likely to continue up to 17,450-17,350 levels.

If the index trades above 17,700, the uptrend texture will continue up to 17,800-17,950 levels. Contra traders can take a long bet near 17,350 with a strict 17,300 support stop loss.

Meanwhile, Bank Nifty has formed a strong bullish formation and the structure suggests further upside if it succeeds to trade above 37,000.

September 17, 2021 / 16:13 IST

Vinod Nair, Head of Research at Geojit Financial Services

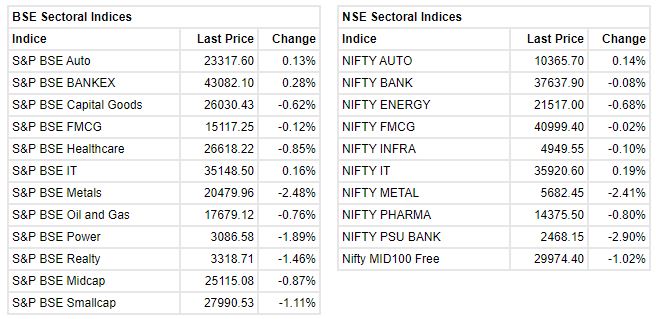

Despite a strong opening, domestic indices gave up early gains to trade flat driven by profit-booking and mixed global sentiments. PSU Banks were heavily wounded by profit-booking although the government approved a guarantee of Rs 30,600 crores to the National Asset Reconstruction Company Ltd with an aim to clean stressed assets from the banking sector. Global markets traded cautiously bracing for the Fed Reserve and Bank of England policy meetings next week.

September 17, 2021 / 15:35 IST

Closing update:

Market benchmarks the Sensex and the Nifty snapped their 3-day winning run on September 17 as investors booked profit after a stellar record-setting spree in the market.

Sensex closed 125 points, or 0.21 percent, lower at 59,015.89 while the Nifty finished at 17,585.15, down 44 points, or 0.25 percent.

BSE Midcap index fell 1.14 percent and the smallcap index closed with a loss of 1.06 percent.

September 17, 2021 / 15:13 IST

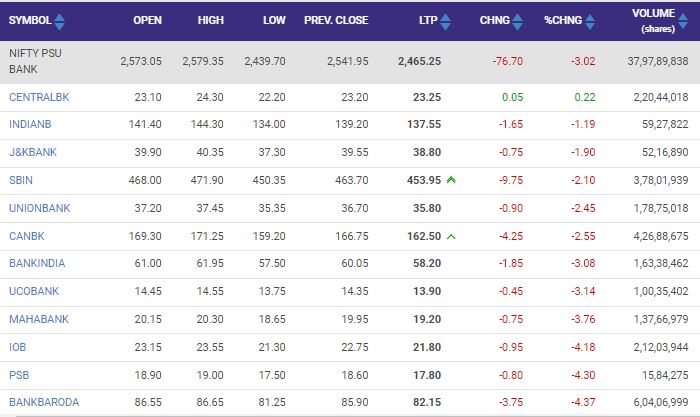

Nifty PSU Bank index has cracked more than 3%

September 17, 2021 / 15:07 IST

More than 250 stocks hit their upper circuits:

More than 250 stocks, including Coffee Day Enterprises, Jindal Poly Investment and Finance Company, Grand Foundry, California Software, Sical Logistics, MRO-TEK Realty, Rohit Ferro Tech and Lancer Container Lines, hit their upper circuits in intraday trade on BSE.

September 17, 2021 / 15:03 IST

More than 225 stocks hit fresh 52-week highs:

More than 225 stocks, including Axis Bank, Bajaj Finserv, Bajaj Finance, Larsen & Toubro, SBI and Titan, have hit their fresh 52-week highs in intraday trade on BSE on September 17.

September 17, 2021 / 14:44 IST

Sensex has erased all gains and slipped into the red.

September 17, 2021 / 14:23 IST

Tapan Patel- Senior Analyst (Commodities), HDFC Securities

: Crude oil prices traded steady with benchmark NYMEX WTI crude oil prices were trading near $72.50 per barrel for the day. MCX Crude oil September futures were trading marginal down near Rs 5,320 per barrel by noon.

Crude oil prices are expected to trade sideways to down for the day with resistance at $74 and support at $70 per barrel. MCX Crude oil September has support at Rs 5,240 and resistance at Rs 5,380.

September 17, 2021 / 14:17 IST

IIFL Finance stock hits lower circuit

IIFL Finance share price hit 5 percent lower circuit on BSE after CDC Group sold stake in the company. UK-based development finance institution CDC Group Plc sold a 3.95 percent equity stake in financial services company IIFL Finance via open market transactions on September 16. The stock corrected 4.69 percent to settle at Rs 294.50.

CDC Group has offloaded shares through transactions, selling 50 lakh equity shares in the company at Rs 295.47 per share on the NSE and 1 crore shares at Rs 294.52 per share on the BSE, the bulk deal data showed.

September 17, 2021 / 14:03 IST

Market update at 2 PM: Sensex is up 129.28 points or 0.22% at 59270.44, and the Nifty added 19 points or 0.11% at 17648.50. Kotak Mahindra Bank and Bajaj Finserv are the top gainers while IRCTC and Tata Steel are the most active stocks.

September 17, 2021 / 13:59 IST

JM Financial announces Tranche I public issue of upto Rs 500 crore of secured, rated, listed, redeemable non-convertible debentures

: JM Financial Products Limited, the flagship NBFC arm of the JM Financial Group, announced Tranche – I public issue of Secured NCDs of face value of Rs 1,000 each. The stock was trading at Rs 89.65, down Rs 1.75, or 1.91 percent. It has touched an intraday high of Rs 92.90 and an intraday low of Rs 89.20.

September 17, 2021 / 13:46 IST

L&T Infotech joins Rs 1 lakh crore market cap club

Larsen & Toubro Infotech, a part of L&T group, has joined the elite club of Rs 1 lakh crore market capitalisation on September 17 after showing multibagger returns in last one year. With this, now this would be sixth IT company to have market cap in trillion after TCS, Infosys, Wipro, HCL Technologies and Tech Mahindra.

Healthy earnings growth, strong revenue visibility due to orderbook, increase in digital opportunities after Covid-19 pandemic which a key catalyst for the exponential growth of the Indian IT industry etc pushed the IT stocks higher including L&T Infotech that hit a market capitalisation of Rs 1,00,684.67 crore.

September 17, 2021 / 13:41 IST

eClerx Services approves share buyback worth Rs 303 crore