June 14, 2021 / 15:52 IST

Jateen Trivedi, Senior Research Analyst at LKP Securities:

Rupee traded minor weak around 73.25 after Friday's bearish trend where dollar index rise kept the pressure on rupee around 72.80 as base resistance for the rupee. Higher Crude price also keeps rise on rupee pressured near 73.00. All eyes will be on FED FOMC meets this week which will give direction to USDINR pair which is now in range of 73.10-73.45 for sessions ahead.

June 14, 2021 / 15:38 IST

Manish Hathiramani, proprietary index trader and technical analyst, Deen Dayal Investments:

The Nifty has respected the 15700 level on a closing basis. Despite the crack in the first hours of trade, it has managed to claw back its losses and has closed well above the lows of the day. 15900-16000 continues to remain the next target for the index and as long as 15700 holds, traders have no reason to be concerned. A buy on dips is a prudent strategy to adopt at these levels of the market.

June 14, 2021 / 15:37 IST

Rupee Close:

Indian rupeeended 20 paiselower at 73.27 per dollar, amidvolatile trade sawin the domestic equity market.It opened 14 paise lower at 73.21 per dollar against previous close of 73.07 and traded in the range of 73.10-73.28.

June 14, 2021 / 15:36 IST

Market Close

: Benchmark indices recovered smartly from the intraday lows and ended marginally higher in the volatile session.

At close, the Sensex was up 76.77 points or 0.15% at 52551.53, and the Nifty was up 12.50 points or 0.08% at 15811.90. About 1624 shares have advanced, 1625 shares declined, and 150 shares are unchanged.

Tata Motors, Reliance Industries, Wipro, Divis Labs and Bajaj Finance were among major gainers, while losers included Adani Ports, Coal India, Kotak Mahindra Bank, HDFC and Maruti Suzuki.

Mixed trend saw on the sectoral front with IT, energy and PSU bank indices ended in the green, while selling seen in the power, realty and metal names.

June 14, 2021 / 15:26 IST

Lupin Healthcare gets UK marketing approval to market Luforbec

Lupin today announced that its UK subsidiary, Lupin Healthcare (UK) Limited has received approval from the Medicines and Healthcare products Regulatory Agency (MHRA) to market Luforbec (beclometasone dipropionate/formoterol fumarate dihydrate) 100/6 µg pressurized metered dose inhaler (pMDI), the first branded generic of Fostair (beclometasone dipropionate/formoterol fumarate dihydrate) 100/6 µg pMDI, which has the potential to offer significant cost savings for the NHS.

At 15:19 hrs Lupin was quoting at Rs 1,192.05, down Rs 38.30, or 3.11 percent.

June 14, 2021 / 15:21 IST

Ashis Biswas, Head of Technical Research at CapitalVia Global Research:

The market witnessed a swift recovery after the initial fall and an attempt to hold the support level around the Nifty 50 index level of 15650. Trading above 15650 is positive from a short-term perspective. Sustaining above 15650 levels, the market expects to gain momentum, leading to an upside projection of 15900 levels.

The momentum indicators like RSI, MACD start showing signs of recovery after the sharp fall the Nifty 50 Index. The market does not observe any divergence signal, alerting any potential deep correction.

June 14, 2021 / 15:10 IST

Adani Group Clarification:

Adani group requested Registrar and Transfer Agent, with respect to the status of the Demat Account of the 3 foreign funds and have their written confirmation clarifying that the Demat Account in which the 3 funds hold the shares of the company are not frozen.

June 14, 2021 / 15:01 IST

Market at 3 PM

Benchmark indices recovered from the lows and trading in the green with buying seen in the PSU bank and IT names. However, power and realty indices were remained under pressure.

The Sensex was up 102.94 points or 0.20% at 52577.70, and the Nifty was up 18 points or 0.11% at 15817.40. About 1473 shares have advanced, 1577 shares declined, and 115 shares are unchanged.

Top losers were Adani Ports, Coal India, HDFC, Kotak Mahindra Bank and Maruti Suzuki, while gainers were Tata Motors, Reliance Industries, Bajaj Finance, Wipro and ONGC.

June 14, 2021 / 14:55 IST

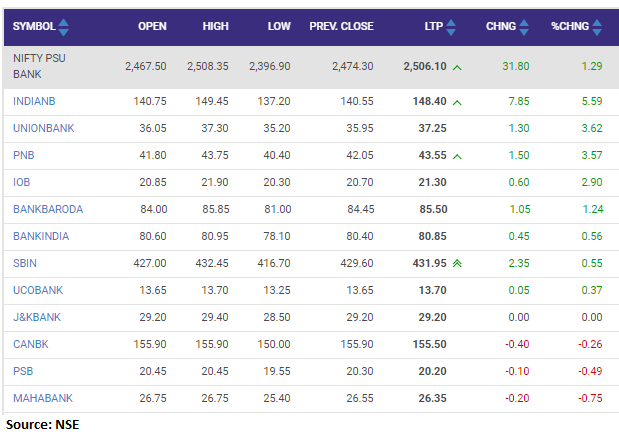

Nifty PSU Bank index added over 1 percent led by the Indian Bank, Union Bank of India, PNB, IOB:

June 14, 2021 / 14:47 IST

Motilal Oswal on BHEL

We now estimate FY22E to be loss making and reduce our FY23E EPS estimate by 36%. While orders are few and far between, the pricing environment remains highly competitive, limiting scope for margin expansion. On its ongoing diversification strategy, the company has won its first order for an SRU for IOCL Panipat and is restructuring its Solar business division.

Any material financial impact is still a long time away. We maintain our sell rating, and change our valuation methodology to EV/EBITDA basis (from P/E earlier), with a target price of Rs 40/share (12x FY23E EV/EBITDA).

June 14, 2021 / 14:38 IST

Gold Updates:

Gold fell nearly 1% on Monday to its lowest in more than a week, weighed down by a stronger dollar, while investors awaited the outcome of the U.S. Federal Reserve policy meeting due this week with recent spikes in consumer prices seen as a temporary blip.