Taking Stock | Sensex Up 347 Points, Nifty Above 13,350 As Market's Record Run Continues

The Nifty PSU Bank index rose 2 percent, while FMCG, infra and pharma rose a percent each.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 84,950.95 | 388.17 | +0.46% |

| Nifty 50 | 26,013.45 | 103.40 | +0.40% |

| Nifty Bank | 58,962.70 | 445.15 | +0.76% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Eternal | 309.55 | 5.80 | +1.91% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| TMPV | 372.70 | -18.50 | -4.73% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty PSU Bank | 8491.65 | 91.75 | +1.09% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Metal | 10495.90 | 1.10 | +0.01% |

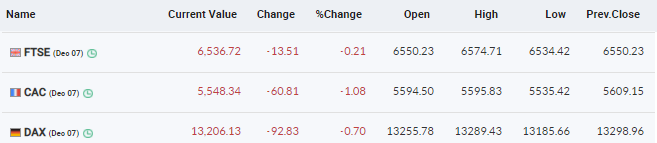

The market started this week continuing its winning streak, much of the momentum was from pharma and small caps stocks, the broader market is outperforming the main indices. European stocks have turned focus to the on-going post Brexit trade deal between the UK and EU, trading a bit cautiously.

We expect the domestic market to remain strong backed by vaccine progress, economic recovery and strong FII inflows. However, it is advisable for investors to consider partial profit booking in pockets trading very expensive like highly valued large caps and trade vigilantly on small & micro caps though the momentum is expected to remain positive in the short to medium-term.

Bears today got a taste of what a broad based market rally means as Bulls took complete control with market breadth improving dramatically as we witnessed more advances than declines. The rally was widespread across market capitalisation and across sectors.

Markets started the week on a positive note amid supportive global cues. Further, news of progress in the Covid vaccine and healthy inflows by FII helped markets to continue its upward trend. Consequently, the Nifty ended near a record high at 13,356 up by 0.7%. On the sector front, FMCG, Healthcare and PSU were the top gainers. Further, midcap and smallcap outperformed and ended with decent gains in the range of 0.95-1.3%

We are seeing buying interest emerging on every dip, thanks to rotational participants across the sectors. Technically, Nifty could face a hurdle around 13,450. The stock-specific trading approach is yielding decent returns so far and we suggest continuing with the same. Also, keep a close watch on global markets and upcoming domestic macro data for cues.

Indian indices continued their upward momentum and ended at fresh record closing highs on December 7 supported by the financials, pharma and FMCG stocks.

At close, BSE Sensex was up 347.42 points or 0.77% at 45426.97, and the Nifty was up 97.30 points or 0.73% at 13355.80. About 1972 shares have advanced, 936 shares declined, and 190 shares are unchanged.

UPL, Adani Ports, HUL, Bharti Airtel and Coal India were among major gainers on the Nifty, while losers included Kotak Mahindra Bank, JSW Steel, Tata Steel, Nestle and SBI Life.

On the sectoral front, PSU Bank index rose 2 percent, while pharma, infra and FMCG indices added 1 percent each. BSE Midcap and Smallcap indices gained 1 percent each.

It has witnessed some strong trends in the market and an attempt to overcome the resistance level around the Nifty 50 Index level of 13340. While sustaining above 13200 is the key factor from a short-term perspective, our research suggests, maintaining above this level market to gain momentum and to open the gate for a movement till 13390. The momentum indicators like RSI, MACD to stay positive and market breadth to improve, further strengthening the view of a short-term bullish outlook.

Research house believe that ICICI’s likely strong delivery on growth, asset quality and return ratios despite the Covid-induced disruption, coupled with its evolution as a strong retail-cum-digital bank, will call for a re-rating. Retain Buy/OW in EAP with a revised target price of Rs 600.

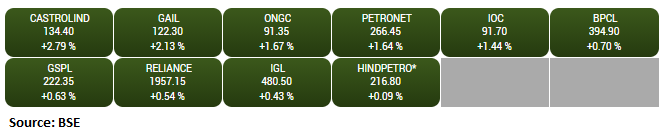

WTI crude oil prices rallied to nine month high due to weakness in dollar index and OPEC+ production plan. Although rising number of coronavirus cases across the globe is likely to keep oil a lid on the price rally.

OPEC+ ministers have agreed to add 500,000 bpd of crude production starting in January. Also, OPEC+ ministers agreed to hold monthly meetings to decide whether to approve similar-sized crude production increases in subsequent months.

Meanwhile, China Nov crude imports rose +4.9% m/m to 10.6 million bpd, the first increase in four months. It is indicating an improvement in economic condition for China and is supportive for crude oil prices.

Rising optimism over stimulus is also providing support to crude oil prices. House Speaker Pelosi have said "there is momentum building" toward a compromise on the $908 billion fiscal stimulus plan.

WTI Crude oil prices for January expiry contract is likely to find support near 20 days EMA at $43.94 per barrel and 50 days EMA at $42.16 per barrel meanwhile critical resistance is seen around $47.35 per barrel and $48.40 per barrel.

Jefferies has maintained buy and raised target price to Rs 525 from Rs 475 per share.Company showcased management focus to improve Krishnapatnam Port’s margins. Jefferies revised its FY21e-23e estimates by 3-7% to factor the November 2020 volume data.

The continuing operational improvement and continuing reduction in promoter pledges should drive further re-rating from current levels, reported CNBC-TV18.

Domestic gold ended marginally lower, while silver rose on December 4, tracking firm overseas prices.The dollar recovered from the lows of the session after investors shrugged off a weaker-than-expected US employment report.

Domestic bullion is expected to trade flat on the morning of December 7, tracking a subdued start in the international prices.Technically, MCX February gold may see some hurdle near 49,500, which is near its 21-daily moving average. However, above it, gold can rally up to Rs 49,750-49900 levels.

MCX March silver is trading above Rs 64,000 levels; above Rs 63,500 indicates a positive momentum up to 65250-66300 levels. Support is at Rs 63,900-63,000.