April 19, 2021 / 15:54 IST

Manish Hathiramani, proprietary index trader and technical analyst, Deen Dayal Investments:

We did not break 14200-14250 on a closing basis and hence the onset of a bear market cannot be confirmed. This patch is a good support for the Nifty and if we disrespect this, we can drift to 13800-13900. Since the upside is capped at 15000, a view on the long side can be only be taken post that level. Until then the index will remain sideways with a downward bias.

April 19, 2021 / 15:49 IST

Yash Gupta Equity Research Associate, Angel Broking:

Jubilant Pharma Limited, a subsidiary of Jubilant Pharmova Limited, announces successful completion of safety and pharmacokinetic/absorption studies in animals and healthy human volunteers in India using a novel oral formulation of remdesivir against the commercially available injectable formulation of remdesivir.

Jubilant has sought authorization for additional studies for this novel oral formulation from the Drug Controller General of India (DCGI). Jubilant is hoping to provide an affordable, more convenient, easy-to-administer and potentially effective treatment option for COVID-19 patients.

The proposed oral treatment is expected to be for 5 days, a duration similar to the injectable dosage form. Remdesivir is the first and the only antiviral drug fully approved by the US FDA for the treatment of patients with COVID-19 requiring hospitalization.

We expect this to be a very short-term benefit for the company, as we expect more players to develop this medicine for covid 19 and once cases in India come down the use of remdesivir will also come down.

April 19, 2021 / 15:47 IST

Naveen Kulkarni, Chief Investment Officer, Axis Securities:

The economic impact of the current rise in covid cases will be significant in the short term as it will lead to lockdowns across many states in the country. However, the demand is never fully destroyed, and will come back.

For many industries like travel, tourism, restaurants and hotels the impact will be significant. IT, Pharma, Metals, Telecom and Consumer staples will be less impacted and provide support. Discretionary consumption will be the most impacted sector and will see challenges.

April 19, 2021 / 15:42 IST

Rupee Close

:Indian rupee ended lower by 52 paise at 74.87per dollar,amid Indian benchmark indices shedover1.5percent on concern over rising Covid cases nationwide.

It opened 43 paise lower at 74.78 per dollar against previous close of 74.35 and traded in the range of 74.77-75.04.

April 19, 2021 / 15:36 IST

Market Close:

Benchmark indices ended lower on April 19 on the back of fresh covid concern.

At close, the Sensex was down 882.61 points or 1.81% at 47949.42, and the Nifty was down 258.40 points or 1.77% at 14359.50. About 723 shares have advanced, 2091 shares declined, and 157 shares are unchanged.

Adani Ports, Power Grid Corp, ONGC, Hero MotoCorp and Bajaj Finserv were among major losers on the Nifty, while gainers were Dr Reddy's Laboratories, Cipla, Britannia Industries, Wipro and Infosys.

Nifty PSU Bank shed over 4 percent, while auto, infra, metal and energy indices slipped 1-2 percent. BSE Midcap and Smallcap indices shed 1.5-2 percent.

April 19, 2021 / 15:27 IST

Ashis Biswas, Head of Technical Research at CapitalVia Global Research:

The market witnessed some swift recovery from its short-term support around the Nifty50 Index level of 14300. The expected level should range between 14300 and 14500, and it’s going to be crucial for the short-term market scenario to hold above the 14300 levels.

The market breadth to recover significantly after a gap down opening that causes it to turn deep negative, while other momentum indicators are recovering from oversold reading, market to consolidate in the short term.

April 19, 2021 / 15:24 IST

Bajaj Consumer Care Q4:

The company has posted consolidated net profit at Rs 54.7 crore against Rs 23.3 crore, YoY and Rs 57.3 crore, QoQ.

The revenue was up 39% at Rs 249 crore versus Rs 179 crore.

Bajaj Consumer Care touched a 52-week high of Rs 323.50 and was quoting at Rs 302.25, down Rs 3.15, or 1.03 percent on the BSE.

April 19, 2021 / 15:20 IST

Subex to launch new AI Automation platform:

Subex will be launching the new AI automation platform on April 22, 2021 and specific details of the same will be unveiled on the launch day, company said in the release.

The share touched a 52-week high of Rs 53.80 and trading at Rs 52.20, up Rs 6.85, or 15.10 percent on the BSE.

April 19, 2021 / 15:14 IST

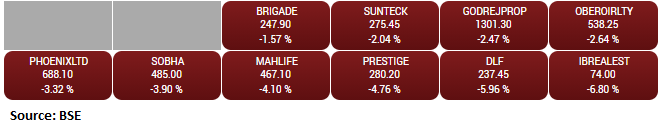

BSE Realty index shed 3 percent dragged by the Indiabulls Real Estate, DLF, Prestige Estate

April 19, 2021 / 15:07 IST

Rupee Updates:

Indian rupeeistrading lower at 74.84per dollar,amid Indian benchmark indices shed 2 percent on concern over rising Covid cases nationwide.It opened 43 paise lower at 74.78 per dollar against previous close of 74.35.

April 19, 2021 / 14:59 IST

Caplin Point Laboratories gets final approval from USFDA:

Caplin Steriles, a subsidiary company of Caplin Point Laboratories, has been granted final approval from the United States Food and Drug Administration (USFDA) for its Abbreviated New Drug Application (ANDA) Milrinone Lactate Injection USP, 10 mg/10 mL (1 mg/mL), 20 mg/20 mL (1 mg/mL), 50 mg/50 mL (1 mg/mL), Single-dose vial presentation, a generic therapeutic equivalent version of (RLD), PRIMACOR Injection, 1 mg/mL, of Sanofi-Aventis U.S. LLC, as per company's release.

Caplin Point Laboratories was quoting at Rs 497.35, up Rs 31.15, or 6.68 percent on the BSE.