September 07, 2022 / 15:57 IST

Vinod Nair, Head of Research, Geojit Financial Services

Latest economic figures indicate that the US central bank will continue to raise interest rates. According to ISM's (Institute of Supply Management) US Non-Manufacturing PMI, the services sector expanded last month at a rate that was higher than anticipated, putting pressure on global markets. Benchmark indices followed the global trend however,mid & small capsrallied with strong outperformance.

September 07, 2022 / 15:55 IST

Kunal Shah, Senior Technical Analyst, LKP Securities

Bank Nifty index is stuck in a broad range of 1500 points where stiff resistance is visible at 40,000 and support is seen at 38,500. The index will witness a trending move on a break on either side. The immediate support stands at 39,200 and if breached, we will see a further decline towards the 38,800-38,500 zone. The bias remains on the Buy side as long as the mentioned support level is held.

September 07, 2022 / 15:44 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

Nifty has been witnessing short term consolidation, swinging in both the directions. On September 7, it opened gap down however there was no follow through selling. The index attracted buying support near the psychological mark of 17,500 as well as near the swing low of 17,468. Structurally, the consolidation can continue further and any move towards 17,700 is expected to attract another round of selling. Additionally, the selling pressure can aggravate once the level of 17,500 is breached on a closing basis.

September 07, 2022 / 15:41 IST

Rupee At Close | Rupee ends at 79.90/$ versus Tuesday’s close of 79.84/$

September 07, 2022 / 15:36 IST

Market at close

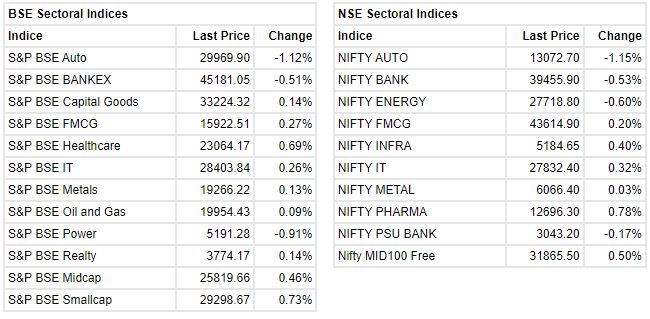

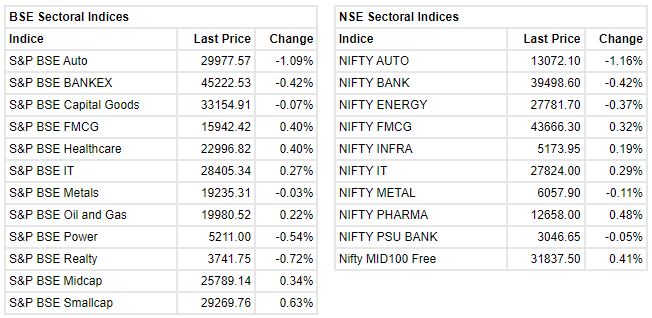

Benchmark indices ended the session on September 7 in the red after having recovered some loses in the afternoon session. Sensex was down 168.08 points or 0.28 percentat 59028.91, and the Nifty shed 31.20 points or 0.18 percentat 17624.40. About 2073 shares have advanced, 1289 shares declined, and 121 shares are unchanged.

Among the sectors, the auto index shed a percent while buying was seen in FMCG, IT and pharma space. The midcap and smallcap indices added half a percent each.

September 07, 2022 / 15:13 IST

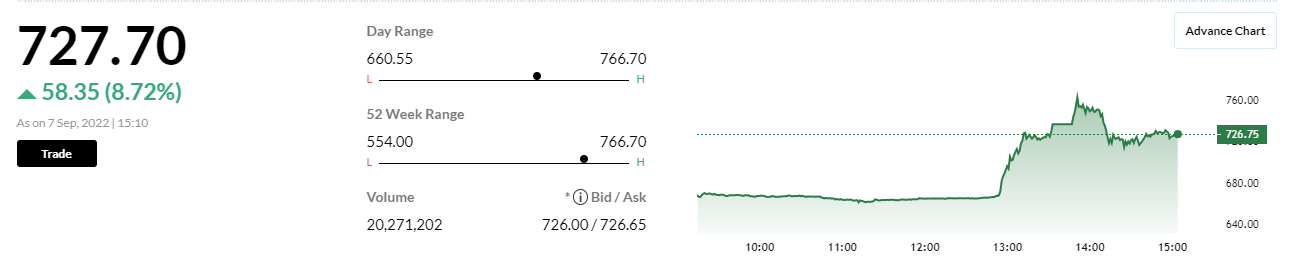

Concor up 8%

Cabinet allows long-term leasing of railway land for cargo related activities for up to 35 years at 1.5% of market value of land

September 07, 2022 / 14:53 IST

Tapan Patel, Senior Analyst (Commodities), HDFC Securities

Spot gold prices at COMEX were trading marginally up near $1702 per ounce on Wednesday. October future contract at MCX were trading 0.02 percentlower near Rs 50,269 per 10 grams by noon session.

Gold held near $1700 per ounce on stronger dollar and better than expected US economic data boosting expectations of aggressive rate hike from US Fed. We expect gold prices to trade sideways to downwards for the day with COMEX spot gold support at $1680 and resistance at $1720 per ounce. MCX Gold October support lies at Rs 49,950 and resistance at Rs 50,600 per 10 grams

September 07, 2022 / 14:43 IST

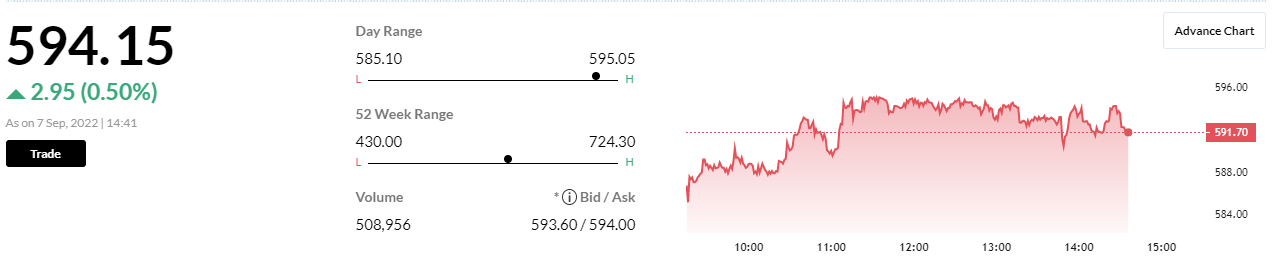

ICICI Pru August Update | New business sum assured up 47.8% YoY. New business premium up 11.3% YoY, APE down 2.3% YoY

September 07, 2022 / 14:19 IST

Avinash Pathak, Research Analyst, LKP Securities

After two years of subdued demand due to the pandemic, positive tailwinds in the second half support a high consumption period. Good monsoons, better rural demand, easing supply constraints along with upcoming festive season and new product launches at varied price points are expected to boost demand ahead. Commodity costs showing some signs of stabilization is also a positive for the FMCG sector.

September 07, 2022 / 14:04 IST

Market update at 2 PM: Sensex is down 123.72 points or 0.21% at 59073.27, and the Nifty shed 25.50 points or 0.14% at 17630.10.

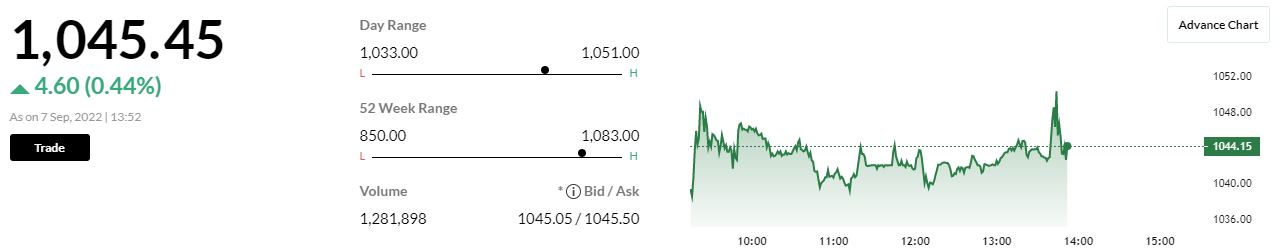

September 07, 2022 / 13:53 IST

Cipla gets US FDA nod for generic version of Revlimid used to treat various types of Cancers

September 07, 2022 / 13:42 IST

European markets open lower

The pan-European Stoxx 600 lost 1.1 percent in the first 30 minutes of trading, with all sectors seeing declines. FTSE 100 is down 78.76 points at 7,221.68

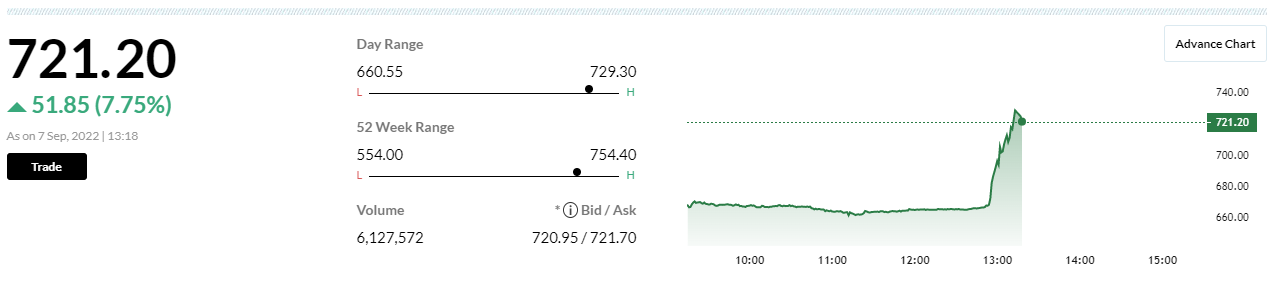

September 07, 2022 / 13:22 IST

Concor sees a sharp spike. According to sources, LLF (Land Licencing Fees) has been slashed to 1.5% from 6%, a much needed step for the company' privatisation