September 18, 2020 / 15:42 IST

S Ranganathan, Head of Research at LKP Securities

An FTSE rejig of the Index coupled with a border skirmish led to a pretty volatile trading session today.

Despite this the day truly belonged to the pharma bulls as several counters posted massive gains on the back of positive newsflow.

September 18, 2020 / 15:41 IST

Market closing:

Sensex closed 134 points, or 0.34 percent, lower at 38,845.82 while Nifty closed 11 points, or 0.10 percent, down at 11,504.95.

BSE Midcap closed 0.26 percent higher while BSE Smallcap index closed 0.32 percent lower.

September 18, 2020 / 15:37 IST

Sensex at the closing

September 18, 2020 / 15:20 IST

Pharma stocks continue to shine

September 18, 2020 / 15:09 IST

RBI has sufficient forex reserves again: BofA Securities

BofA Securities thinks the RBI will buy forex less aggressively than in the past, having achieved adequate forex reserves (over $500 bn BofAe) again.

As per BofA, RBI has stated that appreciation helps cool high CPI inflation, although we find 'imported' inflation relatively weak.

RBI will likely allow rupee to weaken if the USD strengthens, as it can sell up to $50bn to fend off any speculative attack on the rupee, BofA Securities said.

"We continue to expect RBI to consolidate the return to adequate forex reserves. The RBI has actually picked up $24.3bn since July until week ending September 11. Our BoP estimates suggest that it can buy $7.6bn more by March 2021," BofA Securities said.

On balance, BofA Securities expects the RBI to continue with its asymmetrical forex policy of buying forex when the USD weakens and letting rupee depreciate when it strengthens.

"As inflation peaks off, we think that there still will be a policy bias towards a weak rupee till growth revives. Our forex strategists see rupee at Rs 74 per dollar by December," said BofA Securities.

September 18, 2020 / 14:48 IST

Marginal improvement in macroeconomic indicators

"We continue to see incremental improvement in high-frequency indicators. Daily average e-waybills were higher in the second week of September, compared to the previous week and August figures," said brokerage firm Kotak Institutional Equities.

The electricity consumption gap turned negative again, meaning India consumed more electricity in the past week than a similar period in CY2019. Payments data and import duty collection continue to be strong in September.

However, a cross-country comparison of Google mobility report shows that recovery in India lags behind the recovery in other countries, said Kotak.

Kotak tracked the number of property sales registered in Maharashtra and the daily number of vehicles registered in Regional Transport Offices under the Vahan4 umbrella.

The daily average of property registrations in Maharashtra in September is much higher than the daily average of March 2020. In terms of vehicle registrations, the number of cars and two-wheeler registrations did not increase in the first half of August, Kotak said.

September 18, 2020 / 14:35 IST

Rahul Gupta, Head of Research- Currency, Emkay Global Financial Services

: The mixed US data is losing the economic confidence and weighing on dollar. But in coming sessions the Indo-China border and Brexit uncertainty will occasionally keep the dollar bulls active. This week the spot respected both the crucial support of 73 and the resistance of 73.75. Even next week, we expect the sideways trend to continue. Unless the support zone of 72.90-73 doesn't break the spot will trade higher towards 73.75.

September 18, 2020 / 14:30 IST

Sharp fall in markets

Sensex is down 214.74 points or 0.55% at 38765.11, and the Nifty shed 31.10 points or 0.27% at 11485. Among the sectors, the Nifty Pharma jumped 5 percent hitting a 5-year high while on the other hand, banks fell led by Kotak Mahindra Bank, HDFC Bank and SBI.

September 18, 2020 / 14:19 IST

Tapan Patel- Senior Analyst (Commodities), HDFC Securities:

Gold prices traded higher with COMEX spot gold rose by half a percent to USD 1,954 today. Gold October future contract at MCX were trading up by 0.3 percent to Rs 51,600 per 10 grams limiting upside on rupee appreciation. Gold prices kept the narrow trading range as traders and investors are awaiting for fresh triggers post US FOMC meet. The dollar fluctuations has kept prices in range with uncertainty over US aid package and concerns over US economic recovery.

We expect gold prices to trade sideways to up with support at USD 1,910 and resistance at USD 1,970. MCX Gold October support at Rs 51,100, resistance lies at Rs 51,900.

September 18, 2020 / 14:09 IST

ICICIdirect on HUDCO

: The government’s focus on housing and shortage of dwelling provides an opportunity for balance sheet. However, muted construction activity amid pandemic is seen keeping near term credit offtake benign. Decline in cost of funds and revival in urban infrastructure activities is seen leading to uptick in margin (that remained under pressure due to incremental lending to low yield social housing projects). Higher PCR at ~87% provides comfort but given impact on state government revenue, volatility in asset quality cannot be ruled out.

We expect credit cost to remain higher in FY21E. Dividend yield of 8 percent or higher is attractive but sustainability of payment is to be seen ahead. Though exposure to state government entities provides comfort, anticipation of near term volatility in provisioning and, thereby, earnings makes us adopt a cautious stance. Therefore, we maintain hold rating with a target price of Rs 38, valuing the stock at 0.5x FY22E EPS.

September 18, 2020 / 14:01 IST

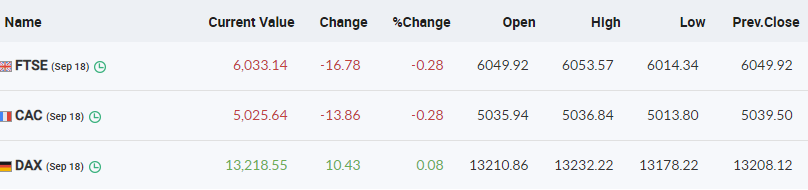

European markets trade flat.