U.S.-based technology stocks saw a sharp sell-off in trade, eroding over $600 billion in value, as U.S. President Donald Trump's broad-based tariffs caused investors to flee their equity holdings.

Overnight, about $2.5 trillion was wiped out from Wall Street after the S&P 500 declined 4.9 percent and the Nasdaq 100 slumped 5.5 percent on April 3, the biggest drop since 2020 for each.

The market downturn is touted as one of the steepest in recent years, which comes as a result of intensified fears of a looming recession, particularly as global supply chains brace for impact.

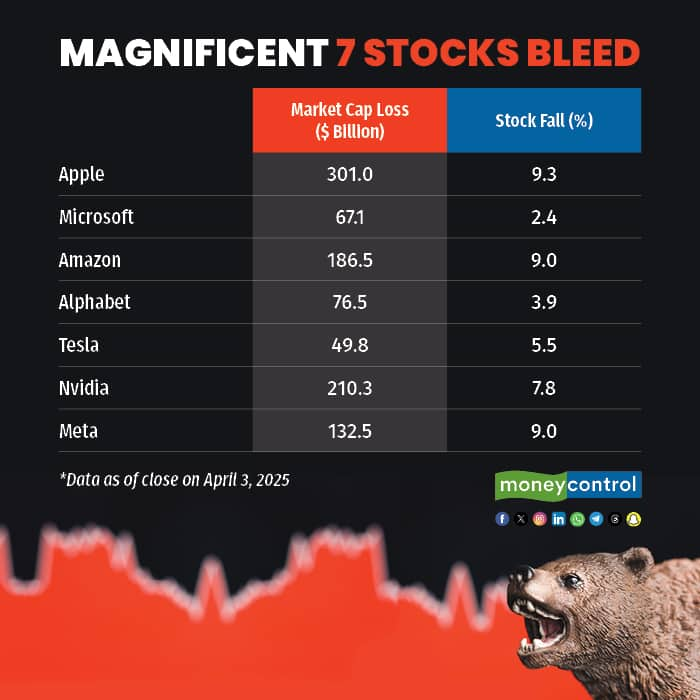

Among the worst hit, the new darlings of American investors, the "Magnificent 7" technology stocks bore the brunt of the selling. The so-called "Magnificent 7" stocks (Apple, Microsoft, Google, Amazon, Nvidia, Tesla, and Meta) account for 37 percent of the S&P 500.

Shares of iPhone maker Apple led the losses, crashing over nine percent, losing $301 billion in market capitalization, followed by Nvidia, which shed $210 billion with a 7.8 percent drop. Amazon and Meta each lost over $130 billion in market cap, both falling around 9 percent.

Cumulatively, the Magnificent 7 index saw around $600 billion in wealth wiped off, with the combined market-cap of the seven stocks falling to $8.34 billion, down from $8.94 trillion earlier.

Also Read | MC Explainer: Why Are Stock Markets Crashing? Understanding Trump's Tariff Policy and Impact

Here's a look at the four reasons behind the crash:

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.