With household investments in real estate and government spending the biggest drivers of capital formation in the country, the best way to play the upcycle in investment-led growth is through lenders, developers and companies supplying building materials, ICICI Securities said in a report.

For FY23, economic revival was driven by 17.1 percent growth in gross fixed capital formation (GFCF) to a nominal Rs 79.5 lakh crore, according to the report. While an institutional break-up of GFCF for FY23 was not yet available, the latest indicators of real estate demand by households remain robust.

Market Veteran, Ajay Bagga, Chairman Elyments Platforms, in a conversation with Moneycontrol on the same issue stated that, "The focus of the Indian government has been on infrastructure development across projects such as roads, railways, airports, and power plants. The government is also investing in urban development, such as smart cities and affordable housing. The real estate sector in India is also growing rapidly. This is due to a number of factors, including rising incomes, increasing urbanization, and a growing middle class. "

"India’s macro fundamentals are well positioned for a multi-year improvement in economic output and earnings. Beyond the long-standing strength of its demographics, urbanization and rising middle class, new factors are emerging that will accelerate investment opportunities in the country," he noted.

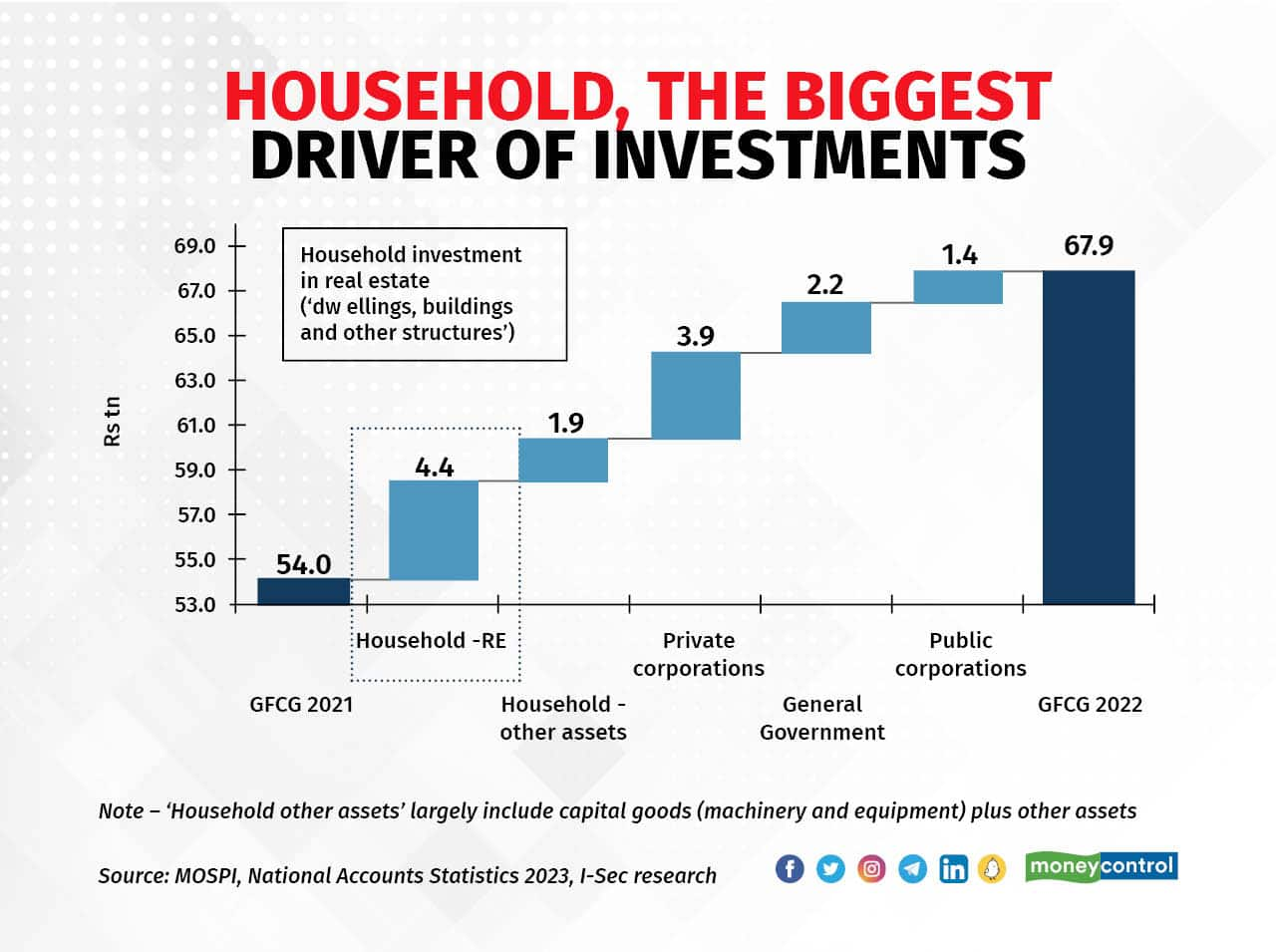

The post-pandemic economic recovery in India was driven largely by investments, as measured by GFCF, which grew 25.6 percent YoY during FY22 to Rs 67.9 lakh crore in nominal terms, the analysts noted in the report.

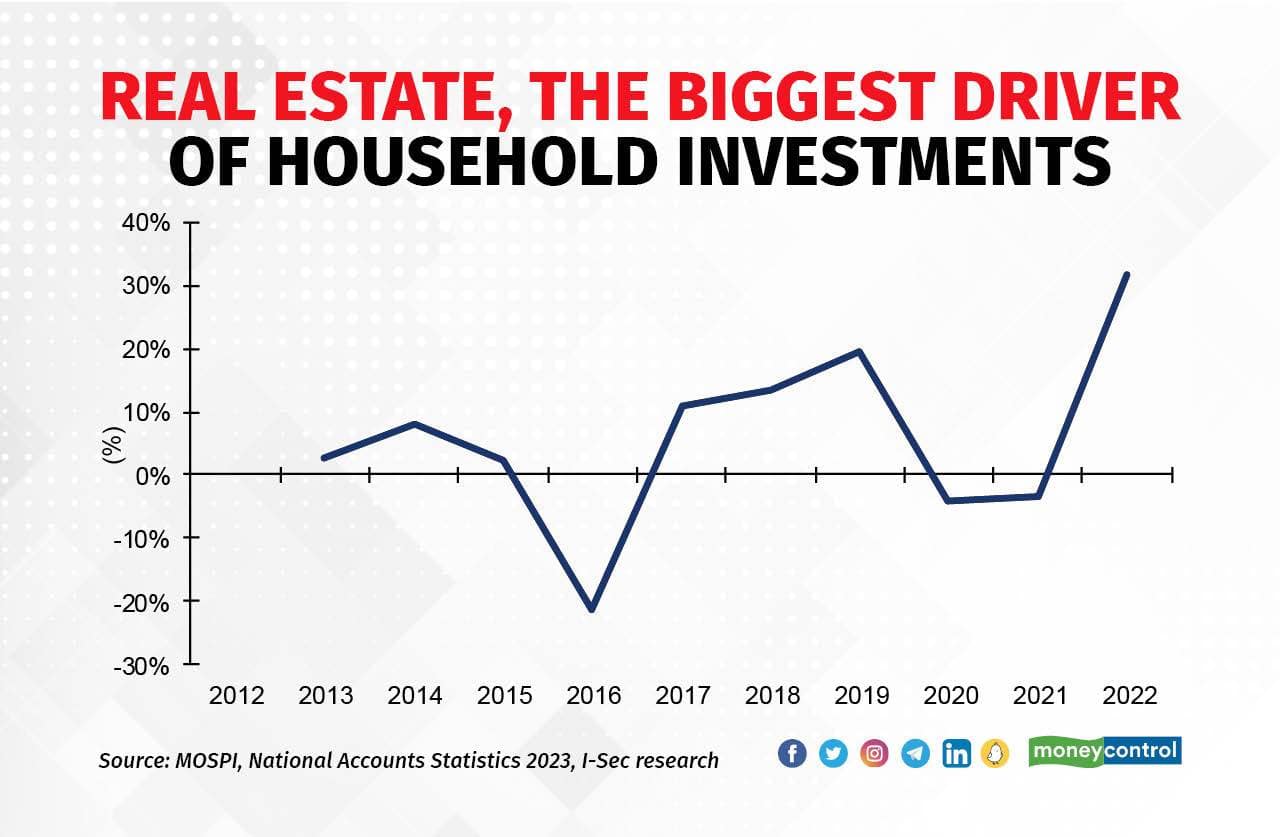

Within this, capital expenditure by the household sector and the government emerged as the largest contributors to the country’s investment rate. The household sector expanded its share to Rs 27.5 lakh crore, clocking a 30 percent growth YoY, while the government’s share in GFCF kept a comparable pace with 29 percent growth. However, the corporate sector underperformed.

"COVID-19 was a wakeup call and it also changed the way we view and perceive lifestyle and work and home balance. Pre-Covid, people compromised on the size of the home as well as the facilities since the distance from the workplace had a higher weightage," Market Analyst, Ambarish Baliga felt.

"Post COVID-19 people prefer to have larger homes with lifestyle facilities and don’t mind traveling the extra mile. The government focus on city infrastructure across India will make commute a bit easier going ahead, thus new locations in cities are offering a suitable option. With real estate prices inching up due to cost push inflation as well as increasing end-user demand, the latent demand was quickly getting converted as those waiting for better deals realized they can’t afford to wait much longer," Baliga added.

Real Estate the biggest driver of household investment

Real Estate the biggest driver of household investment

Housing loan growth

Household sector investments in FY22 were driven mainly by real estate – primary dwellings – which grew 32 percent YoY to Rs 18.5 lakh crore. The contribution of the household sector’s investment in real estate to the GFCF rose to a seven-year high of 27.2 percent. This trend was corroborated by strong aggregate sales growth of 29 percent YoY of real estate companies.

Revival of growth in housing loans by banks (15.4 percent YoY) and indications by companies such as UltraTech Cement and Tata Steel of robust housing-related demand are strong signs of economic recovery.

The best way to ride the investment-led story at this stage is through lenders, real estate companies and housing-allied businesses, ICICI Securities said.

Axis Bank, State Bank of India and HDFC Bank are its top picks in the banking sector from a capex and real estate upcycle theme perspective, whereas in materials and cement, Kajaria Ceramics, Greenpanel Industries, Century Ply, JK Cement, Jindal Steel & Power, Shyam Metalics and Energy, and APL Apollo, among others, are the brokerage firm’s preferred bets.

Ajay Bagga, held a similar view on the Indian investment story going ahead stating that, "India’s macro fundamentals are well positioned for a multi-year improvement in economic output and earnings. Beyond the long-standing strength of its demographics, urbanisation and rising middle class, new factors are emerging that will accelerate investment opportunities in the country."

"Indian corporates have deleveraged and now sit on strong balance sheets, banks have strong capital adequacy ratios, and the government has plugged loopholes in the real estate sector. Post the general elections in 2024, we expect a strong revival of the corporate capex cycle which has lagged in the past decade. The contribution of corporate profits in GDP has also recovered to 4 percent plus from a decade low of 0.5 percent. This is creating a surplus with corporates that will be deployed in enhanced capacities in the coming years," Bagga added.

Household is the biggest driver of investments

Household is the biggest driver of investments

Overall, the brokerage firm expects Central government capex (Rs 10 lakh crore during FY24, as per budget estimates) and real estate investments to continue leading growth in the investment rate.

“While corporate capex cycle has clearly formed a bottom and is showing signs of improvements selectively, we further expect a broad-based upcycle to build up gradually as global uncertainties subside,” ICICI Securities said.

According to the analysts, the potential end of an aggressive interest rate hike cycle could augment the overall investment and real estate cycle further. Real estate upcycle is a positive for income generation in the unorganized segment and manufacturing activities.

“Besides, the growth in housing real estate investments has historically boosted growth in ‘aggregate household income’ in India,” the brokerage said. “Reason for this dynamic is that real estate development is estimated to be the second-largest employment generator in India after agriculture and is largely concentrated in the unorganized sector. Also, a real estate upcycle has the potential to boost a variety of allied manufacturing activities," as per ICICI Securities.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.