The year 2019 saw Indian equity benchmarks hitting fresh record highs amid explicit signs of weakness in the economy.

Foreign investors remained net buyers in the Indian market as the data available with NSDL showed foreign portfolio investors (FPIs) invested Rs 1,36,835 crore in the Indian market up to December 30.

As on December 30, Sensex is up about 14 percent while Nifty has logged a gain of 13 percent in the calendar year 2019 and as many as 26 PMS schemes across categories have managed to outperform in the same period, showed data from PMSBazaar.

The benchmark index for each scheme could be different depending on the nature of the strategy.

Portfolio Management Schemes (PMSes) cater to wealthy investors with portfolio sizes exceeding Rs 50 lakh. The professional fee charged by them is slightly higher than regular mutual funds (MFs).

PMS schemes run by leading portfolio managers and boutique wealth management firms managing money for the ultra-rich gave as much as 27 percent return in 2019 – this is almost double of what Nifty50 generated in the same period.

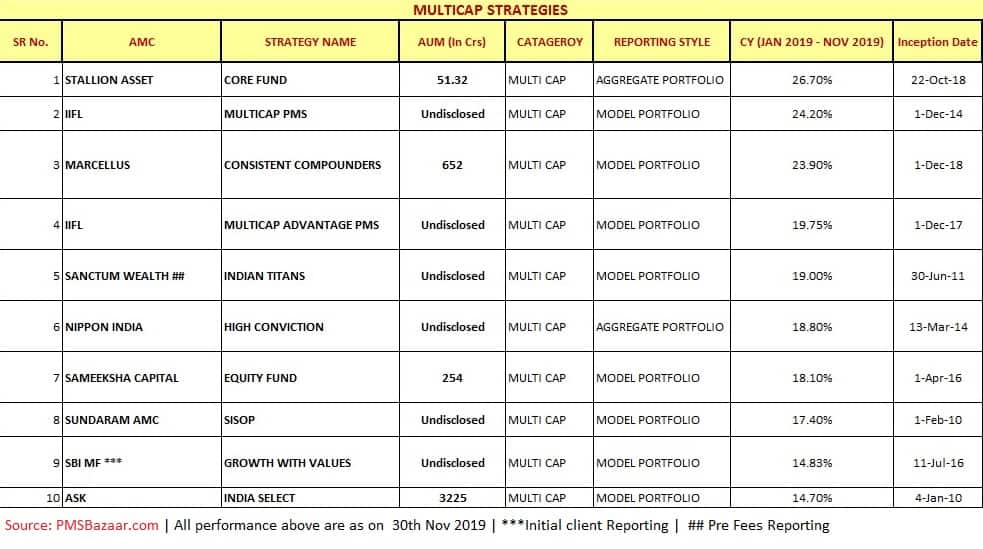

Top multi-cap strategies

Data for PMS schemes for the period December 31, 2018, to November 30, 2019, highlighted that Stallion Asset’s Core Fund theme which is a multi-cap strategy generated 26.70 percent return till November 30, 2019.

Multicap PMS of IIFL and Consistent Compounders theme of Marcellus generated 24 percent returns in 2019 till November 30.

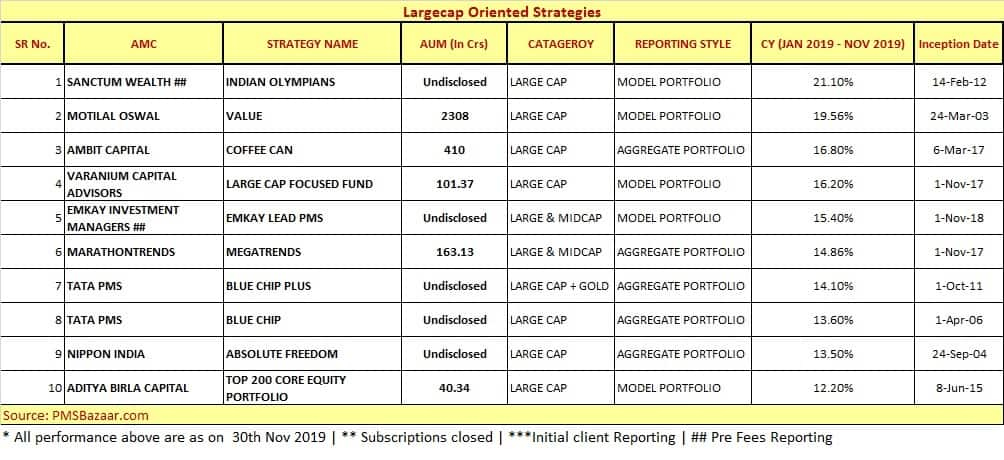

Top large-cap strategies

The Indian Olympians theme of Sanctum Wealth, Value theme of Motilal Oswal and Coffee Can theme of Ambit Capital were among the large-cap strategies that generated healthy returns till November 30.

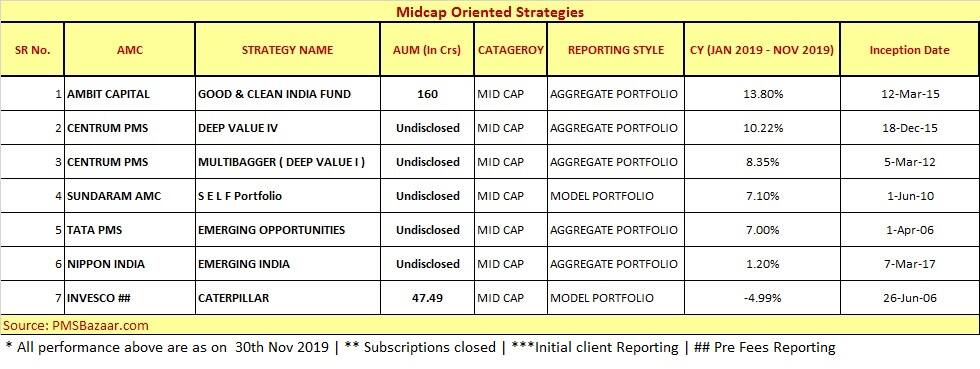

Top Mid-cap strategies

Good & Clean India Fund of Ambit Capital, Deep Value IV and Multibagger (Deep Value I) of Centrum PMS were among the top midcap strategies for the same period.

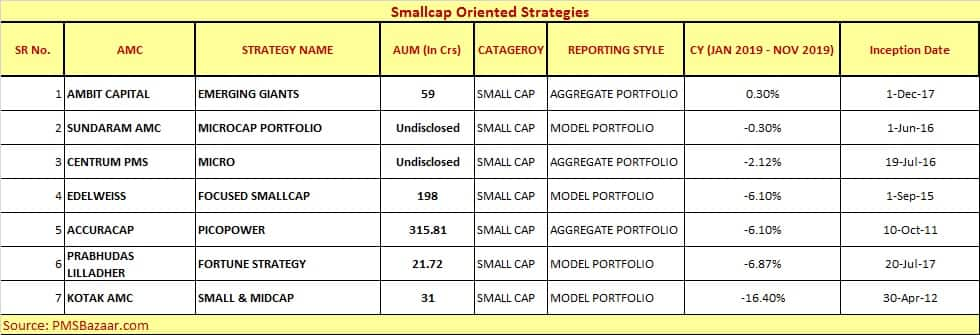

Smallcap strategies

Smallcap strategies could not do well in the calendar year, data from PMS Bazaar showed. Emerging Giants scheme of Ambit Capital was the only strategy that generated a positive - even though nominal - gain during the same period.

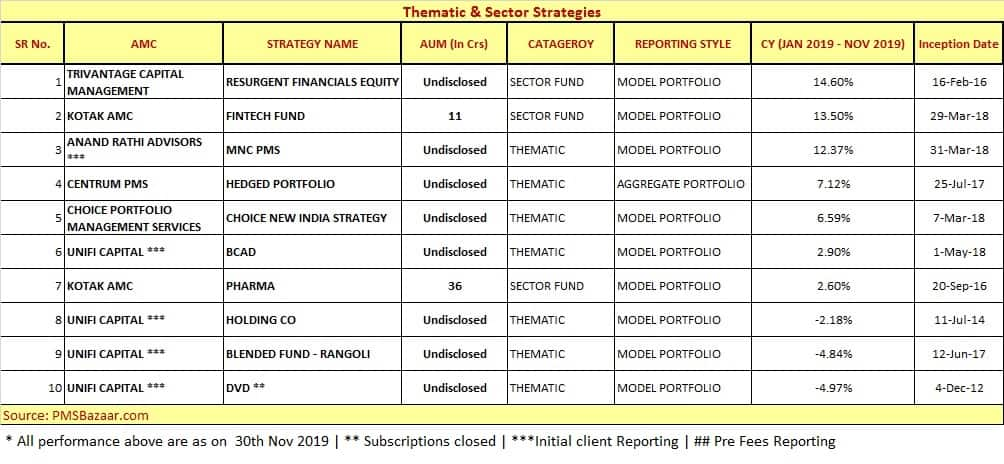

Thematic & Sector strategies

Resurgent Financials Equity theme of Trivantage Capital Management, Fintech Fund of Kotal AMC and MNC PMS of Anand Rathi Advisors were the top strategies from the Thematic & Sector category.

The data shows that the large-cap strategies outperformed the Midcap and Smallcap strategies in the calendar year.

In the large-cap space, the Sanctum Wealth scheme ‘Indian Olympics’ generated 21 percent returns maximum among the schemes in the large-cap space.

The India Olympics scheme is a large-cap-oriented strategy that focuses on investing in high-quality companies with long-term sustainable growth, driven by dominant leadership positions in their respective segments.

Market participants believe the coming year will see a revival in mid and smallcap stock with the economy looking up.

In 2019, mutual fund managers have raised their stake in over 100 smallcap companies. More than 60 percent of them have given negative, data from AceEquity showed.

Experts feel that 2020 could be a year when we could see a catch-up rally in many of the small & midcap names as earnings start to look better with recovery in the Indian economy, so the multi-cap category could do well in the next 12 months.

“There could be earnings and valuation upgrade going ahead as nominal growth is expected to revive from lows which should aid both top-line and bottom-line growth,” Vinay Khattar, Head, Edelweiss professional Investor Research told Moneycontrol.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.