Torrent Power has been in limelight since last week with the stock rallying on the back of upbeat quarterly earnings and huge growth potential in the renewables space. The scrip had shot up 10 percent alone on February 15 reacting to the results, which were declared after market hours on February 14.

On the BSE, the number of shares traded on February 15 was over 29 times higher than the average number of shares traded from February 1 to 14. Even as the volume activity moderated after February 15, barring February 24, all other days saw that the daily number of shares traded is still significantly higher than the average.

The integrated power player is expected to be one of the prime beneficiaries of the government's thrust on the clean energy transition. It has a presence across the entire power value chain, including generation, transmission and distribution, and seems to be well-positioned to capitalise on the opportunities in the sector, believe analysts.

JM Financial Institutional Securities is of the view that the abatement in transmission and distribution losses along with renewable portfolio addition will drive the company’s growth over the medium to long term.

Torrent Power is a private integrated utility company with a presence in power generation, transmission and distribution businesses. It also manufactures and supplies high-quality power cables.

The recent geopolitical conflicts have brought back to the fore the need for a swifter transition to cleaner fuels and countries around the globe are trying to reduce their reliance on fossil fuels while increasing the concentration of renewables in their energy portfolio. India is also targeting about 500GW of installed renewable energy capacity by 2030.

Keeping this in mind, Torrent Power also aims to increase its renewable portfolio through new bids or acquisitions in the coming years.

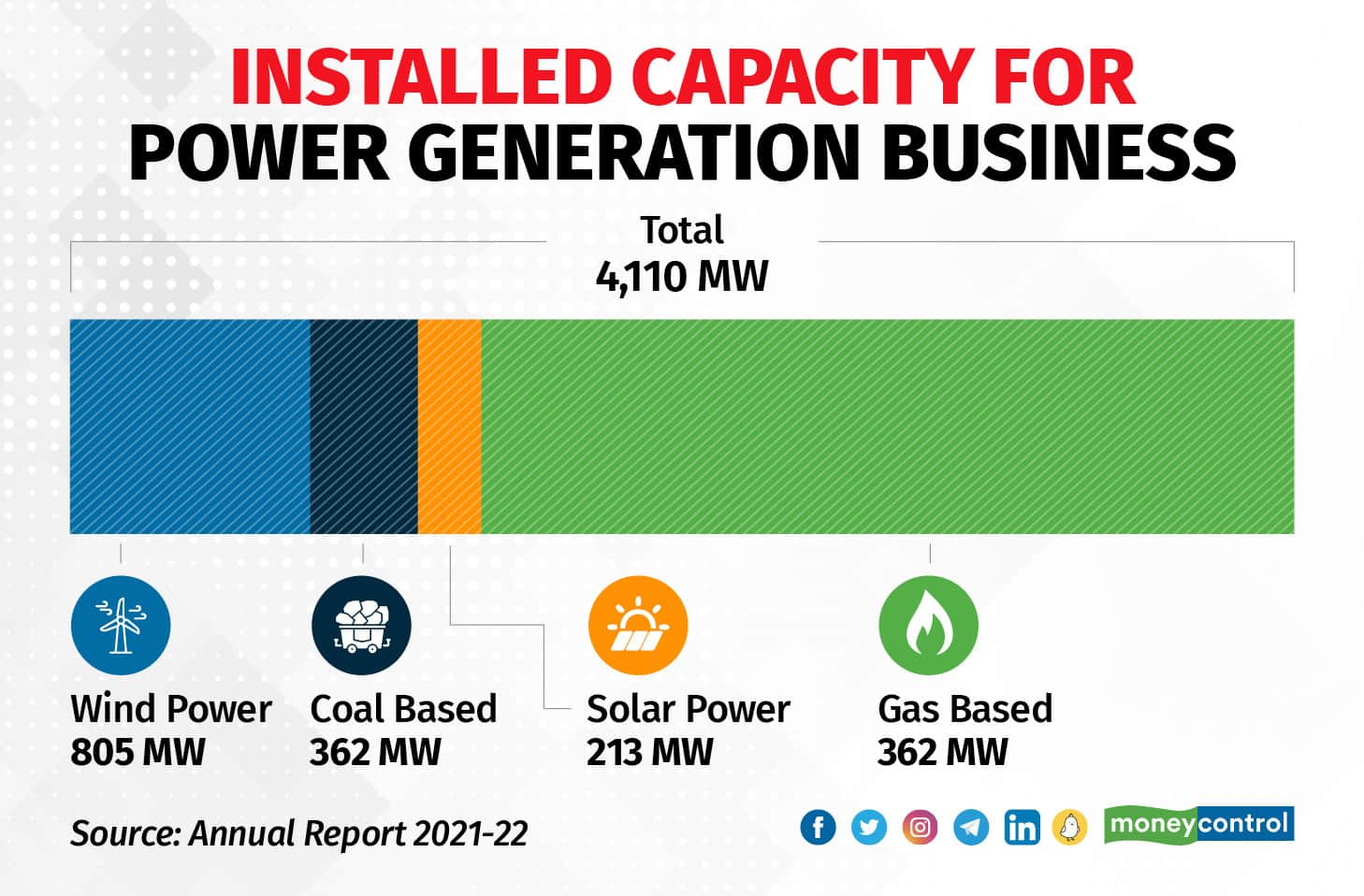

The power company has an aggregate operational generation capacity of 4,110MW at present, with a distinctive mix of coal-based, gas-based, solar and wind power plants. Further, 565MW of renewable capacity is in the pipeline, as per its annual report for 2021-22.

The company’s clean energy assets comprise 90 percent of its total power generation assets. Torrent Power is also looking at exploring new and upcoming opportunities in several areas like green hydrogen and battery energy storage.

For the distribution business, it works as the licensed operator for electricity distribution in some cities and as a franchisee of the licence holder for electricity distribution in some. It covers the end-to-end cycle of power distribution from the procurement of electricity and maintaining and augmenting the network to deliver electricity to end customers as well as handling the meter reading, billing and collection. Torrent Power has managed to reduce its cost of power supply and keep its tariff competitive.

Besides, the company operates 249 km and 105 km of 400 KV double-circuit power transmission lines and 128 km of 220 KV double-circuit transmission lines.

Besides the power business, the company manufactures cables through its subsidiary TCL Cables Pvt Ltd and is among the market leaders in the manufacturing of HV cables.

At end-March 2022, revenue from operations came in at Rs 14,257.61 crore against Rs 12,172.66 crore a year earlier, while profit for the year stood at Rs 453.98 crore, down from the previous year’s Rs 1,290.93 crore.

For the quarter ended December 2022, the power company's net profit surged 88 percent year-on-year to Rs 694.54 crore, driven by higher income, even as sales jumped 71 percent to Rs 6,442.79 crore.

A sturdy gain from trading of LNG (liquefied natural gas), a strong revival in demand across licensee and franchisee divisions, a fall in transmission and distribution losses along with an increased contribution from existing distribution circles and the newly-acquired Dadra and Nagar Haveli & Daman and Diu circle aided the company’s performance in the December quarter, analysts said.

Generation declined across all gas-based stations due to unviable RLNG (regasified LNG) prices but improved significantly across the solar-based stations while remaining largely flat across the wind stations, HDFC Securities said.

Torrent Power incurred capex of Rs 2,300 crore in the first nine months of FY23. For FY24, the management has guided for a capital expenditure in licence and franchisee distribution of Rs 1,200 crore and Rs 250 crore, respectively.

The management has also retained its guidance to scale up its renewables portfolio capacity to 5GW by FY25-26, from around 2GW now. The company is open to both organic and inorganic routes to achieve this target.

HDFC Securities is of the view that a sustainable free cash flow, healthy net debt-to-equity and net debt-to-EBITDA (earnings before interest, taxes, depreciation and amortisation) are enough to fund new capacities.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.