Defence is the flavour of the season and marquee investors are finding new avenues to tap into it.

With big, mainstream plays having rallied beyond comfort levels, Samit Vartak's SageOne Investment Managers on October 4 found a small gem — Goodluck India.

At a market capitalisation of Rs 1,916 crore, Goodluck India is among the leading manufacturers of engineering structures, precision/auto tubes, forging, CR (cold rolled) products and GI (galvanised iron) pipe. It is essentially a converter of raw steel into finished goods.

Also read: Samit Vartak loves smallcaps for firm balance sheet, better earning and prudent strategyAccording to the company's Q1FY24 investor presentation, its products are used by automobile, agricultural machinery, rail road, petrochemical, marine, aerospace and defence industries.

Currently, the defence sector makes for only 2 percent of the company’s top line but this is where fund managers are seeing incremental growth.

Vartak's firm lapped up 200,000 shares at Rs 617.07 per share, which sent the stock soaring 13 percent to Rs 708 on October 5.

The defence playAccording to Hemant Shah, fund manager at Seven Islands PMS, Goodluck India was one of the first-movers in the defence value chain. The company had manufacturing capacities to cater to defence and aerospace sectors even three years back, but order flow has been slow.

"The pace seems to be picking up now. The company is also infusing fresh funds into a wholly owned subsidiary, Goodluck Defence and Aerospace Pvt Ltd, to carry on the business in the sector," said Shah.

The company plans to issue up to 5 lakh warrants, on a preferential basis to the promoter category, and 11 lakh shares to non-promoter category at an exercise price of Rs 600 apiece. All of Rs 96 crore is set to go into growing this division.

Also read: Specialty steel maker Goodluck India to raise Rs 96 crore

Shah believes that defence can contribute Rs 200-250 crore to the top line from the current Rs 50-60 crore. After all, India's defence budget is only growing and the ‘Make-In-India’ push makes the case stronger for this ancillary player, he said.

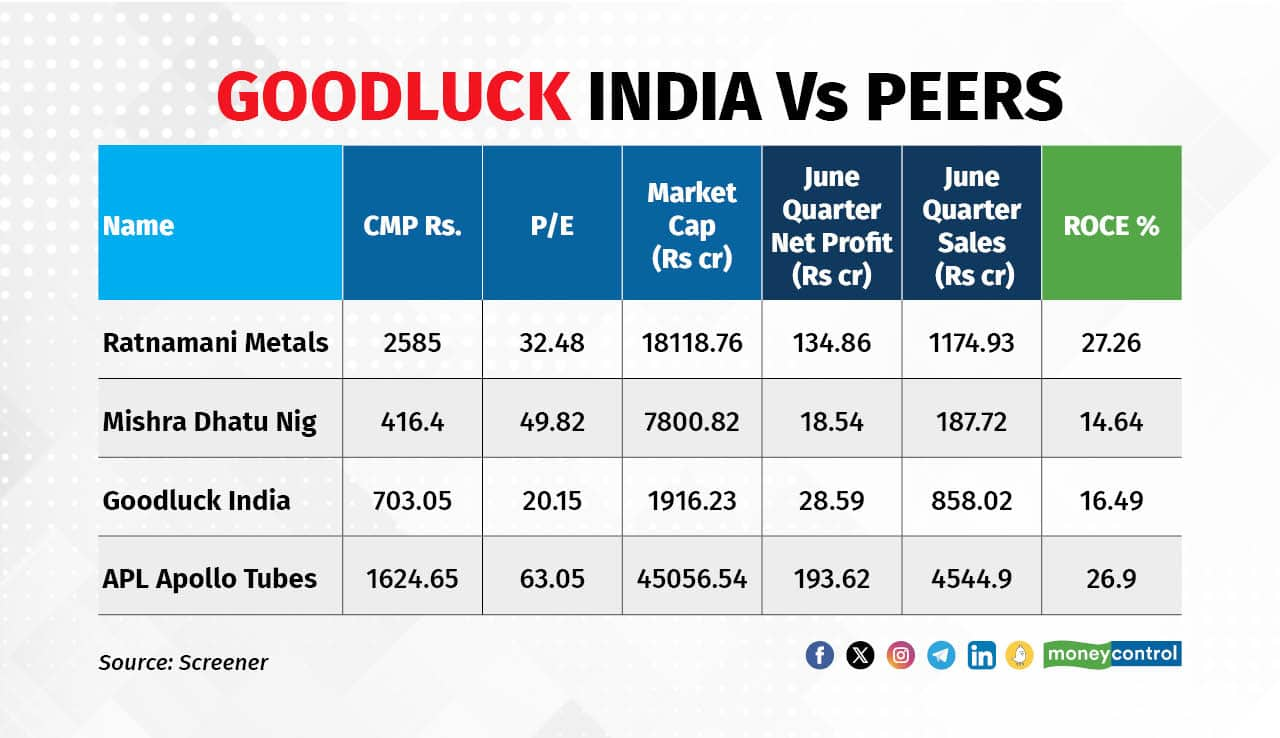

Valuation gameCompared to its peers, Goodluck India is relatively cheaper on a trailing P/E basis. With the focus on high-margin defence components to its business model, analysts believe a re-rating could be on cards.

*Data as per 15:00 on Oct 5

*Data as per 15:00 on Oct 5"It will be a stretch to say that an ancillary company like Goodluck India should command a very high P/E like some pure-play defence manufacturers which have enough visibility on the order book. However, its relatively cheap valuation, compared to steel peers, can certainly change," said Kranthi Bathini of WealthMills Securities.

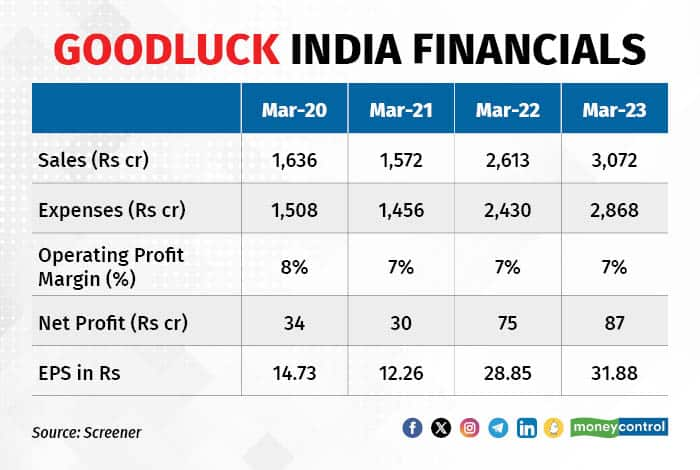

In the past three years, the company's revenue has compounded by 23 percent and net profit by 37 percent. Its FY23 sales, at Rs 3,072 crore, is greater than its market capitalisation, which has piqued investors' interest. "The company is on track to achieve Rs 3,500 crore in sales in FY24, with over 30 percent coming from global markets," said Shah.

The company was incorporated in 1986 by Mahesh Chandra Garg, an IIT graduate. It is headquartered in Ghaziabad with a 3,64,000 MTPA manufacturing facility in Sikandrabad, Uttar Pradesh, and Kutch, Gujarat, with more than 3,000 employees.

A fund manager, on the condition of anonymity, said that he likes the company for its promoters' pedigree. "Despite being in the business for 30 years, the Garg family has kept a low profile. Even at their last AGM, investor queries were addressed straight to the point," he said.

Also Read: Know Your Stock | What makes CCL Products second most held small-cap consumer stock among MFsUnlike other old-economy companies, here the second generation is also interested in the business and has started leading from the front, he added.

Promoter and promoter group hold 58.73 percent in the company, which has remained stable over the past three quarters. Continuing their consistent performance, they hope to deliver an EPS of Rs 42-43 in FY24, growing from Rs 31.8 in FY23.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.