KEC International shares bucked the negative trend in the market and climbed as much as 6 percent on news of winning orders that could improve the engineering, procurement and construction company’s revenue visibility in the high-growth water pipeline segment.

The stock gained 2.2 percent to Rs 485.80 at the close on the BSE on February 20. It has rallied 15 percent in the past month.

KEC International secured Rs 3,023 crore of orders including contracts in the water pipeline and commercial building segments in India, transmission & distribution (T&D) projects in the US, and cables in India and overseas, the company informed the stock exchanges after the market closed on February 17.

To date, a Rs 2,060 crore water pipeline contract was its single largest order. With the new orders, the company’s order intake is at a record level of over Rs 18,500 crore year to date, growing over 30 percent from a year ago, KEC said.

“We are pleased with the size of new order wins, especially the orders in the water pipeline segment including our single largest order till date,” Vimal Kejriwal, MD of KEC International, said in the exchange filing. “We are now executing 10 prestigious projects in this segment with an overall project value of over Rs 5,000 crore under the Jal Jeevan Mission of the government.”

Rural water projects

The Jal Jeevan Mission’s aim is to provide safe and adequate drinking water through tap connections to all households in rural India by 2024.

With the government’s focus on the Jal Jeevan Mission, which was also evident in the recent Union Budget, companies that operate in this segment will stand to benefit materially, said Amit Anwani of Prabhudas Lilladher.

Even KEC’s closest competitor, Kalpataru Power Transmission, is expanding in the water segment, a business that now forms 22 percent of its order book of Rs 44,550 crore.

Nomura said the spending momentum will continue in the Jal Jeevan Mission in FY24 as the budget has boosted the allocation by 27 percent to Rs 70,000 crore. The foreign brokerage firm estimated that Jal Jeevan Mission orders can constitute about 20 percent of the civil order book of Rs 10,500 crore by the end of FY23.

“This portion of civil projects, coupled with data centre orders, can provide for strong growth in FY24,” it added.

This large order win in the water segment will not only diversify the order book but will also help the company expand in an area that is set to grow massively in a few years, Anwani said.

About the company

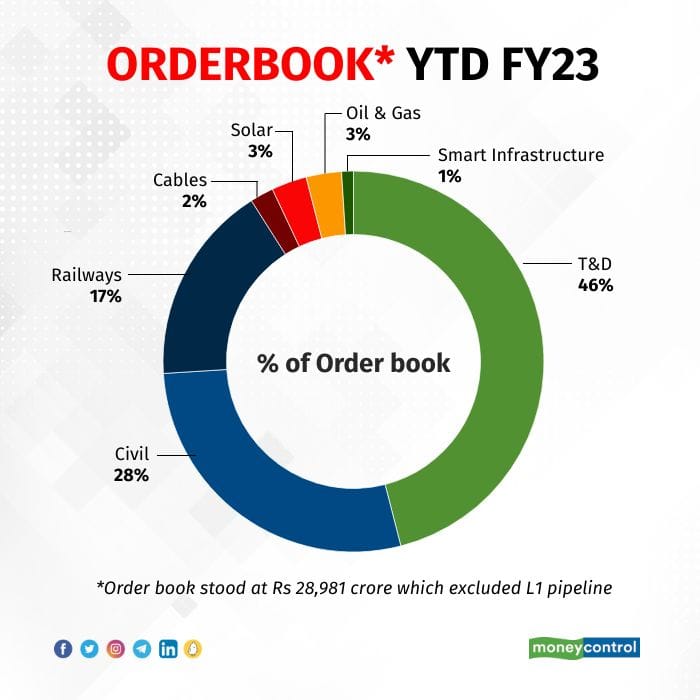

KEC International is one of the major EPC companies in key infrastructure sectors such as power T&D, railways, civil and urban infrastructure, solar, smart infrastructure, oil & gas pipelines and cables. The company is the flagship of the RPG Group and has projects in over 30 countries.

The consolidated revenue of KEC came in at Rs 4,375 crore in the December quarter as against Rs 3,340 crore a year ago. Net profit fell to Rs 18 crore from last year’s Rs 94 crore on account of higher interest costs and lower other income.

According to Sharekhan by BNP Paribas, high-margin orders would reflect in revenue and lead to strong recovery in earnings in the medium to long term.

Management said it expects to exceed its revenue growth guidance of 20 percent YoY for FY23, given strong execution in Q3 of FY23. KEC International has a record order backlog of about Rs 35,000 crore. Management has maintained its order intake guidance of Rs 18,000-20,000 crore for FY23.

Outlook

The current order book consists of better margin orders and indicates improved quality of orders, said Sharekhan.

Axis Securities said the worst of margin contraction is behind us and the operating margin is set to improve as the company has started executing new projects which are at current prices.

Meanwhile, the government’s focus on infrastructure and the Green Hydrogen mission should lead to an increase in solar energy projects and associated transmission lines and substations.

“Further, reducing competitive intensity in most of the business segments and strong order prospects of Rs 1,11,000 crore bode well for future growth in order inflows,” Sharekhan said. “In addition, successful diversification into other high-growth potential segments such as civil, railways, and oil and gas would help to scale up its business and profitability.”

The Union Budget for FY24 provides about 15 percent higher allocation to the Indian Railways which can support rail tenders. Moreover, the allocation for the Jal Jeevan Mission has also been increased. These budget announcements along with a national transmission plan to support renewable integration can support strong growth in orders over FY24-25, according to Nomura.

Analysts are also looking at a debt reduction of Rs 300 crore to Rs 5,200-5,300 crore by the end of FY23.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.