Indian markets saw a slight rebound in foreign fund inflows in the week ending December 6 after facing consistent outflows over the past two months. This reversal of flows comes after more than five weeks of redemptions, since the Chinese stimulus announcements and anticipation of the US election results.

According to a report by Elara Capital, India-dedicated funds recorded $156 million in inflows, entirely in the large-cap categories, following $1 billion in redemptions since October.

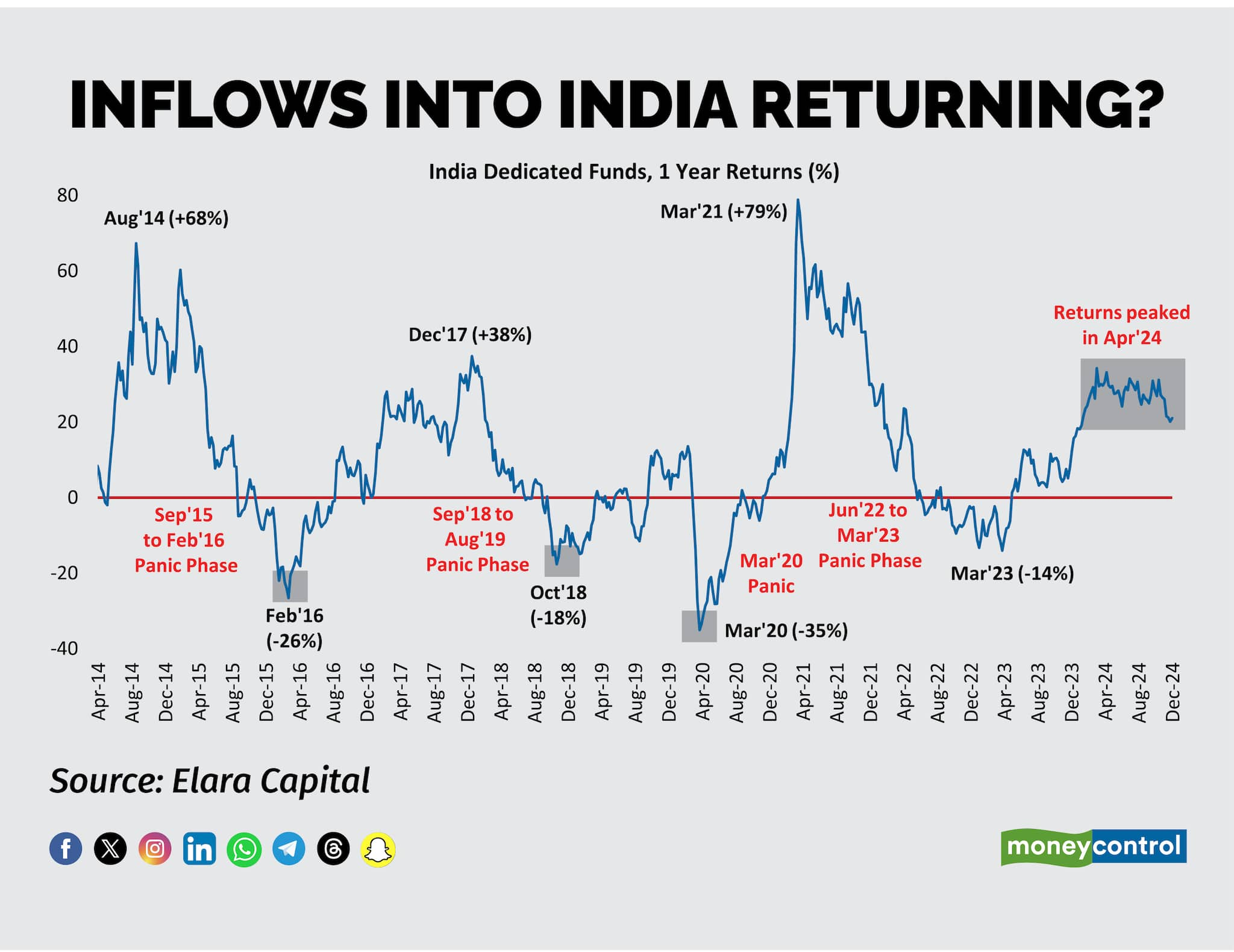

However, mid-cap funds continued to struggle, with redemptions persisting for the 22nd consecutive week, totalling $900 million. Historical trends indicate that while India may see sporadic inflow bursts, the broader foreign inflow cycle appears to have peaked for now.

However, mid-cap funds continued to struggle, with redemptions persisting for the 22nd consecutive week, totalling $900 million. Historical trends indicate that while India may see sporadic inflow bursts, the broader foreign inflow cycle appears to have peaked for now.

In a November 28 report, Elara Capital had noted that the largest outflows from emerging markets over the five-week period were from China at $11 billion. India saw the second-highest outflows at $2.2 billion, followed by Taiwan at $1.4 billion.

Meanwhile, as per NSDL data, as of December 6, equity flows into Indian markets in 2024 stands at Rs 9,435 crore (around $1.1 billion). October saw the largest equity outflows, amounting to Rs 94,017 crore (approximately $11.4 billion) while September recorded the largest equity inflows, totalling Rs 57,724 crore (approximately $7 billion).

Currently, total flows across equities, debt, hybrid funds, mutual funds, and alternative investment funds (AIFs) for the year so far stand at Rs 17,460 crore (approximately $2.1 billion). September saw the largest inflows of Rs 93,538 crore (approximately $11.4 billion), driven by equity inflows. October saw the most outflows of Rs 96,358 crore (approximately $11.7 billion).

US continues to dominate

The US continued to dominate global capital flows, with foreign investors pouring $9.9 billion into US funds, following $8 billion the previous week. Mid-cap and small-cap funds showed consistent improvement, attracting $611 million and $4.6 billion, respectively.

Globally, emerging markets showed signs of stabilisation, according to Elara Capital, with foreign inflows into China ($221 million), Hong Kong ($176 million), South Korea ($57 million), and smaller contributions to Argentina, Israel, Singapore, South Africa, and Thailand.

On the other hand, European markets and Japan faced substantial outflows, reflecting investor caution in developed economies. France saw the largest outflow of $625 million, followed by the UK ($372 million), Germany ($320 million), Japan ($267 million), and the Netherlands ($196 million).

According to the report, high-risk assets remained attractive to investors, with junk bonds sustaining their upward momentum.

“Commodities also recorded positive flows for the third consecutive week, gradually gaining pace over the past two months. However, the long-term momentum in commodity investments has fallen to levels last seen during historical turning points in January 2009, October 2015, and October 2019—periods linked to the outperformance of India’s metal index,” stated the report.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.