India is in a multi-year bull market with intermittent pullbacks and corrections, the latest report from DSP Mutual Fund has said. According to the fund house’s market strategy and economy team, the opportunities will be more in small- and mid- cap space, with valuations in largecaps having run up and consolidation likely in this segment.

“We see a lot of strength in the Indian markets because of its strong earnings growth, strong fundamentals and GDP growth that is stronger than other emerging markets (EM; India-EM GDP Growth differential is 3.6%). There is a clear-cut earnings-driven push towards India vis-à-vis other emerging markets, that’s why we see a multi-year bull market which may see some short-term time corrections,” said Ankita Pathak, product manager and economist at DSP Mutual Fund, and co-author of the report "The Navigator".

Also read: High probability of our entering a bull market: IIFL's Sriram Velayudhan

Strong earnings

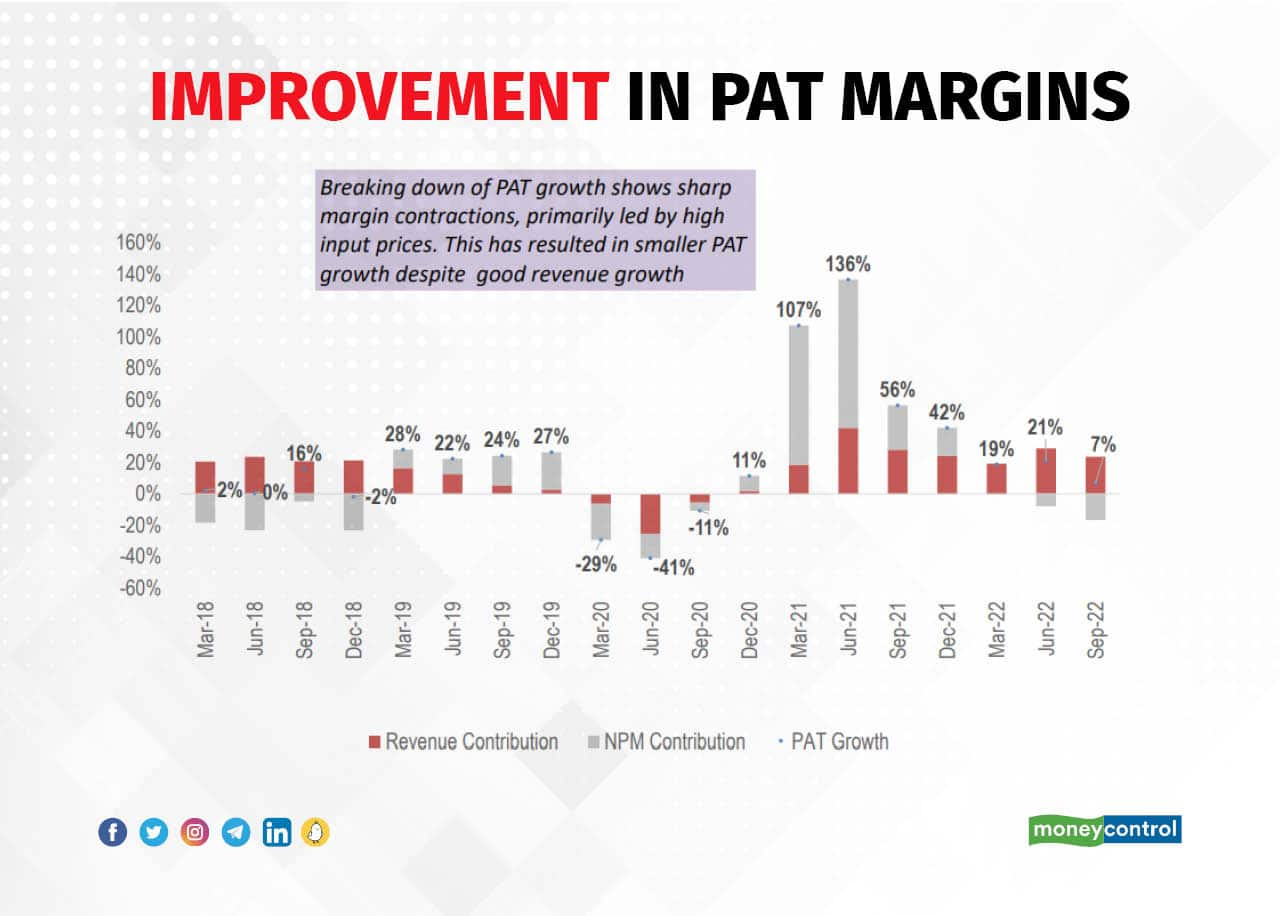

The researchers believe that the earnings growth will be strong because they see the margins improving.

“After a sharp margin expansion in the Covid era that was driven by cuts in travel/ employee costs and administrative expenses, margins are drying away largely driven by high input prices and/ or high attrition rate. However, with input prices easing, margins are likely to improve hereon,” stated the report.

(Graphics: Rajesh Chawla; Source: DSP MF)

(Graphics: Rajesh Chawla; Source: DSP MF)

According to Pathak, PAT growth could improve from 7 percent because “profit margins won’t be negative as input prices come down”.

DSP’s team does not see China reopening causing any significant increase in commodity prices.

“Our expectation is that a gradual reopening of China will not only improve demand for commodities but also improve supplies coming out of China. This needs closer monitoring and may remain a non-event for most commodities, on balance,” the report said.

Earnings growth for Nifty for September 2022 TTM was 17 percent, and for the sectors that DSP’s team prefers –consumer discretionary, financials, health care and industrials—earnings growth numbers for the same period have largely beaten the index at 19 percent, 33 percent, 20 percent and 10 percent, respectively.

In the overall market, quality parameters of sectors—return on equity (RoE) and net debt to equity—are also showing a healthy trend. The Nifty’s RoE is at pre-Covid levels and the net-debt-to-equity ratio levelled to FY19 levels too.

EM rally coming

The DSP’s team expects an emerging market (EM) rally with the dollar weakening. The dollar could weaken because of a pause in quantitative tightening, a lower yield differential between the US and the rest of the developed world and a global economic slowdown.

“We expect quantitative tightening to pause somewhere in the first half of 2023, then there will no sucking out of dollar liquidity from the system. Secondly, until now the US hiked policy rates hawkishly and the rest of the world hiked rates with a lag but going forward the yield differential between US and European markets will shrink. Some part of the money from the developed markets would go to Europe and not just one way to the dollar. Finally, the global slowdown would be bad for the dollar too,” said Pathak.

When EMs perform well, it works well for the small and midcap segments of the Indian markets too.

When the EM region does well, India can benefit more than its peers because the FII flows favour the country.

“In the last year, the average return of Indian markets has been higher than the EM peers but so has been the growth. Clearly, with strong fundamentals, India is likely to be the choice of FIIs for EM investing,” the DSP report said.

Also read: Santa rally fizzles out even before the market could say ho, ho, ho

Why small and mid-cap space?

Besides the EM rally, small and mid-cap space is also likely to benefit from the economic growth picking up.

"Real economy in India is expected to be buoyant as domestic indicators remain resilient. There’s a risk to this hypothesis from global slowdown but that can be mitigated with the right stock selection," the report said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.