Indian equity markets extended their winning streak to a third consecutive week, buoyed by a robust rally across global markets. However, the celebration was somewhat muted—while domestic indices closed in positive territory, India's gains were the most modest among major global markets, as seen in the chart below.

The Nifty50 edged up 0.52 percent during the week, though the narrow market breadth remained a persistent concern. Among individual stocks, Reliance Industries led the pack, followed by Bajaj Finance, HDFC Bank, and ICICI Bank. Sectoral performance painted a relatively bright picture, with Pharma, Media, PSU Bank, Metal, IT, and Private Bank indices each advancing between 1-2 percent.

FIIs continued their selling, dumping equities worth Rs 3,659 crore even as markets climbed higher.

US stock indices finished their holiday-shortened week on a strong note, lifted by dovish commentary from Federal Reserve officials and a series of weaker-than-expected economic reports. These developments reinforced market expectations that a December rate cut remains firmly on the table.

For Indian markets, the biggest news arrived after Friday's closing bell with India's GDP surged to 8.2 percent in the latest quarter, marking a six-quarter high and comfortably beating analyst forecasts. Markets are expected to greet this development enthusiastically when trading resumes on Monday.

However, this robust growth figure presents something of a double-edged sword. While undeniably positive from an economic standpoint, the stronger-than-anticipated expansion could give the Reserve Bank of India pause, potentially discouraging a rate cut at its December Monetary Policy Committee meeting—a prospect that may temper investor enthusiasm in the weeks ahead.

Bullish sentimentsA slow and steady ascent has characterised the Nifty's third consecutive week of gains. Weak market breadth continues to unsettle investors, though the midcap index has bounced back and set a higher high. Small caps, however, failed to match this performance, leaving unresolved the battle between bulls and bears. Notably, FIIs unwound a substantial portion of their short positions on expiry day, and the key question now is whether they will continue buying into the rally and further reduce their shorts.

Options market data reveals an intriguing pattern as puts have outnumbered calls at the close for several consecutive days. The last time this occurred was immediately after the monthly expiry in early October, which was followed by a strong market surge through the rest of the month. Could history repeat itself? This positioning reflects short covering by call option writers, while put selling—typically a bullish action—suggests traders see limited downside risk ahead.

Source: web.strike.money

The 20-day A/D ratio did not break out of the oversold territory even though Nifty did make a higher high. The weak breadth into expiry has affected the averages. However, the reading is close to the oversold zone and indicates a potential rally in stocks ahead.

Source: web.strike.money

Clients as a group are continuing to reduce their long market positions. This behaviour aligns with a bullish market trend. The ratio illustrates the divergence between the Nifty index and the client group at significant lows. These divergences, particularly near overbought or oversold levels, contain directional messages.

Client positions tend to move in the opposite direction of price action. Although the data has been declining, it has not yet reached oversold territory, which would typically suggest a market peak. This indicates considerable potential for market growth, even as client positions diminish.

Source: web.strike.money

Sector RotationNifty 50 – The Benchmark Index ended higher by +0.52% this week and closed at 26202.95.

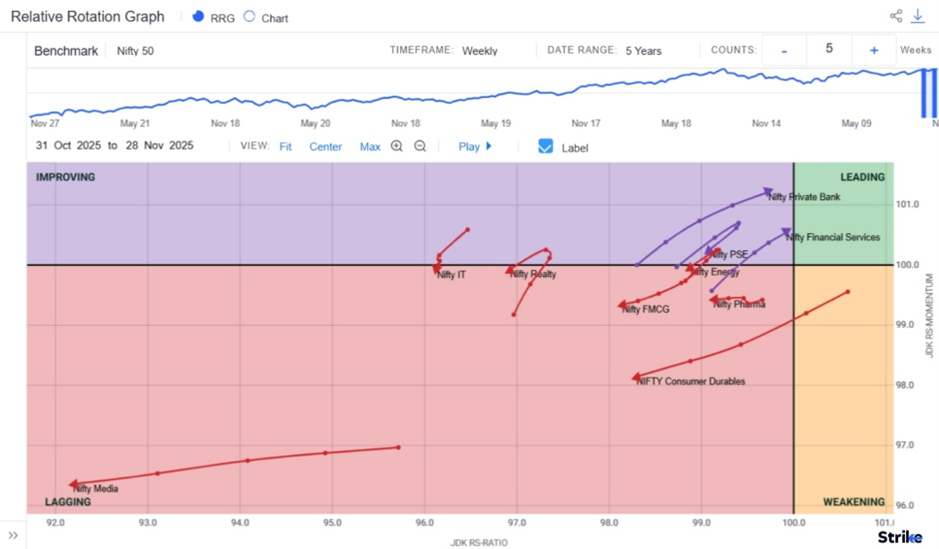

Weekly RRG:

Nifty Bank continued its journey into the leading quadrant, gaining both momentum and relative strength, while Nifty Oil & Gas saw its momentum and relative strength marginally increase. Nifty Infrastructure, on the other hand, has shown a moderation in momentum and relative strength. Nifty Metal is seen losing further momentum and relative strength, while Nifty PSU Bank is beginning to see some moderation after seeing four consecutive weeks of relative strength and momentum.

Weakening Quadrant:The Nifty MNC is seeing a sharp drop in momentum and relative strength week-on-week.

Nifty Private and Nifty Financial Services gained momentum and relative strength, and can probably jump into the leading quadrant in the coming week. Nifty PSE, which began to lose momentum and relative strength in the last week, weakened further this week.

The lagging quadrant has seen significant activity, including new entrants and potential new entrants. Nifty Realty, Nifty IT and Nifty Energy, which were losing momentum in the last week in the improving quadrant, have entered the weakening quadrant this week with a loss in relative strength as well.

Nifty Media remains the outlier in this quadrant, losing momentum and relative strength, and there is no sign of a turnaround yet.

Stocks to watchAmong the stocks expected to perform better during the week are Shriram Finance, Motherson, Muthoot Finance, MCX, AB Capital, GMR Airport, Canara Bank, LTF, Reliance, Hero MotoCorp, Adani Ports, Cummins, and PNB.

Cheers, Shishir AsthanaDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.