Foreign Portfolio Investors (FPIs) withdrew $17.1 billion from the Indian capital markets during March and April amid coronavirus pandemic that brought the world to a virtual halt.

According to a report from CARE Ratings, March alone saw an outflow of about $15.2 billion of foreign money from the equity and debt segment (including Debt – VRR).

The outflow was primarily driven by uncertainties surrounding the outbreak as well as global recessionary concerns, the agency said.

Nearly 80 percent, or $13.6 billion, withdrawals were made between March 1 and March 24 before the country was put on lockdown.

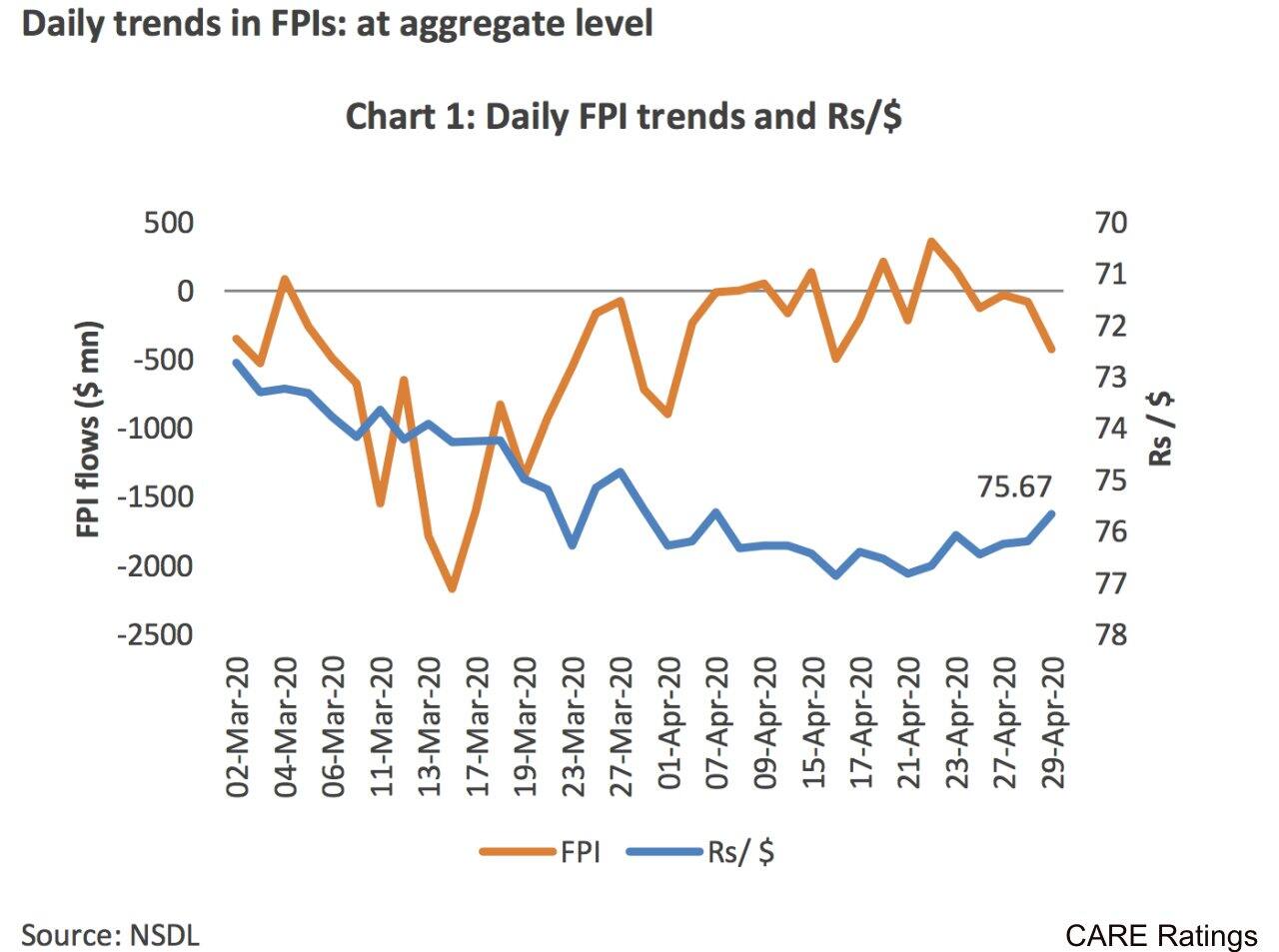

Of the 39 trading sessions during these two months, only eight days recorded net FPI inflows, it noted adding that the mass exodus of overseas money led to a 3.3 percent fall in the rupee against the greenback during March-April 2020.

During the two months, the INR/USD exchange rate was the lowest on April 16 at Rs 76.87/dollar, a 5.7 percent drop from March 2 levels.

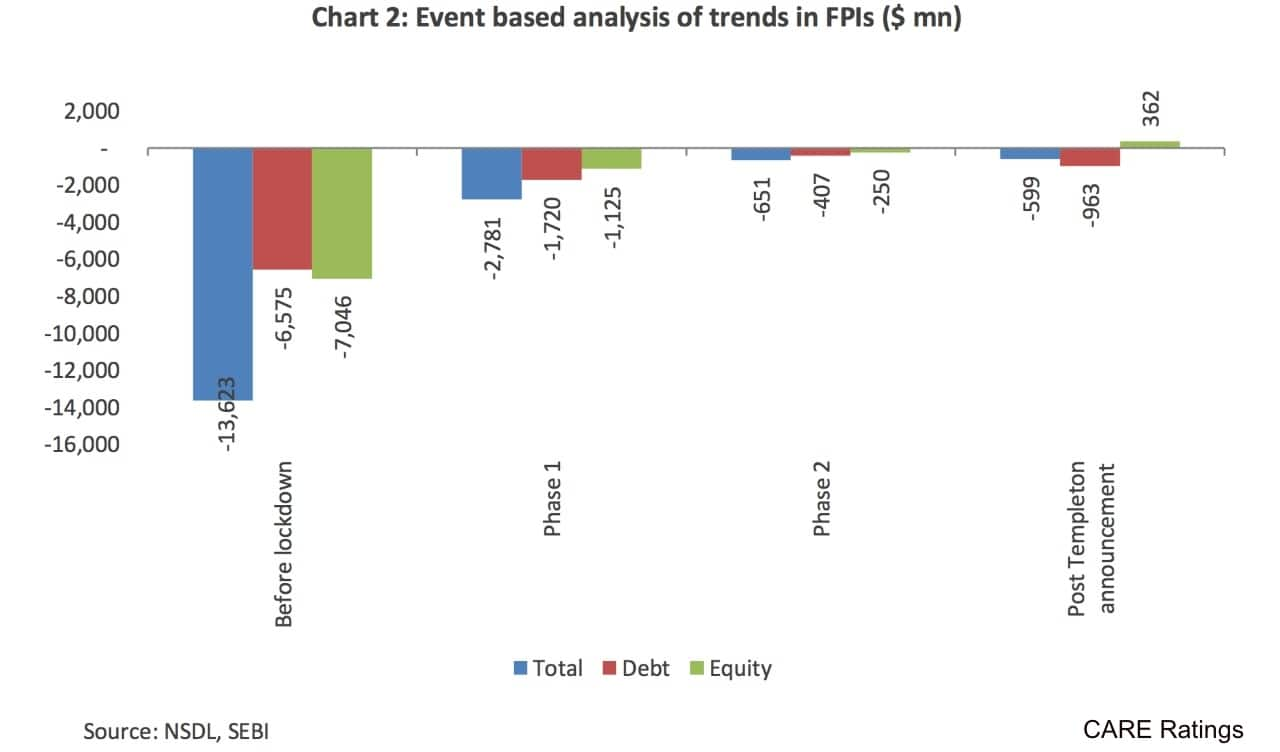

Analysts at CARE Ratings broke down the March-April period into four phases to see how the foreign money moved during the COVID-19 crisis.

Also Read: Despite highest-ever sell-off in March, FIIs bought into these 6 sectors

Before lockdown (March 1 to March 24)

Before the lockdown, FPIs were net sellers to the tune of $13.6 billion, of which, $6.6 billion were withdrawn from the debt segment, while $7 billion were taken out from the equity market.

With the virus spreading to most major economies, this period witnessed the highest sell-off as investors feared that the economic disruption due to COVID-19 would be much worse than previously anticipated. Some European countries had assumed lockdowns during this time which further augmented their concerns.

Foreign investors were net sellers in 14 out of the 15 trading sessions between March 1-23 which led to a 4.9 percent drop in the Rs/$ exchange rate during this period.

Phase 1 of lockdown (March 25 to April 14)

During this phase, the net FPI outflows were significantly lower than the period before the lockdown. Net FPI outflows aggregated to $2.8 billion, out of which, $1.7 billion was from the debt segment.

According to CARE Ratings, the announcement of lockdown, as well as the sobering economic outlook from the International Monetary Fund (IMF) and World Bank, roiled FPIs' sentiment.

However, the truncated working hours in the stock exchange coupled with fiscal stimulus announced by the government (both centre and states) and the Reserve Bank of India (RBI) cushioned the fall.

Phase 2 of lockdown (April 15 to April 23)

After the March rut and some stability in the first two weeks of April, foreign interest once again returned to the debt segment of the Indian markets. FPIs pumped in $556 million into debt schemes; however, the foreign money continued to evade the equity segment which lost $611 million during April 15-23.

Post Franklin Templeton crisis (April 24 to April 30)

On April 23, Franklin Templeton India, one of the largest fund houses in the country, announced it would wind up six credit funds citing severe market dislocation and illiquidity in the wake of the pandemic.

The revelation sent shockwaves across the debt market which lost $963 million of overseas investment between April 24-30. Meanwhile, the equity market saw an influx of $362 million after three weeks of consolidation led many participants to believe that the Nifty may have already found its bottom.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.