Foreign institutional investors (FIIs) turned net buyers for the first time in 2020 in May pumping in Rs 13,914.49 crore in the cash segment of the Indian market.

The economic disruption led by the COVID-19 pandemic coupled with an already slowing economy kept overseas investors on the sidelines for the first four months of the current calendar. However, after the wild swings of March and April, consolidation in the month of May seems to have reignited foreign interest in the Indian market.

In May, the Nifty50 fell 2.84 percent though broader market outperformed the frontliners as Nifty Midcap index and smallcap index fell 1.7 percent and 1.84 percent, respectively, suggesting a shift in investor sentiment.

Despite an otherwise gloomy month for the equities and capital market in general, overseas money once again returned to the Indian markets in May primarily driven by the gradual reopening of economies around the world, cheap valuations and a comparatively sharp run-up in other markets.

Of the 35 sectors classified by the BSE, foreign investors were net buyers in 13. Meanwhile, 18 sectors saw outflows and four witnessed no action from FIIs in May, data provided by National Securities Depository Ltd (NSDL) showed.

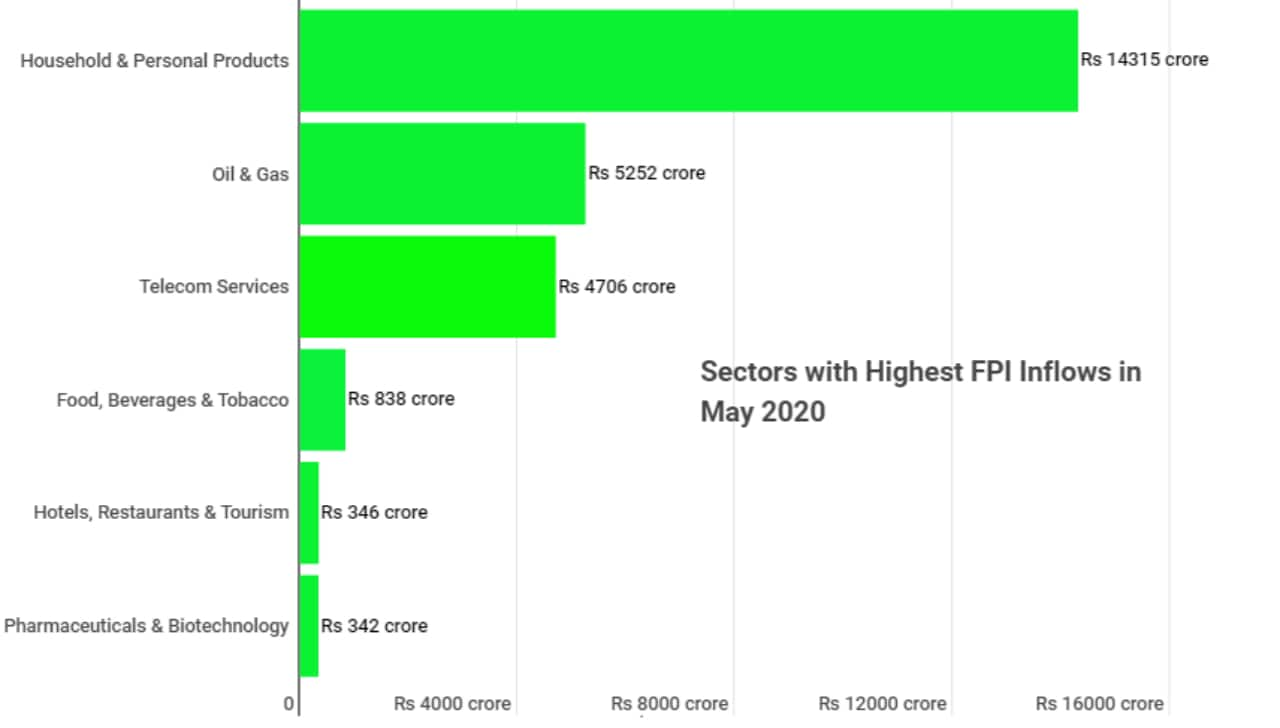

The Household & Personal Products sector was on the top of FIIs' shopping list, raking in Rs 14,315 crore during the month. The sector was the biggest gainer in April as well, drawing in Rs 2,816 crore in foreign funds.

Oil & Gas was another sector that remained on top of their buying list for the second straight month. In May, it added Rs 5,252 crore and in April it saw an inflow of Rs 1,320 crore.

Other sectors that FIIs bought into include Telecom Services (Rs 4,706 crore), Food, Beverages & Tobacco (Rs 838 crore), Hotels, Restaurants & Tourism (Rs 346 crore), Pharmaceuticals & Biotechnology (Rs 342 crore).

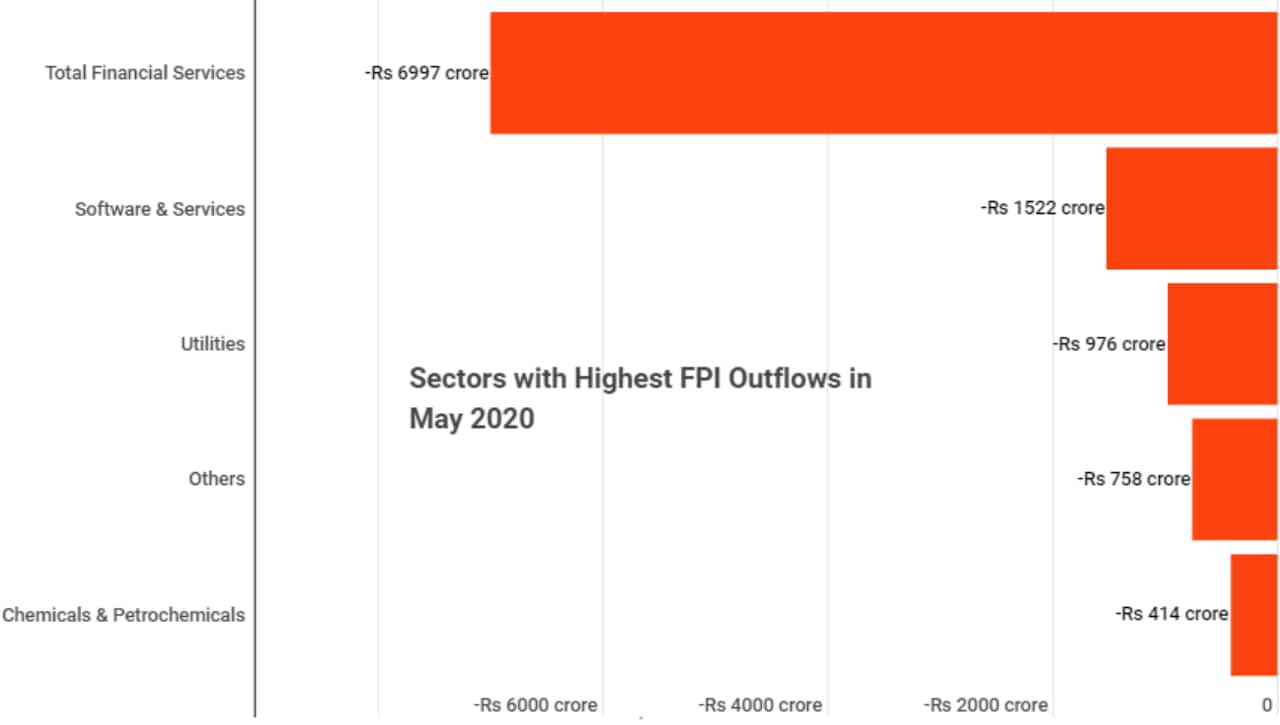

Meanwhile, the biggest carnage was seen in Total Financial Services, which saw an outflow of Rs 6,997 crore. According to a BSE classification, the sector consists of Banks and Other Financial Services. Both components saw FII exodus of Rs 3,251 crore (banks) and Rs 3,747 crore, respectively.

As per BSE, Other Financial Services include financial institutions, holding companies, housing finance companies, investment companies, NBFCs, asset management companies and any other issuer dealing in financial services not categorised as banks or the aforementioned sub-categories.

In April, Other Financial Services was the top loser as well at Rs 1,991 crore, however, Banks was among gainers receiving overseas money to the tune of Rs 1,238 crore.

According to experts, the sharp sell-off in Other Financial Services segment can be attributed to the elevated risk of non-performing assets (NPAs), especially for the NBFCs due to the extended nationwide economic shutdown as well as RBI’s decision to extend moratorium to August 31.

"Moratorium extension is a major negative for all NBFCs (including the ones with strong liability franchises), as this would further delay the overall collection and recovery procedure, and stretch the total liquidity cycle for all. Also, this would further damage financial discipline, especially for small-ticket borrowers and MFIs," Emkay said in a note last month.

Other sectors that foreign investors exited in April include Software & Services (Rs 1,522 crore), Utilities (Rs 976 crore), Others (Rs 758 crore), Chemicals & Petrochemicals (Rs 414 crore) among others.

BSE had classified around 4,700 issuers into 35 sectors. Any FII investment outside those 4,700 issuers is classified under 'Others'.

The four sectors which saw no action in April from FIIs were Food & Drugs Retailing, Real Estate Investment, Hardware Technology & Equipment and Sovereign.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!