The Nifty continued to rally beyond four weeks, adding more than 100 points on November 28 and exeeding the previous top resistance of 19,875 on a closing basis. For last many trading sessions, the index sees support near the five-day EMA (exponential moving average), placed at 19,816. The Nifty is trading above 5, 10, 20, 50, 100 and 200 DEMA, which indicates a bullish trend on all time frames. The Nifty Midcap 100 Index has registered a fresh all-time high.

Indicators and oscillators like RSI (relative strength index), DMI (directional movement index) and MACD (moving average convergence divergence) have been showing strength in the current uptrend of the market. Nearly 85 percent of the NSE500 stocks are trading above their respective 200 DMA, which indicates strong breadth in the market.

Recent Fall in crude prices and Dollar Index augers well for equity market sentiments. FII’s long to short ratio in Index future is still at 0.29, which could trigger more short covering by FII’s in index future any time soon.

December month has been the best month for Nifty50 Index with more than 3 percent average return, if we were to consider last 29 years of monthly performance historical data. So probability of Indian markets continuing its upward journey in December month is high.

For the last five consecutive Lok Sabha elections, 6 months before the announcement of election results, Nifty has rallied between 10-32 percent going into the day of election result announcement. We entered those “auspicious” six months period starting from November 2023. Every period had its own contextual shades but broadly for 25 years and 5 Lok Sabha elections – markets have obliged with the pre-election rally.

Considering the evidences discussed above, we expect markets to continue its upward journey and we expect Nifty to register fresh all-time high above 20,222 soon. On the down side, 19,600 is expected to act as a strong support for the Nifty.

Here are three buy calls for next 2-3 weeks:

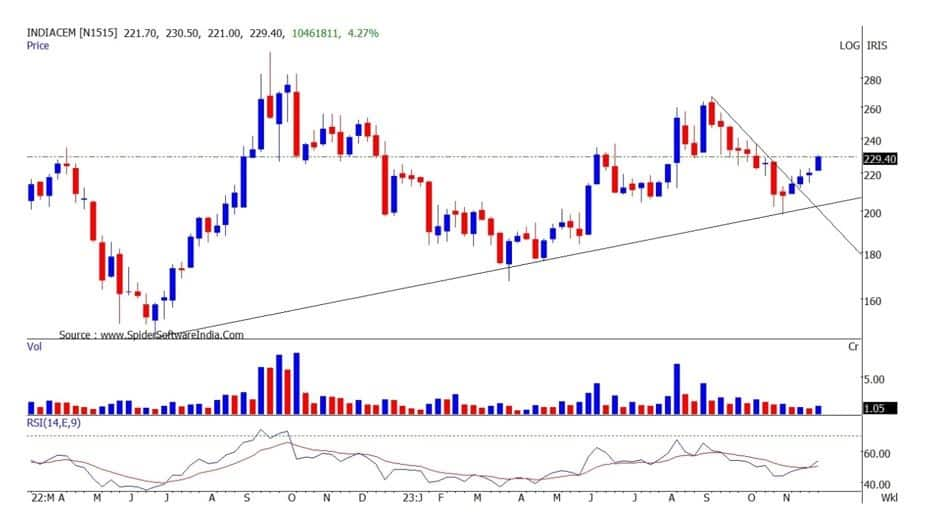

India Cements: Buy | LTP: Rs 230 | Stop-Loss: Rs 216 | Target: Rs 269 | Return: 17 percent

The stock price has broken out from downward sloping channel on the weekly chart. Stock found support on its 100-week EMA and reversed north.

The stock is holding above its 20, 50, 100 and 200 DEMA, which indicates bullish trend on all time frame. Indicators and oscillators like DMI and RSI (relative strength index) have turned bullish on the daily charts. Cement Sector has started outperforming.

Hindustan Copper: Buy | LTP: Rs 168.7 | Stop-Loss: Rs 156.5 | Target: Rs 190 | Return: 13 percent

The stock has broken out from bullish Inverted Head and Shoulder pattern on the daily chart. PSU and metal and mining stocks have been performing exceptionally well in recent time.

The stock is placed above all important moving averages, indicating bullish trend on all time frames. Indicators and oscillators have turned bullish on weekly time frame.

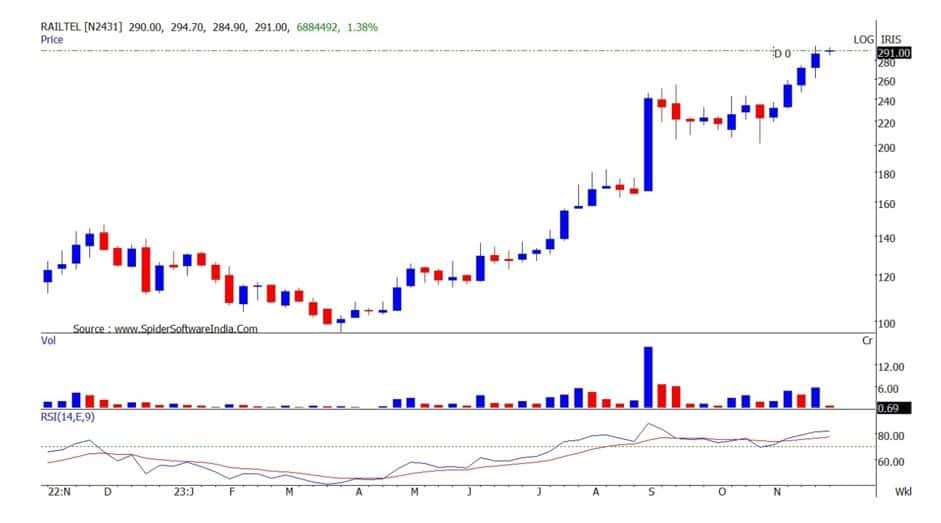

Railtel Corporation of India: Buy | LTP: Rs 291.45 | Stop-Loss: Rs 263 | Target: Rs 340 | Return: 17 percent

The stock has been rising for last 5 consecutive weeks and currently trading near its all-time high. Railway stocks have been outperforming and same is expected to continue. The stock is placed above all important moving averages, which indicates bullish trend on all time frames.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.