2020 has been quite a year presenting all of humanity with the storm and the calm at the same time. The year has been unprecedented from a health as well as wealth standpoint with both getting worse before it got better.

With active caseloads in India hitting a peak mid-year to a drastic decline, capital markets moved inversely as bellwether indices slumped by almost 40 percent from its January levels to hit a record high as the year came to an end. While absolute returns from January 2020 to December 2020 itself have been good, what's exciting is the journey that markets traversed between the New Year Eves.

As investors globally prepare for the new calendar year and scour reports for directionality, we believe 2020 left us with a treasure trove of learnings which will help navigate the markets of 2021.

Here are the top four observations and learnings from 2020 that can help investors navigate Mr. Market’s 2021 avatar.

Never bet against the human race

The pandemic was, quite paradoxically, a reflection of the fragility and strength of humans at the same time. When broader indices tanked late March, many decided to pull the plug on their equity investments and swore to never invest again. But at the same time, smart money started moving into the capital markets. Today, we know why some monies are called smart monies.

Times like these warrant rationalities more than emotional decision-making. It is textbook that capital markets will progress as long as mankind progresses and the day mankind stops progressing, neither will the capital matter nor the markets. In the short term there may be anomalies, but equities are also not meant to be the avenue for a quick buck.

The treasure is buried way past performance metrics

People often invest basis past performance – some invest in stocks and funds which have had a stellar run expecting the run to continue while some decide to invest in the most beaten-down instruments with the hope of a resurrection. Both strategies, in isolation and mathematically, have a 50 percent chance of success – the same as that of tossing a coin.

Past performance is data, reasons for such performance is information and an understanding of the reasons in today’s context is called an insight. Investment decisions made basis data and information is often as good tossing a coin, but decisions basis insights improve the odds dramatically.

It is imperative that investment decisions are not made by looking at past performance alone.

Asset allocation is underrated

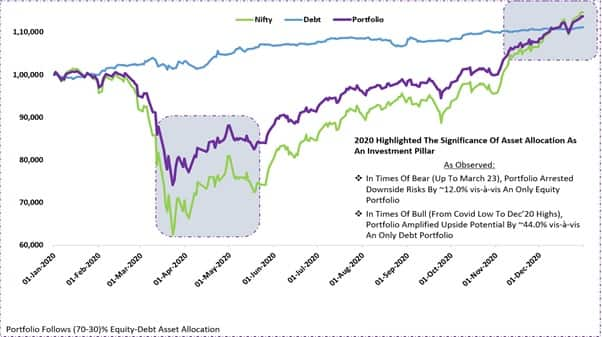

Great portfolio managers, globally, can swear by the principles of asset allocation. The very premise of asset allocation is deciding upon a mix of asset classes in alignment with the investor and investment profile. The objective of asset allocation is to generate risk-optimal returns in line with investment objectives across economic and market cycles.

Every asset class has a relationship with developing economic and market conditions and a good asset mix allows the portfolio to participate in the upside significantly while mitigating the downside risks. Going forward, with uncertainty being the only certainty, it is important to acknowledge the role of asset allocation in optimising cycles and refrain from deviating basis hyper-volatile news flow.

With 2020 being quite the roller coaster, the following illustration reflects the optimisation prowess of good asset allocation.

Portfolio reviews are not just about P&L

Portfolio reviews are not just about P&L

Long term investing is different from dormant investing. Being a long-term investor means to stay invested for the long-term and not letting the volatility translate to investment decisions while continuously reviewing the portfolio for weaknesses.

Most investors make the mistake of reviewing & rebalancing their portfolio in light of the profits or losses on the account. However, this couldn't be farther from the ideal review. The right way to review a portfolio is by working the portfolio from scratch. The review frequency should ideally be six months or whenever there is a material change in the financial position of the investor, whichever is earlier.

The number one vector to take stock of is the decided asset allocation and checking if a change is warranted. A change in asset allocation is recommended only if there is a material change in the investor or investment profile. Once the ideal asset allocation is decided, it is now time to realign the portfolio to match the ideal asset allocation. A deviation of +/- 5 percent is considered non-actionable. While rebalancing, one must be cognizant of the exit load and tax implications.

To sum, a portfolio rebalancing activity must be undertaken only if one of the following cases materialise:

i. Change in investor profile (e.g. risk appetite, legal restrictions)

ii. Change in investment profile (e.g. tax status, cash flow expectation)

iii. Outlook on a holding changes materially

Investors who attempted to review & rebalance their portfolios in light of the news flow and P&L standing at any point in 2020 most probably ended up making a wrong decision.

2021 is going to be a year of ramifications of every decision made in 2020 along with being the opportunity to learn from the year that went by for a brighter 2022.

(Nirav R Karkera is the Head – Research at Fisdom.)

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.