“The most dangerous phase of a bull market isn’t when investors lose money; it’s when they stop believing they can.”

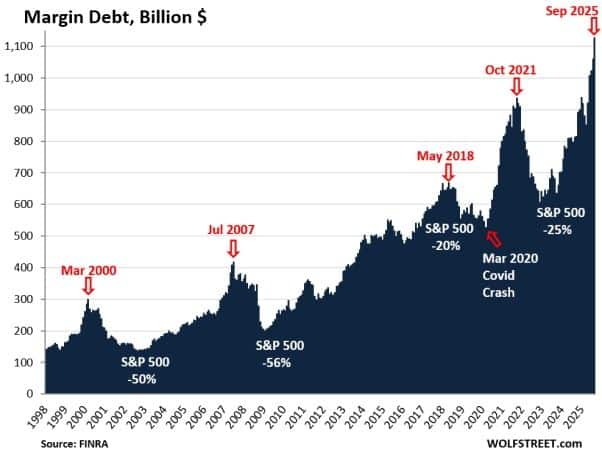

Lately, this illusion seems stronger than ever. Margin debt in the US has surged to a record $1.13 trillion, the highest in history. Market volatility is at multi-year lows, valuations are stretched, and investors appear fearless. When everything looks calm on the surface, that’s usually when the tide begins to turn.

Every time we’ve seen this cocktail of euphoria and leverage in 2000, 2007, and 2021, it was followed by a major market correction. The signs are flashing again, but this time, the stakes appear even higher.

The Complacency Trap

The biggest risk to investors isn’t always a crash, it’s complacency before the crash. The US market’s current mood is one of overconfidence. Retail and institutional investors alike are taking on record leverage, convinced that momentum will outpace risk.

The rise of leveraged ETFs in the US offering up to 5x exposure has only added fuel to this fire. It’s an easy way to amplify returns until markets move the other way. Remember, with 5x leverage, a 15% decline in stock prices wipes out 75% of capital, leaving just 25% of the portfolio. That’s how small corrections turn into big crises, as a real-life butterfly effect. When everyone believes “this time is different,” that’s usually when history repeats itself.

Herd Mentality at Its Peak

Today’s market reflects classic herd behaviour of the investors rushing to chase what they see trending or what everyone else is buying. It’s no longer about fundamentals; it’s about FOMO (Fear of Missing Out). But as Warren Buffett famously said, “Be fearful when others are greedy, and greedy when others are fearful.”

Right now, the crowd is clearly in the greedy phase. Margin accounts are swelling, and market sentiment shows extreme optimism. History tells us that such confidence rarely ends quietly.

The AI Bubble – Déjà Vu of the Dot-Com Era

Much of this optimism is built around the AI boom, which is also breeding speculation. As I highlighted in my previous article about how AI companies are engaged in circular deals, boosting valuations without real cash flow support.

The parallels with the dot-com era of 2000 are hard to ignore grand narratives, sky-high valuations, and blind faith in “limitless potential.” The AI story might be the next big technological revolution, but it’s also becoming the market’s next emotional bubble.

If the tide turns, even slightly, it could trigger a chain reaction of margin calls and ETF liquidations, amplifying volatility far beyond expectations.

Valuations at Breaking Point

Valuations, too, are echoing signs of excess. The S&P 500’s price-to-sales ratio has climbed to around 3x, among the highest in history, while the Cyclically Adjusted Price Earnings (CAPE) ratio multiple hovers near its overvalued zone, close to two standard deviations above the mean. This suggests stretched expectations across the board.

What the Smart Money Is Doing

Interestingly, the world’s top investors aren’t chasing this rally; they’re stepping back.

• Warren Buffett is sitting on a record $382 billion cash pile, the highest in Berkshire Hathaway’s history.

• Michael Burry, the famed investor who predicted the 2008 subprime crisis, has taken short positions in AI-linked stocks.

• And at the Global Financial Leaders’ Summit, both Goldman Sachs CEO David Solomon and Morgan Stanley CEO Ted Pick warned of a potential 20% market correction in the next 12–24 months.

When the veterans turn cautious, it’s rarely without reason.

History’s greatest investors made their fortunes not by predicting peaks, but by respecting cycles. Today’s environment of easy money, high leverage, and AI euphoria may look unstoppable, but so did every bubble before it.

No one can predict when the market tide turns. But all indicators: record margin credit, high valuations, and complacent sentiment suggest that we’re closer to the top than the bottom. It may not happen tomorrow, but gravity eventually catches up.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.