The financial year 2021 (FY21) ended on a positive note for Indian equities, with benchmarks the Sensex and the Nifty jumping 68 percent and 71 percent, respectively, during the year.

The BSE Midcap surged 91 percent, while the smallcap index gained a whopping 115 percent.

The cumulative market capitalisation (m-cap) of BSE-listed firms is at more than Rs 205 lakh crore, a rise of about 92 percent in FY21. On March 31, 2020, the market-capitalisation of BSE-listed firms stood at Rs 113.5 lakh crore, data available with BSE showed.

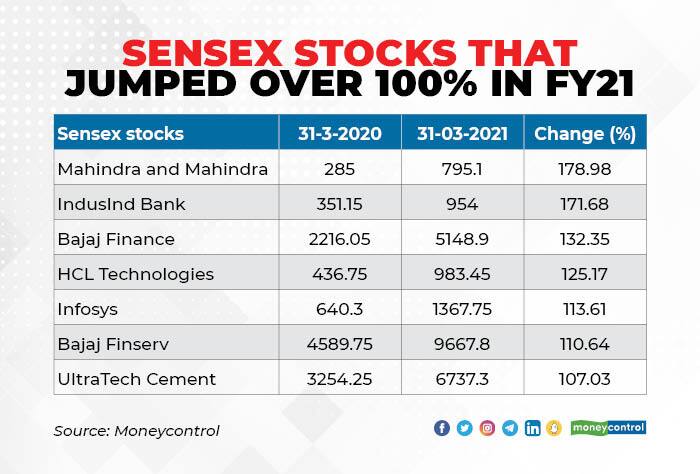

Seven stocks—Mahindra and Mahindra, IndusInd Bank, Bajaj Finance, HCL Technologies, Infosys, Bajaj Finserv and UltraTech Cement—jumped over 100 percent each in the 30-share pack Sensex.

Sensex stocks rose in the range of 5 to 179 percent during the year. Only two stocks— Hindustan Unilever (up 5.77 percent) and Nestle India (up 5.32 percent)—failed to give returns in double-digit in FY21.

In the Nifty50 index, 14 stocks jumped over 100 percent in FY21 and only two stocks—Hindustan Unilever (up 5.79 percent) and Nestle India (up 5.30 percent)—gave returns in single-digits.

Only one component of the Nifty—Coal India (down 6.93 percent)—ended the year in the red. In terms of gains, Nifty stocks rose in the range of 5-325 percent.

The market delivered positive returns in all four quarters of FY21. Brokerage firm Motilal Oswal Financial Services said FII flows in equities in FY21 were the highest ever at $37.6 billion, while DII saw outflows after five consecutive years of inflows.

"The year ended far better than it began—as the economy and markets recovered after May 2020 with a gradual easing of lockdowns. Corporate India surmounted the challenges posed by COVID with unprecedented cost- containment measures with a parallel improvement in the balance sheet as well as cash flows," Motilal Oswal said.

Top gainers in the sectoral space were metals (up 151 percent), autos (up 108 percent), technology (up 103 percent), real estate (up 90 percent), and private banks (up 75 percent).

Also read: Metal, auto, IT sectors more than doubled in FY21, will the trend continue in FY22?

The theme of FY21 was high beta, cyclical and value. Quality and defensive themes, the flavour of the past few years, took a breather, said Motilal Oswal.

As per Motilal Oswal, after the sharp rebound, the Nifty now trades at a 12-month forward P/E of 20.7 times, nearly 10 percent above its historical average of 18.8 times.

"At 3.1 times, the Nifty P/B is also well above its historical average of 2.6 times. The market capitalization-to-GDP is at a new yearend high of 105 percent (FY21E nominal GDP, which is expected to decline nearly 4 percent)," Motilal Oswal said.

The road ahead

The pace of vaccination and the trajectory of quarterly earnings will drive the market in FY22.

"Given the recent resurgence in COVID-19 cases, the pace of vaccination will assume crucial importance. Expeditious containment of COVID-19 cases and accelerated pace of vaccination will provide comfort for FY22 economic growth recovery," Motilal Oswal said.

"The expectations for FY22 earnings are running high at more than 30 percent growth in Nifty FY22E EPS. Given the rich valuations, any misses on FY22 earnings delivery may act as a dampener."

Amar Ambani, Senior President and Head of Research–Institutional Equities, Yes Securities, is of the view that the market structure is promising and the Sensex may surpass 1,25,000 by 2025.

"The market structure looks very promising and with volatility receding from its elevated levels. We have entered a super-cycle for Indian equities as we had seen in the year 2003," Ambani said.

"We see the high possibility of decisive reforms from the government, accelerated earnings growth and a continued liquidity flow chasing growth, in a period of weakening US dollar. I expect the Sensex to surpass 1,25,000 by 2025," he said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.