India equity benchmarks climbed higher on March 27 morning on easing concerns over the crisis in the global banking sector and largely positive global cues. Some buying at lower levels also supported the recovery.

Traders, however, remain sceptical of the recovery as the market failed to sustain pullbacks in the previous week.

At 10.44 am, the Nifty was up 47.30 points, or 0.28 percent, at 16,992.30. Nifty futures rose 54.70 points, or 0.3 percent, to 17,009.75.

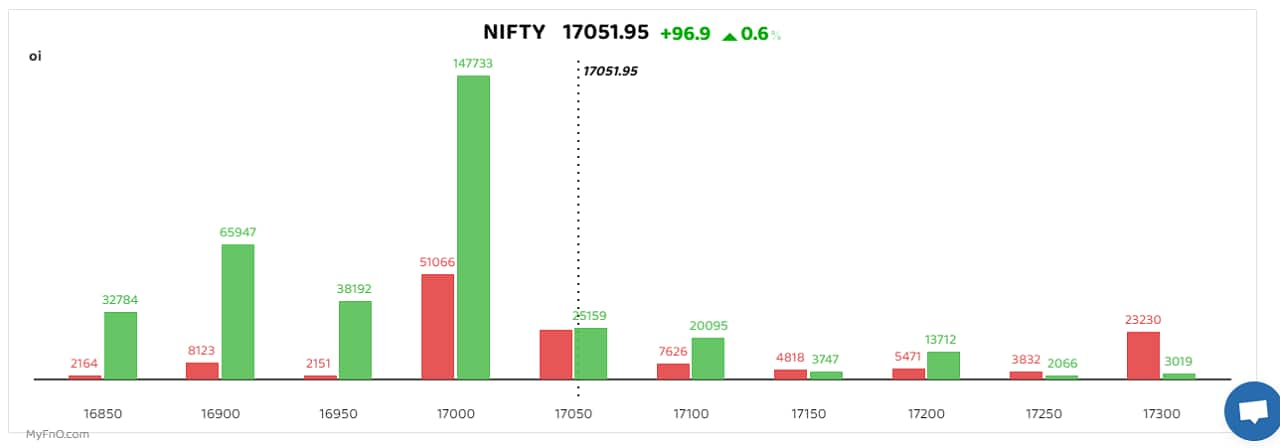

Among put options, maximum accumulation of writers was at 17,000. Heavy put writing was seen at 16,900, 16,950 and 16,850, which suggest underlying caution in the market. Call writers were also active at 17,000, as the level emerges as a battleground for the bears and the bulls.

Ankush Bajaj, a Bengaluru-based trader, was not convinced and saw the gains as a mere pull-back move after the recent fall. His scepticism emerges largely from the subdued trend in the banking sector, which has the maximum weightage in the Nifty. "I will be going short until the Nifty manages to sustain above 17,050," Bajaj said.

As for Bank Nifty, Bajaj said the sectoral index needed to hold above its intraday high of around 39,500 to make a sustainable recovery or it would slip into losses.

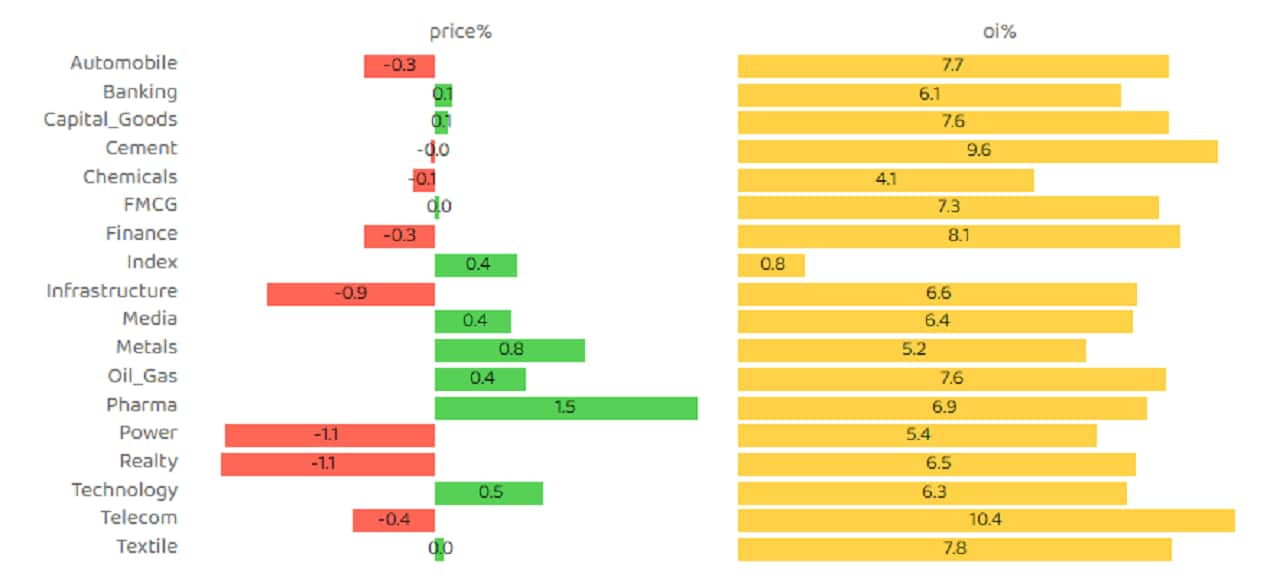

Aside from banks, other sectors showed a mixed trend. A similar trajectory was seen in the F&O segment, as traders were bullish on pharma and technology, while they added bearish bets in automobile, chemical, realty and power.

Adani Enterprises saw an addition of short positions as open interest in the counter rose to a one-week high. Manappuram Finance, Rain Industries, Indian Energy Exchange and Tata Power also saw short buildups. A short buildup is a bearish sign which happens when prices fall along with a rise in open interest.

Most pharma counters, including Lupin, Biocon, Glenmark Pharma, Aurobindo Pharma and Metropolis Healthcare saw an addition of long positions. Index heavyweight Reliance Industries also witnessed long additions as open interest in the counter shot up over 6 percent, the highest in a year. A long buildup is a bullish phenomenon characterised by rising prices along with an increase in open interest.

Some short covering, also a bullish sign, was seen in Atul Ltd and Multi-Commodity Exchange.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.