Indian benchmark indices have been trading in the green amid favourable global cues. At noon, Nifty was trading at Rs 22,488.25, up 84.40 or 0.38 percent.

Support for the Nifty came in at 22,200-22,250 and 21,950-22,000 levels. On the higher side, immediate resistance for Nifty was at the 22,500 mark and the next resistance zone was at 22,750-22,800 levels.

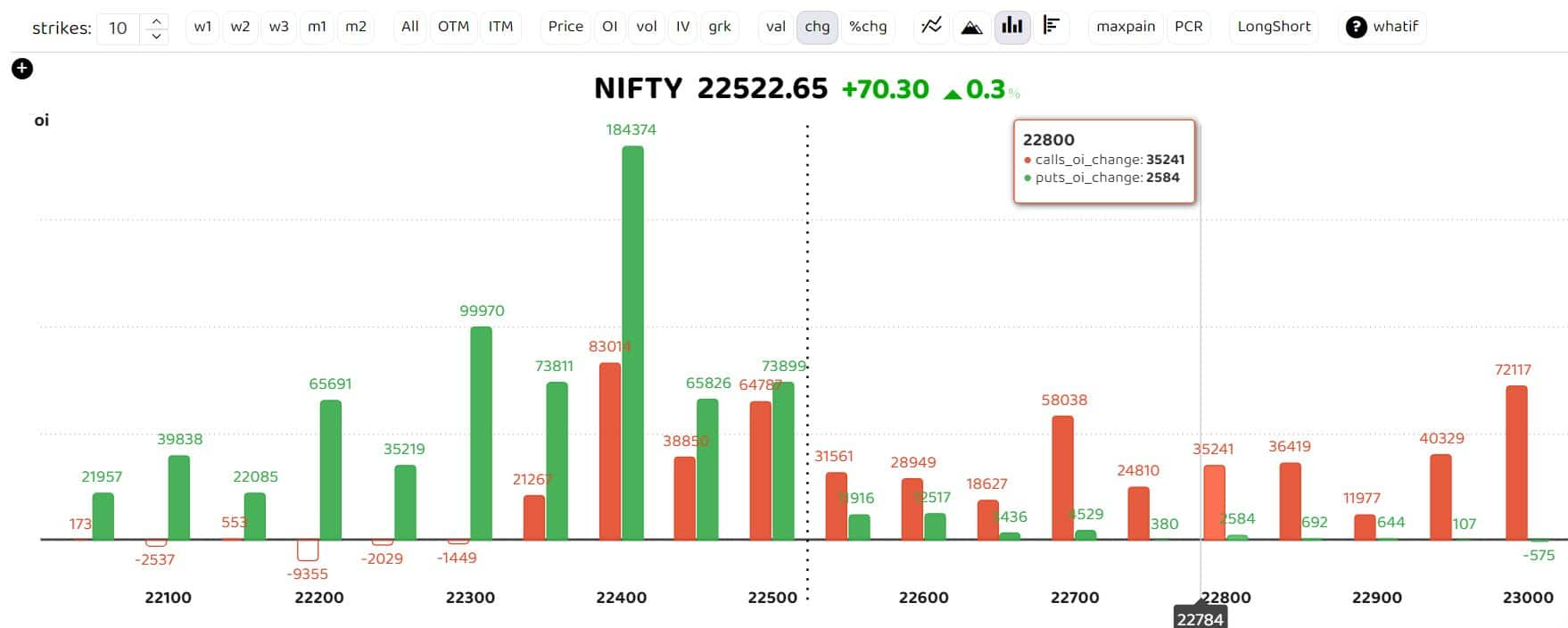

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Options data suggests heavy call writing from the 22,700 to 23,000 strikes. "While the current momentum is constructive, the zone of 22,500-22,530 will act as an immediate hurdle for the index. Any sustainable move above the level of 22,530 will lead to a sharp upside rally in the index up to the level of 22,680, followed by 22,770 in the short term. On the downside, the zone of 22,220-22,180 will act as immediate support for the index," said Sudeep Shah, DVP and Head of Technical and Derivative Research at SBI Securities.

SBI Securities: "Positionally, the zone of 21,750-21,700 will be crucial support for the index. As long as it is trading above this zone, we recommend adopting a buy-on-dips strategy," he added.

JM Financial: "Supports for the Nifty are now seen at 22,200-22,250 and 21,950-22,000 levels. On the higher side, immediate resistance for Nifty is at the 22,500 mark, and the next resistance zone is at the 22,750-22,800 levels," said Tejas Shah, Vice President - Technical Research at JM Financial.

Bank Nifty

JM Financial: "We believe that Bank Nifty would further outperform only if it is able to decisively close above this resistance zone; otherwise, profit booking is likely to continue. On the downside, the support zone lies at 47,600 / 46,900-47,000, while the resistance is seen at 48,000-48,100 / 48,500," said Tejas Shah.

SBI Securities: The 48,000 strike has significant call open interest, followed by the 48,500 strike. On the put side, 48,000 has significant open interest, followed by the 47,500 strike. "The weekly series OI PCR is at 0.88, while for the May monthly series, OI PCR is at 0.79. Going ahead, the 20-day EMA zone of 48,050-48,100 will act as an immediate hurdle for the index. Any sustainable move above the level of 48,100 will lead to a sharp upside rally up to 48,400, followed by the 48,700 level in the coming sessions. On the downside, the zone of 47,700-47,650 will act as immediate support for the index," said Sudeep Shah.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.