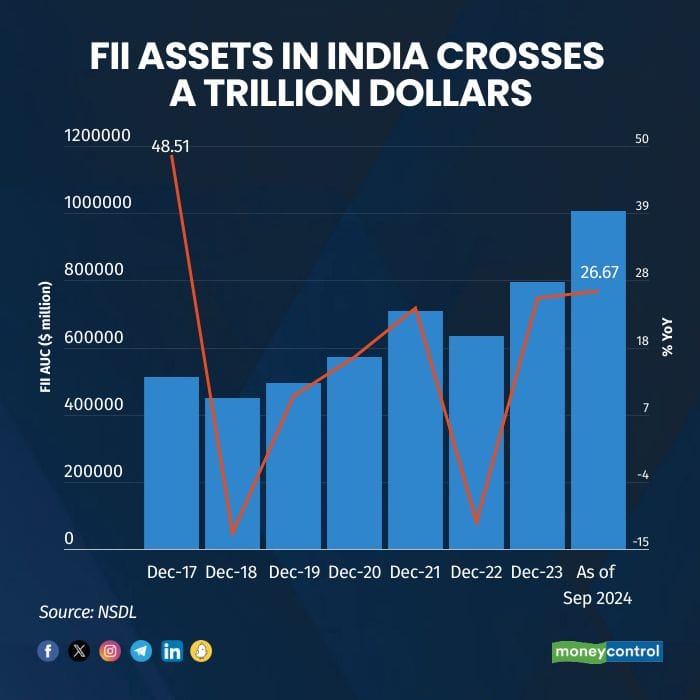

Foreign institutional investor (FII) ownership in Indian listed companies or FII equity asset under custody (AUC) as a percentage of the total market capitalisation of all companies listed on BSE hit a six-month high in September, primarily fuelled by record investments following the US Federal Reserve's dovish stance and rate cut.

The cumulative assets under custody of FIIs in debt, equity, AIF, mutual funds, and hybrid funds crossed $1 trillion for the first time, marking a 26.7 percent increase since the beginning of the year and the highest rise since December 2017. The equity AUC stood at $930 billion and debt & others at $76.83 billion.

fii

fii

In 2023, the total FII assets under custody surged 25.5 percent, climbing to $795.20 billion from $633.56 billion in 2022. Notably, FIIs have seen a decline in their total assets under custody only in 2022 and 2018.

FII ownership in Indian equities rose to 16.43 percent, the highest since March 2024. In September, FIIs invested nearly $7 billion in Indian equities, a sharp increase from August's $873 million, marking the highest monthly buying since December 2023, when FPIs net bought shares worth $7.9 billion.

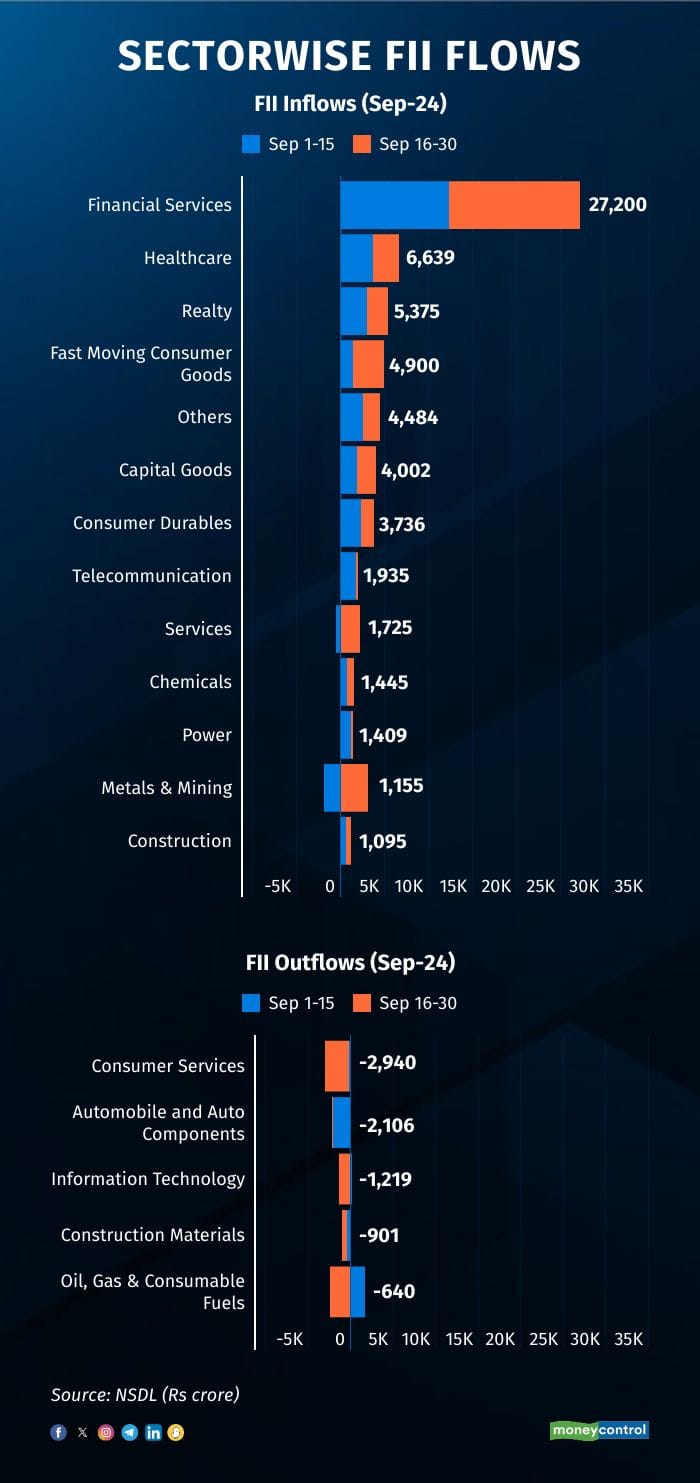

During the month, FIIs made significant investments, with over Rs 27,200 crore flowing into financial services -- the single-largest sector allocation. Healthcare and real estate followed with Rs 6,639 crore and Rs 5,375 crore, respectively.

Other notable sectors attracting investment included FMCG (Rs 4,900 crore), capital goods (Rs 4,000 crore), and consumer durables (Rs 3,736 crore). Sectors like telecommunications (Rs 1,935 crore), services (Rs 1,725 crore), chemicals (Rs 1,445 crore), power (Rs 1,409 crore), metals & mining (Rs 1,155 crore), and construction (Rs 1,095 crore) also drew substantial interest from foreign investors.

On the flip side, FIIs offloaded Rs 2,940 crore worth of shares in consumer services, Rs 2,106 crore in automobiles, and Rs 1,219 crore in information technology stocks. Other sectors facing selling pressure included construction materials (Rs 901 crore) and oil & gas (Rs 640 crore).

FIIs invested $3.75 billion in Indian debt in September, raising total debt investments for 2024 to $17.09 billion. Overall investments across debt, equity, AIF, mutual funds, and hybrid funds have reached about $30.66 billion this year thus far, surpassing last year's $28.70 billion.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.