Indian benchmark indices are trading higher after yesterday's sharp short covering driven reversal. Around 11 am, Nifty is trading at Rs 22,890, up 269.65 or 1.19 percent on June 6.

Nifty 22,900 is expected to provide intermediate resistance, followed by a solid barrier at the psychological mark of 23,000.

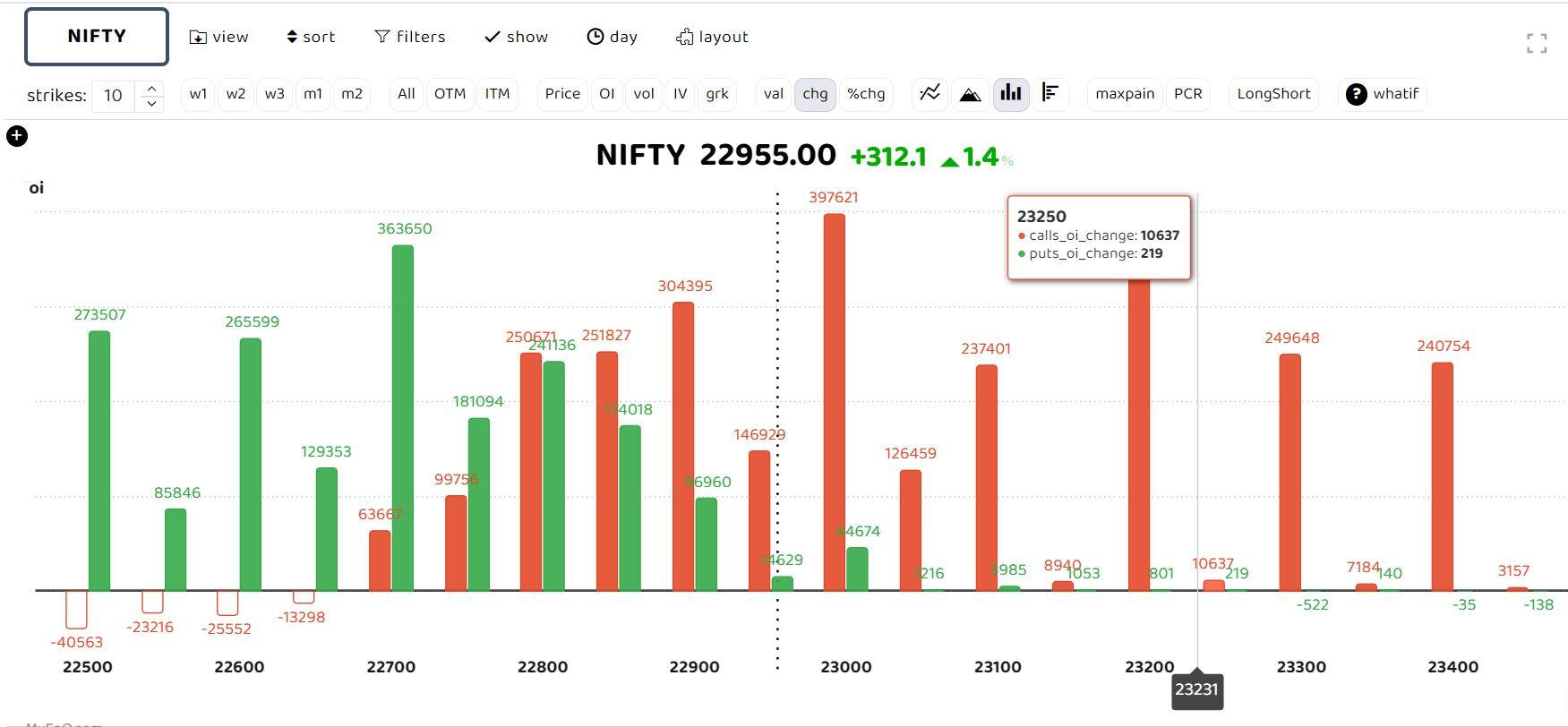

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers.

Options data suggests heavy call writing across strikes 23,000 to 23,400. According to Sudeep Shah, DVP and Head of technical and derivative research at SBI Securities, "The zone of 22,350-22,400 is likely to act as immediate support for the index. As long as this support zone holds, the index is likely to test the level of 22,950 level."

"Any sustainable move below the level of 22,350 will lead to resume its downward journey. In that case, the next support is placed in the zone of 22,050-21,960 level, " added Shah.

Talking about the reversal, Sameet Chavan, Head Research, Technical and Derivative - Angel One said, "Technically, the persuasion over the fall seems to be a constructive development and sustainability is likely to attract positive momentum in the primary trend."

"As far as levels are concerned, 22,500-22,400 is likely to cushion a short-term blip, followed by the strong support of the lower band of the channel placed around the 22,200-22,100 subzone. Additionally, 22,900 is expected to provide intermediate resistance, followed by a solid barrier at the psychological mark of 23,000, " added Chavan.

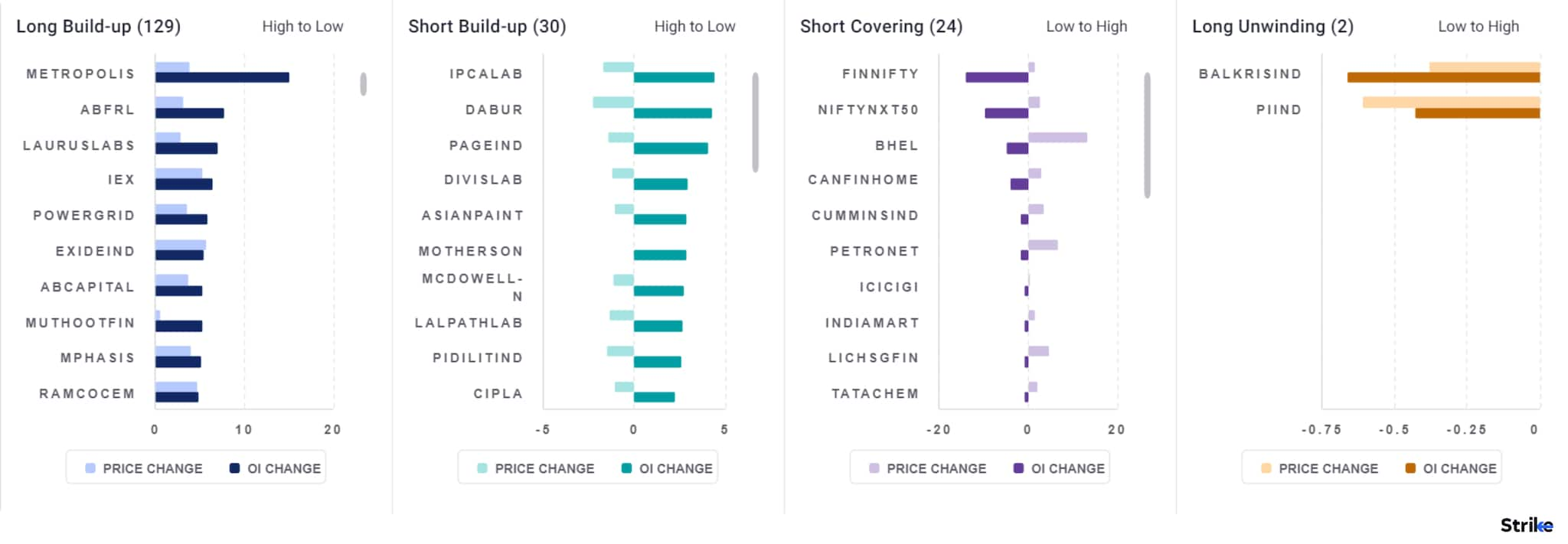

Among individual stocks, ABFRL, Metropolis, IEX, Power Grid and Exide Industries witnessed long build up. While short build up is seen in Dabur, Ipca Labs, Page Industries and Divi's Lab.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.