Domestic institutional investors (DIIs) put in over Rs 1 lakh crore in Indian stocks since March, taking advantage of a recent drop in the equity markets.

DIIs invested about Rs 1.13 lakh crore since March 1, according to provisional data from the National Stock Exchange. The bulk of the investments flowed in during the past few weeks.

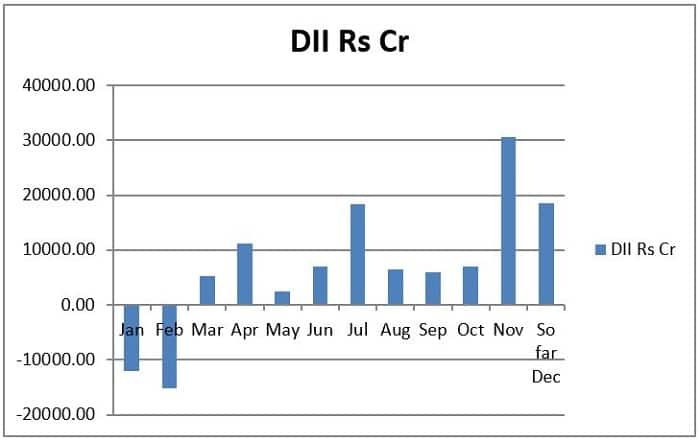

The net investment by DIIs in the Indian equity market stood at Rs 49,085 crore since November. They bought Rs 30,500 crore of shares in November alone, while the total in December so far stands at Rs 18,563 crore.

Analysts said DIIs tried to take advantage of the recent fall in share prices. The benchmark BSE Sensex and Nifty 50 indices have each declined 3.8 percent since November.

The Sensex had hit an all-time high of 62,245.43 on October 19, while the Nifty 50 climbed to a record 18,604.45 on that day. Since then, the Sensex has lost 5,119.43 points, or 8.22 percent, while the Nifty erased 1,586.45 points, or 8.53 percent.

Domestic investment was backed by strong and sustained flows into mutual funds through systematic investment plans (SIP).

“Mutual funds have to invest the inflows that they get in their equity schemes, barring some timing flexibility, which they normally avoid. In November, MFs got robust net inflows and a record SIP investment. They also could have deployed part of the cash lying with them as the feared correction in the markets got postponed,” said Deepak Jasani, head retail research, HDFC Securities.

According to Piyush Nagda, head of investment products at Prabhudas Lilladher, new fund offerings from mutual funds mobilised almost Rs 79,000 crore so far in 2021 across equity, debt and hybrid schemes. PMS schemes are attracting good flows. Funds and portfolio management scheme asset managers have been on a buying spree to deploy these funds.

“Fears of the Omicron variant impact, Fed tapering and inflation rising also do not seem to have impacted their investments in the equity markets as they would not want to defer their purchases for long on the fear of underperforming their benchmarks in case the fall does not happen,” Jasani added.

Equity mutual fund schemes got a net flow of Rs 10,686 crore in November, a four-month high, while monthly SIP contributions were at a new high at Rs 11,004 crore, according to data from the Association of Mutual Funds in India.

Domestic investment flows more than compensated for the increasing outflows of foreign institutional investors.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.