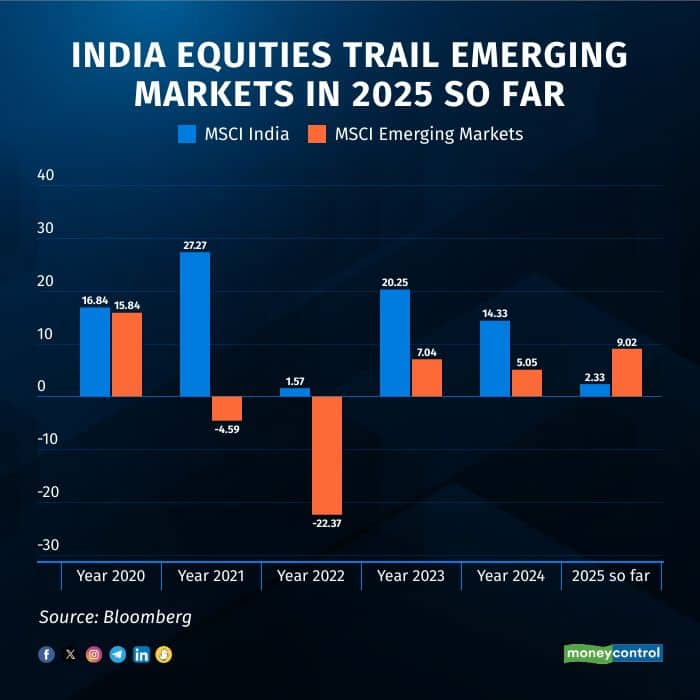

Despite a strong rebound since mid-April, Indian markets have underperformed their emerging market peers so far in 2025, marking the first such instance in six years, as they are pressured by elevated valuations and concerns over a slowing economy.

So far this year, the MSCI India index has risen just 2.33 percent, compared to a robust 9 percent gain in the MSCI Emerging Markets index. This divergence marks India’s first relative underperformance since 2020.

Interestingly, the gap remains despite a sharp recovery in recent weeks, triggered by US President Donald Trump's decision to pause tariffs for several countries. Since mid-April, MSCI India has climbed over 11 percent, marginally ahead of the MSCI Emerging Markets' gain of nearly 10 percent.

Dhananjay Sinha of Systematix Group noted that despite the recent correction, Indian markets remain relatively expensive compared to the pace of earnings growth, which has seen more disappointments than surprises. Foreign institutional investors (FIIs) have been net sellers for much of the period, although flows have recently turned positive. Domestic institutional investors, meanwhile, provided consistent support during the correction triggered by FII outflows.

According to Sinha, the underperformance of Indian equities can be attributed to both fundamental factors and sustained FII selling. Looking ahead, he expects the Indian markets to move sideways.

The MSCI India index is currently priced at 22.31 times its expected earnings for the next year. This is higher than its long-term average of 19.86 times. In comparison, the MSCI Emerging Markets index is trading at 12.25 times its forward earnings, slightly above its 10-year average of 11.99 times.

From the beginning of 2025 until mid-April, Indian markets faced a sharp correction. Benchmark indices Sensex and Nifty lost over 5.3 percent, while MSCI India declined 7.1 percent. During this period, FIIs pulled out more than $16.5 billion, whereas DIIs stepped in with net purchases of over Rs 2.06 lakh crore.

Nifty50 earnings per share (EPS) rose 4.9 percent in Q4FY25. However, post-results, analysts have trimmed EPS estimates for FY26E and FY27E by 5.3 percent and 5.9 percent, respectively. The steepest EPS downgrades for FY26E are concentrated in Automobiles, Cement, Oil & Gas, and NBFCs. Sectors expected to drive growth include Telecom, Metals & Mining, Consumer, Oil & Gas, and Banks.

Analysts also highlight stretched valuations across most sectors amid tepid volume growth and ongoing structural disruptions. Domestic macro headwinds such as weak consumption, softening investment trends, and external pressures from a slowing global economy and inflation uncertainty are likely to weigh on market sentiment.

A recent note by Kotak Institutional Equities pointed to a few tailwinds, such as lower interest rates and subdued commodity prices, which could support household and government savings. However, a broad-based economic recovery appears unlikely, due to persistent challenges in job creation, a slowdown in private and government investment, and muted export and outsourcing demand in a weak global environment.

Ambareesh Baliga, independent market analyst, expects Indian equities to remain range-bound in the near term and does not anticipate a return to the record highs seen last year anytime soon. "The market is likely to consolidate within a band," he said.

At the same time, Baliga believes the February lows may have marked the bottom, barring any major negative shocks. “Unless there’s a significant adverse development, I don’t see those levels being breached,” he noted. He added that a sustained uptrend is unlikely without a meaningful and consistent recovery in corporate earnings.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.