The market clocked a nearly one percent rally amid optimism surrounding GST rationalisation, continuing the uptrend for the second consecutive week ending August 22.

However, Friday's correction and profit booking trimmed weekly gains, making the bulls cautious ahead of Federal Reserve Jerome Powell's speech at the Jackson Hole symposium (wherein he signalled for rate cut in the September policy meeting) and the deadline for implementation of an additional 25 percent tariff on Indian goods ending this week.

On Monday, the market might react positively to Wall Street's Friday rally amid hope for the beginning of the rate cut cycle next month. However, overall it could see a rangebound trading in the coming truncated week (starting from August 25) with focus on the India and US GDP numbers, and any fresh update over the deadline for additional tariff approaching, according to experts.

The Nifty 50 advanced 239 points (0.97 percent) during the week to 24,870, and the BSE Sensex jumped 709 points (0.88 percent) to 81,307, while the Nifty Midcap and Smallcap 100 indices outperformed and rallied 2 percent each.

"Globally, clarity on US tariff actions against India and upcoming GDP data from both India and the US will shape investor sentiment," said Siddhartha Khemka, Head of Research, Wealth Management at Motilal Oswal Financial Services.

He expects Indian equities to remain supported by optimism around GST 2.0 reforms and domestic macro strength.

Despite external headwinds, Vinod Nair, Head of Research at Geojit Investments, also believes domestic economic indicators offer a glimmer of hope. "A record-high composite PMI and early signs of an urban demand revival are expected to support the market. The consumption sector is likely to benefit from a favourable monsoon, low interest rates, and indirect tax reliefs," he said.

Equity markets will remain shut on August 27 for Ganesh Chaturthi.

Here are 10 key factors to watch this week:

Deadline for Additional 25% US tariffs Nears

The most important factor to watch would be any fresh update from the United States on additional 25 percent tariffs imposed on Indian goods due to the country's increased purchases of Russian oil, which is set to be implemented effective August 27. India has already been paying 25 percent tariffs since August 1.

The US officials already cancelled the scheduled visit to India during August 25-29, hence there seems to be no hopes for the extension of date for additional 25 percent tariff implementation or lowering the rates, while recently the foreign minister Subrahmanyam Jaishankar at the Economic Times World Leaders Forum 2025 said the negotiations between the country and United States is underway but there are some red lines (including interests of farmers and small producers) which need to be defended.

Ukraine-Russia Peace Deal Progress

The market participants will also look for any cues with respect to the Russia-Ukraine peace deal, as there is too much uncertainty surrounding a potential Russia-Ukraine truce.

Peace negotiations supposed to take place between Russia and Ukraine appeared to be stalled now, with Russia launching its largest air attack since July, targeting Western Ukraine (which included an American factory in Ukraine), while Ukrainian forces struck an oil refinery in Russia’s Rostov region near the Donbas this week. According to Reuters reports, Ukrainian President Volodymyr Zelenskiy said on Friday that Russia was doing everything it could to prevent a meeting between him and Putin, while Russia's foreign minister said the agenda for such a meeting was not ready.

US President Donald Trump on Friday threatened Russian President Putin with "massive sanctions" if Russia doesn’t agree to a peace deal with Ukraine within two weeks. Trump met Putin in Alaska earlier this week for negotiations to end the Russia-Ukraine war, followed by starting to make arrangements for a meeting between Putin and Zelenskiy, which could not take place.

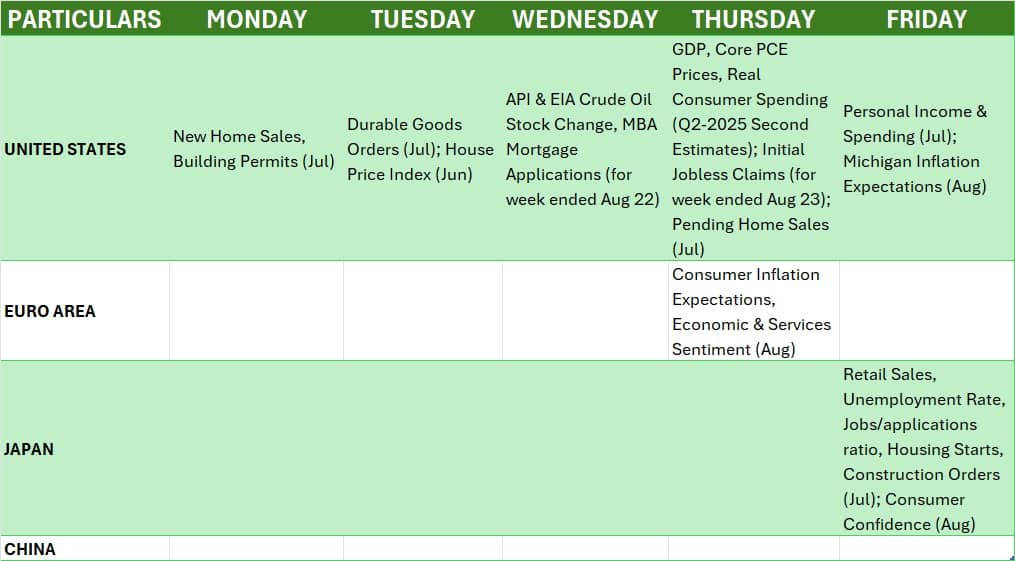

US GDP

Apart from tariff related developments, globally the focus will be on the slew of data points from the United States scheduled this week including the second estimates for the GDP growth, core PCE prices, and real consumer spending for June quarter of 2025 releasing on August 28; monthly new home sales, durable goods orders, and personal income & spending; and weekly jobs data, which all are important for upcoming Fed interest rate decision in September.

According to advance estimates, the US economy grew 3 percent in the second quarter of the current calendar year, against a contraction of 0.5 percent in the previous quarter.

Global Economic Data

Further, consumer inflation expectations, and economic & services sentiment numbers for August from the Euro Zone, along with monthly retail sales, unemployment rate, housing starts, and construction orders for July from Japan, will also be watched.

India GDP

Back home, the focus would be on the GDP numbers for the quarter ended June 2025, releasing on August 29. According to the recent RBI forecast, the economy is expected to grow 6.5 percent for Q1FY26, which is lower compared to 7.4 percent growth seen in Q4FY25 and similar to Q1FY25, while the SBI Research report indicated the growth in the 6.8-7 percent range for the quarter.

On the same day, fiscal deficit numbers for July as well as foreign exchange reserves for the week ended August 22, and bank loan & deposit growth for the fortnight ended August 15 will also be released.

Industrial production data for July will also be announced this week on August 28. Industrial output grew 1.5 percent in June, marking a 10-month low, down from a revised 1.9 percent growth in May.

The market participants will also keep an eye on the FII activity, as despite a couple of days of buying, they remained net sellers to the tune of Rs 1,560 crore for the week passing by, though the quantum of outflow was much lower compared to the past several weeks.

FPIs can't be incremental buyers until the easing of US yields, fading tariff risk, the rupee turns steady, and improvement in earnings breadth, said Nikunj Saraf, the CEO of Choice Wealth.

On the contrary, DIIs (Domestic Institutional Investors) provided healthy support to the market; in fact, they are consistent buyers in equities and their net buying for the current month (Rs 66,184 crore so far) is higher than the previous month (Rs 60,939 crore). They net bought Rs 10,388 crore for the last week.

The rupee gained strength for the first time in the last eight consecutive weeks, rising 0.21 percent to 87.3 against the US dollar. The US dollar index has remained below the 100 mark since the second half of May this year, falling 0.11 percent to 97.732 and continuing its downtrend for the third consecutive week.

The primary market will be having a busy schedule this week with a total 10 IPOs worth Rs 1,240 crore opening for subscription and eight new companies available for trading on the bourses. In the mainboard segment, Vikran Engineering and Anlon Healthcare IPOs worth Rs 893 crore will open for public subscription on August 26 and close on August 29.

In the SME segment, there will be a total of eight IPOs getting launched, including NIS Management and Globtier Infotech on August 25, followed by Sattva Engineering Construction and Current Infraprojects on August 26. Oval Projects Engineering will open its maiden public issue on August 28, while on August 29, investors will see three IPOs - Sugs Lloyd, Abril Paper Tech, and Snehaa Organics - available for subscription.

Public issues of ARC Insulation & Insulators, Classic Electrodes (India), Shivashrit Foods, and Anondita Medicare, which opened last week, are set to close this week.

Meanwhile, a total of eight companies - Patel Retail, Vikram Solar, Gem Aromatics, Shreeji Shipping Global, and Mangal Electrical Industries from the mainboard segment, and Studio LSD, LGT Business Connextions, and ARC Insulation & Insulators from the SME section - will be available for trading on the bourses in the coming week.

Technical View

Technically, the Nifty 50 showed weakness on Friday and reversed near to Monday's low in a single session, forming a long bearish candle on the daily timeframe, while on the weekly charts, there was a small bearish candle formation with a long upper wick, signalling pressure at higher levels. But in between, it managed to defend Monday's low intraday (tad above 24,850) and stayed above 20-and-50-day EMAs (24,830-24,840), which is positive. If the index decisively breaks these levels in the upcoming sessions and cannot take support at 24,700, the bears may start closing the bullish gap of August 18; however, sustaining above the same can bring the index back to 25,000, followed by 25,150 hurdles, according to experts.

F&O Cues

The monthly options data suggest that the Nifty 50 is expected to be in the 24,500-25,500 range in the F&O expiry week. The maximum Call open interest was seen at the 25,000 strike, followed by the 25,100 and 25,500 strikes, with the maximum Call writing at the 25,000 strike, and then the 24,900 and 25,100 strikes, while the 25,000 strike holds the maximum Put open interest, followed by the 24,500 and 24,900 strikes, with the maximum Put writing at the 24,900 strike, and then the 24,400 and 24,600 strikes.

Meanwhile, the India VIX, the fear index, still signals a favourable trend for bulls as it corrected 5.08 percent to the 11.72 zone and also closed below short-term moving averages.

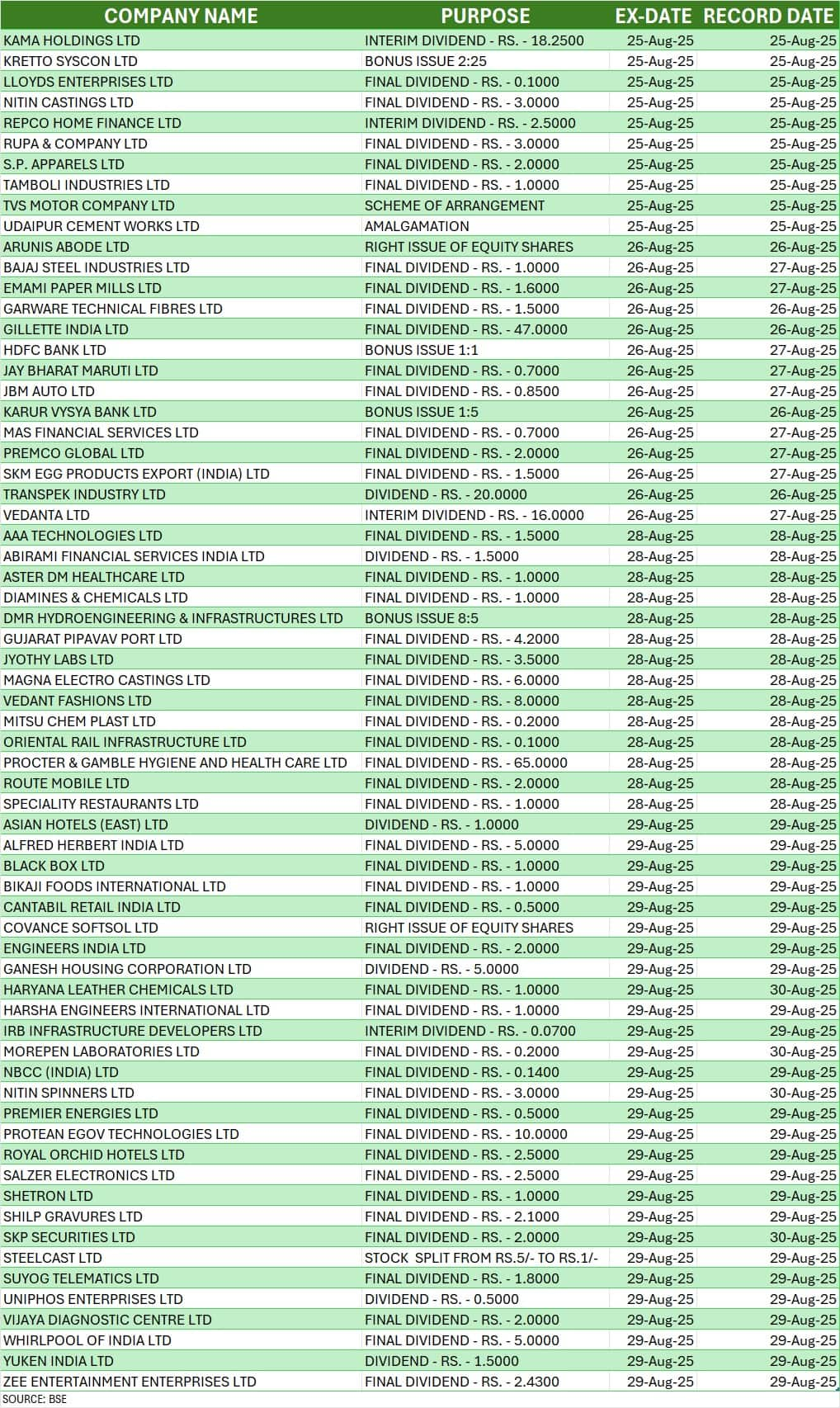

Corporate Action

Here are key corporate actions taking place this week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!