Benchmark equity indices marked their third successive week of gains as risk appetite recovered in global markets led by signs of reopening of the Chinese economy following an outbreak of COVID-19 and evidence of continued economic growth in the US.

The Nifty 50 and BSE Sensex closed over 1.4 percent higher each for the week led by gains in banks, information technology, and Reliance Industries. Nifty IT index surged over four percent amid bargain hunting and as brokerages like Macquarie Securities upgraded their outlook on the sector to bullish.

Reliance Industries rose nearly eight percent in one of its best weekly performances of the year on hopes of strong June quarter earnings as global refining margins continued to strengthen.

Buying in the market was broad-based as reflected in the over four percent gains in Nifty Smallcap 100 index and over one percent rise in Nifty Midcap 100 index.

“We believe the present market volatility offers an attractive opportunity to build a long term portfolio of quality companies, which have lean balance sheets, are capital efficient and have growth longevity,” brokerage firm ICICI Direct said in a note.

Here are 10 key factors to watch out for next week:

RBI meeting

The Reserve Bank of India’s Monetary Policy Committee will meet next week with the outcome expected on June 8. RBI governor Shaktikanta Das in a recent interview to CNBC-TV18 said that a hike in interest rate was a “no-brainer”, however, the quantum of the increase remains in doubt following the emergency rate rise of 40 basis points in May. A Reuters poll showed economists split between 25 and 75 basis point hike in repo rate by the rate-setting panel.

ECB meeting

Besides the Reserve Bank of India, the European Central Bank is also set to meet next week with the outcome expected on June 9. The ECB recently suggested it needs to move quickly on interest rate hikes after Eurozone inflation touched multi-year highs and crossed the eight percent mark in May.

Crude oil prices

The price of black gold will be in focus next week as a recent upswing in the commodity’s price had investors concerned over the trajectory of inflation. Global Brent futures touched a high of $123 per barrel during last week amid new sanctions imposed on Russia by the European Union. Prices cooled off towards the end of the week as the Organization of Petroleum Exporting Countries (OPEC) decided to hike oil output to ease supply pressures.

Economic data

Several key economic data points will also be on investors’ radar next week. The Street will look out for China’s inflation data for May for signs of economic revival as lockdowns ease in cities like Shanghai. Further, India’s industrial production data for April will also be released later next week. Besides, global markets will watch out for balance of trade data in China and the inflation print for May in the US.

Monsoon progress

The earlier-than-expected arrival of the south-west monsoon rains have helped ease investor concern around food prices but in coming weeks the market will track the progress of the rains critical to crop yields, farm income, and rural demand.

FII selling

Selling pressure from foreign institutional investors (FIIs) will continue to dominate investor psyche as the cohort remained net seller of Indian equities for another week. Last week, FIIs were net sellers to the tune of Rs 3,417 crore taking their total for the year to Rs 1.8 lakh crore. Their selling momentum slowed considerably last week raising hopes that the cohort may soon turn net buyers in the market.

Technical view

The Nifty 50 index failed to hold above its 50 day moving average of 16,870 points on Friday and closed the day below that crucial level.

“A long negative candle was formed on the daily chart after opening higher. Technically, this pattern indicates a formation of counter attack of bears type candle pattern (not a classical one) at highs. But the formation of such a pattern amid a range movement rules out any sharp negative impact as of now,” said Nagaraj Shetti, technical research analyst at HDFC Securities.

Shetti, however, asserted that the near term uptrend in the market is still intact and there is no sign of any reversal yet. The support for the index is likely to be around 16,350-16,400 points while 16,800 points remains a key resistance.

F&O positioning

Traders unwound their long positions in the Nifty 50 index’s June futures on June 3 as open interest in the contract fell 1.2 percent while the index closed 0.3 percent lower.

Traders aggressively sold the out-of-money call options of the index suggesting that they see limited room for upside in the index in the coming sessions. The 16,700 strike price of the index saw unwinding of long positions as another weak sign for the bulls.

On the put options side, traders added long positions in out-of-money strike prices suggesting possibility of some more downside for the 50 stock index. The 16,400 strike price put option saw sharp covering of short positions as buyers came rushing to take long positions.

US May jobs report

On June 3, the US government released the May non-farm payrolls data that indicated that job creation remained robust despite concerns over economic slowdown and rising inflation. The US economy added 390,000 jobs in May as against economists’ expectations of 320,000. The report comes as several technology companies from Meta to Tesla freeze hiring with the latter suggesting it may have to lay off 10 percent of its staff.

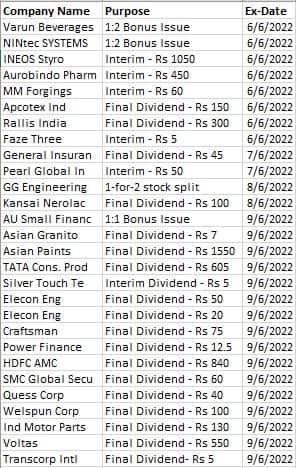

Corporate action

Here are key corporate actions taking place in the coming week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.