It was another rocking week for the equity markets. Tracking positive global cues and favourable economic data, the benchmark indices clocked one percent gains to end at a record closing high for the week ended December 2, though bulls took a breather on Friday after consistent run up in the previous eight sessions.

The BSE Sensex rallied 575 points to 62,868, and the Nifty50 rose 183 points to 18,696, while the broader markets gained significant momentum and performed much better than the leading indices. The Nifty Midcap 100 and Smallcap 100 indices gained more than 3 percent and 2 percent, respectively.

All sectors participated in the upward journey with technology, metals, FMCG, energy, oil & gas, and realty leading the charge.

Given the recent run some more consolidation is likely in the coming week ahead of the meeting of the Reserve Bank of India’s (RBI) Monetary policy Committee (MPC). But given the strong momentum and favourable cues, the northbound journey towards 19,000 on the Nifty is expected to resume in the coming days, experts said.

"Next week, all eyes will be on the MPC meet. Besides, the performance of global indices and foreign flow trends will continue to provide cues," said Ajit Mishra, VP - Technical Research at Religare Broking.

He feels the markets may witness some consolidation early next week, however, the tone would remain positive and the immediate target of 19,000 for the Nifty is intact.

Since all sectors are contributing to the move on a rotational basis, the focus should be on accumulating quality stocks on dips, he said, adding that the recent improvement in the broader market participation is encouraging, but participants should remain selective.

Here are 10 key factors that will keep traders busy next week:

1) RBI Policy

Given the slowing economic growth and elevated inflation, the MPC meeting scheduled during December 5-7 will be keenly watched. Since inflation is above the RBI's upper threshold of 6 percent, a 25-35 basis point (bps) rate hike is expected. It is expected to be smaller than the 50 bps hikes we have seen in the past due to declining commodity prices, especially that of oil, and moderation in the inflation, experts said.

In October, inflation cooled to 6.77 percent from 7.41 percent in September as oil traded below the RBI's assumed level of $100 a barrel. In fact, oil prices have been headed south in the past month.

"We believe that the magnitude of the rate hikes will be lower this time, probably 25-35 bps. Specifically, we believe that the terminal repo rate for the financial year will be 6.5 percent, which means there will be one more rate hike in February," said Madan Sabnavis, Chief Economist at the Bank of Baroda.

While the RBI will take a hard look at both the GDP and inflation projections, there could be some downward revision of GDP growth, he feels.

2) Domestic Economic Data

Apart from the interest rate decision, the street will also keenly watch the Services PMI for November, which, along with the Composite PMI, will be released on Monday.

The S&P Global Services PMI in October was at 55.1, increasing from a six-month low of 54.3 in September, as favourable demand for services continued to drive growth in output at the start of the third quarter. The PMI has remained above 50 for 15 months in a row, indicating expansion in economic activity.

Data about foreign exchange reserves for the week ended December 2 will also be released coming Friday.

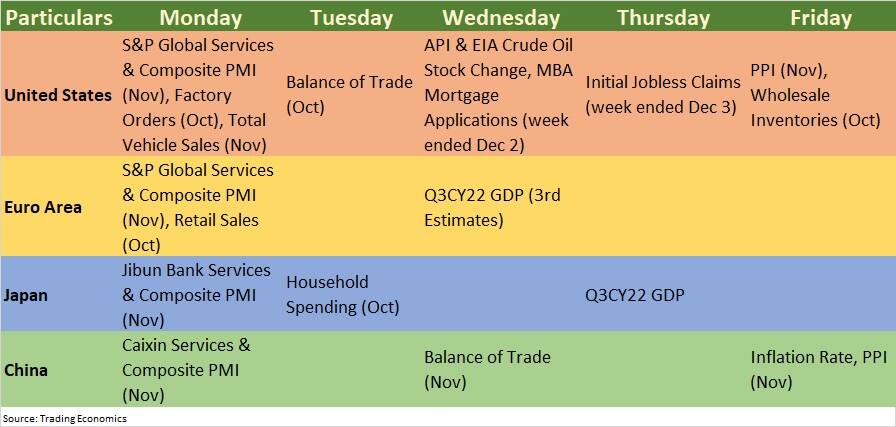

3) Global Macroeconomic Data

Here are key global macroeconomic data points to watch out for:

4) Oil Prices

The OPEC+ meeting on December 4 to decide on oil production may impact prices. Market participants will also be scanning for further developments with respect to G7 countries capping the price of seaborne Russian oil.

OPEC+, which comprises 23 oil producing countries led by Russia and Saudi Arabia, might announce a production cut at the meeting. In the absence of a production cut oil prices could fall further, experts said.

Over the last one month oil prices have seen consistent correction from around $100 a barrel to around $85 a barrel due to weak demand from China, the world's second largest economy, and fears of a recession in the Western world. However, in the past week, Brent crude futures gained more than 2 percent to close at $85.6 a barrel, snapping a three-week losing streak.

"Traders await the crucial OPEC+ meeting where the cartel is expected to decide on a production cut. If the current level of output is maintained, we may see some selling on Monday," said Mohammed Imran, Research Analyst at Sharekhan by BNP Paribas.

In October, the OPEC+ group agreed to cut output by two million barrels per day, equal to two percent of global supply, effective until December 2023.

"The European Union has capped the price of Russian oil at $60 a barrel. The US energy department is seeking congress mandate to curb outflows from the US SPR (strategic petroleum reserve) so it can refill the 147 million barrels of oil flown out this year," said Imran, who feels there may be volatility in oil prices depending on the outcome of the OPEC+ meet.

5) FII Flow

The FII flow is also expected to drive market sentiment in the coming weeks as foreign institutional investors have net bought more than Rs 15,000 crore worth of shares last week, the biggest weekly inflow in a long time. With this, net FII buying stood at Rs 22,500 crore in November, the highest since February 2021.

While FII sentiment has improved, there could be volatility (in FII flows) due to movement in the Dollar index, experts said.

"In the short run, the most important factor determining FPI strategy is the movement in the Dollar index. When the Dollar index moves up and is expected to trend up, they sell. Conversely when the Dollar index declines and is expected to trend down, they buy," said V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

On the other hand, domestic institutional investors (DII) have taken advantage of the situation and booked profits in the market, driven by FII monies to record highs recently. DIIs have net bought more than Rs 1,300 crore worth shares during the last week.

6) Listing

Agrochemical company Dharmaj Crop Guard is set to make its debut on the bourses on Thursday. The final issue price is expected to be at the upper end of the price band of Rs 216-237 per share.

Before that, the company will finalise the share allotment by Monday followed by refunds to unsuccessful investors, and transfer shares to eligible investors by Tuesday.

The Dharmaj Crop stock traded at a 20 percent premium in the grey market, experts said.

Other than that, Uniparts India will also finalise the allotment of shares ahead of its listing in the following week.

7) Technical View

The Nifty50 closed Friday's trade with a bearish candle, which was on expected lines, due to profit taking after a rally in the previous eight sessions. For the week though there was a bullish candle formation and the index ended at a record closing high, with continuing higher high formation for the seventh consecutive week, indicating that the momentum is intact.

Hence, after the expected consolidation with support at 18,500-18,600 levels, followed by 18,300, the Nifty50 is expected to march towards the 19,000 mark in the coming weeks, experts said.

The RSI (relative strength index) dropped to around 67 on Friday after reaching overbought levels of around 74 on a daily basis. But on a weekly scale, it still signals an upward move at 67 levels.

"It is still holding above the short-term supports. 18,600 is a key support from where the index can start moving up again. Overall, the short-term outlook continues to be positive for a target of 19,000," said Gaurav Ratnaparkhi, Head of Technical Research at Sharekhan by BNP Paribas.

8) F&O Cues

The Options data indicated that 18,500-19,000 is the expected trading range for the Nifty50 in the short term. We have seen maximum Call open interest at 19,000 strike, followed by 20,000 and 19,500 strikes, with Call writing at 18,800 strike, followed by 18,700.

The maximum Put open interest was seen at 18,000 strike, followed by 18,500 strike, with Put writing at 17,800 strike, followed by 18,100 strike.

"Call strikes are witnessing heavy open interest build-up suggesting limited upside. The highest Call base is placed at 18,800 strike, making it a hurdle for the coming week. At the same time, the Put base is visible at 18,500 strike. Hence a retesting of 18,500 levels cannot be ruled out," ICICI Direct said.

Moreover, the FII net longs are at one of the highest levels seen in recent years, hence liquidation risk may put some pressure on the index, the brokerage added.

9) India VIX

The volatility index India VIX remained below 15 mark for more than couple of weeks now, giving more comfort to the bulls, though on weekly basis, it inched up by 0.9 percent to 13.45 levels.

Hence, if the said volatility remains around these levels for coming sessions, then the market is expected to get more stability going ahead which may take Nifty near 19,000 mark, experts said.

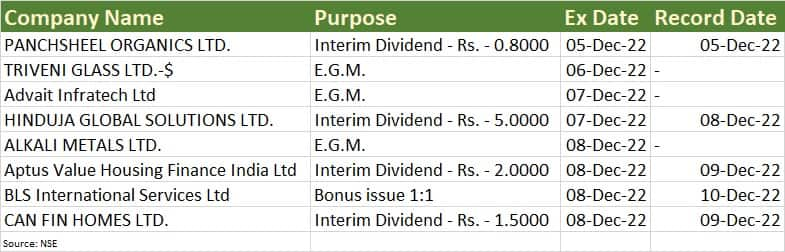

10) Corporate Action

Here are key corporate actions taking place in the coming week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.