Concerns around the artificial intelligence bursting get louder as big-ticket investors decided to cut their exposure to chipmaker Nvidia, the leader in the AI-led rally in the U.S.

Silicon Valley giant Peter Thiel has sold his Nvidia stake, SoftBank’s Masayoshi Son has also exited his position, while Michael Burry was shorting the chipmaker, with put options with a notional value of over $1 billion, and wound up his firm.

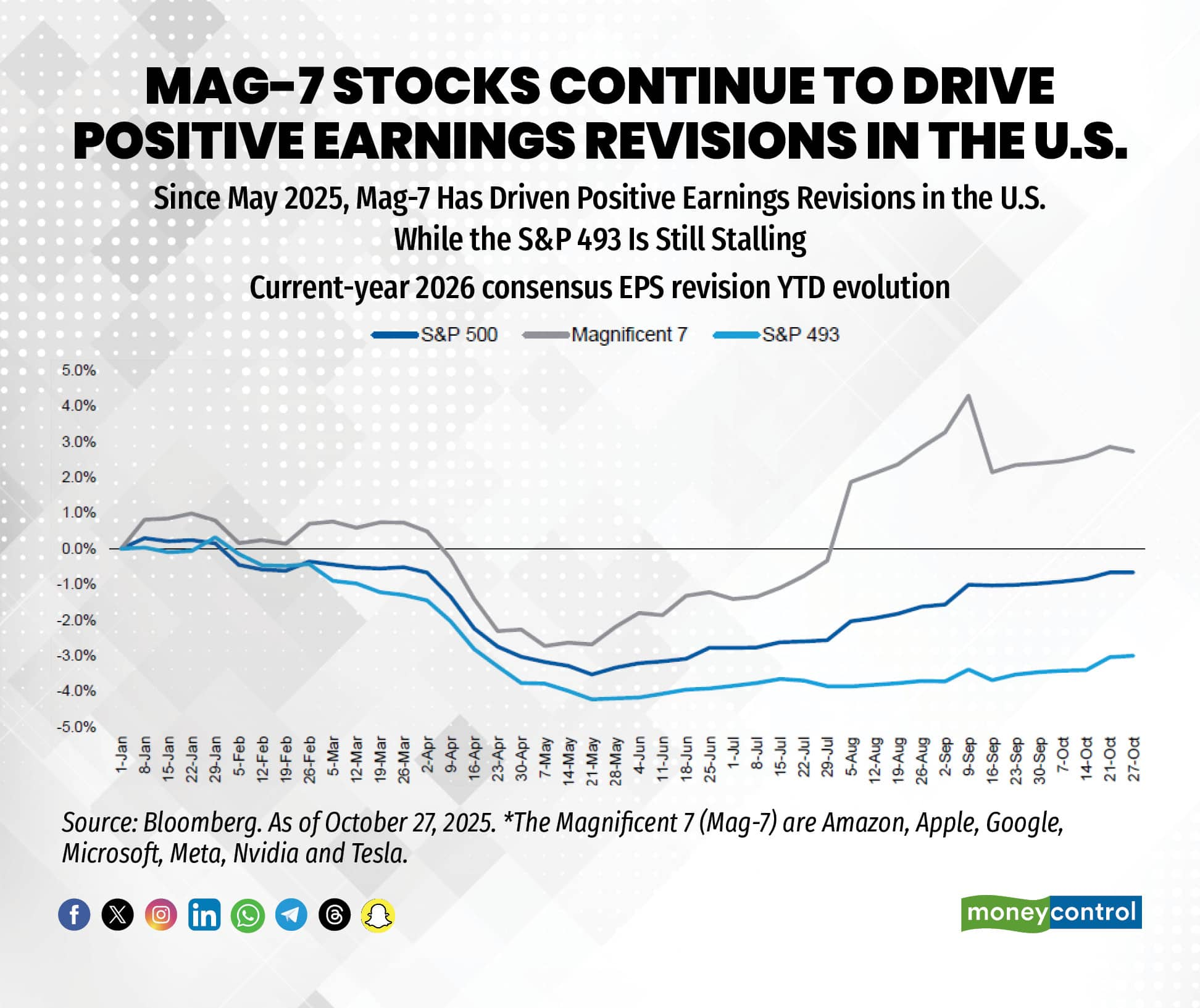

In the listed universe, a large share of the S&P 500’s recent upward earnings revisions has being driven by the Magnificent Seven cohort, most of which are viewed as core beneficiaries of the AI boom.

Not just in the listed universe, but even valuations of private AI players are bewildering investors. Its latest valuation has risen to $500 billion, with $1-1.5 trillion of committed investments. Further, Mira Murati, the former CTO at OpenAI, founded Thinking Machines Lab, an AI startup, and is seeking funding at a $50 billion valuation in less than a year.

"Private market valuations [for AI companies] are well above public market valuations. Private companies are predominantly being valued on revenue and incremental revenue growth, with seemingly less focus on profits and margins," said Eric Sheridan, US Internet Equity Research Analyst, Goldman Sachs.

The strength of this narrative-led boom has pushed S&P 500 valuations to elevated levels, placing the index among the world’s most expensive equity markets and roughly two standard deviations above its long-term average.

The four big hyperscalers, Meta, Alphabet, Amazon and Microsoft, are set to spend $360–370 billion in capex this year, rising to nearly $470 billion in 2026, according to estimates.

This capex surge is also distorting the macro data. According to Harvard economist Jason Furman, U.S. GDP growth in the first half of 2025 was almost entirely driven by data center and AI investment; without it, growth would have been just 0.1 percent annualized.

Still, the Mag 7 remains the sole source of earnings momentum in the S&P 500 index. Since May, they’ve driven nearly all U.S. earnings upgrades, while expectations for the S&P 493 have yet to recover from April’s downgrades.

The strength of this narrative-led rally has pushed S&P 500 valuations to elevated levels, placing the index roughly two standard deviations above its long-term average.

Earlier this month, SoftBank Group has fully exited its Nvidia investment once again, offloading shares worth about $5.8 billion, the company told investors in a presentation early Tuesday. The move reflects a broader realignment of capital toward OpenAI, signalling Masayoshi Son’s intensified focus on backing the next wave of artificial intelligence development and his continued appetite for large, high-conviction technology wagers.

This is the second time SoftBank has unwound its entire position in the semiconductor major. The group had sold a previous $3.6 billion holding in 2019 before rebuilding the stake a year later. That original divestment has since become emblematic of the opportunity cost of mistimed exits: the shares sold at the time would be valued at more than $150 billion today.

Michael Burry’s Scion Asset Management disclosed sizable bearish positions built during the September quarter. The fund initiated put options tied to 1 million Nvidia shares and another 5 million Palantir shares, carrying notional values of about $187 million and $912 million. These option bets dwarfed Scion’s relatively small equity book, which consisted of only eight holdings and four direct stock positions worth a combined $68 million.

Another prominent investor and PayPal cofounder, Peter Thiel, also pared back his exposure. A quarterly filing from Thiel Macro LLC showed the firm exited its entire Nvidia stake of 537,742 shares during the third quarter. At the end-September closing price, the holding would have been valued at roughly $100 million. The liquidation comes shortly after SoftBank Group announced in October that it had divested Nvidia shares worth $5.83 billion.

The undertone of caution has been reinforced by commentary from Wall Street leaders. Goldman Sachs CEO David Solomon warned that equities could face a correction of ten to twenty percent over the next one to two years as a result of lofty valuations, and earnings that can’t keep up. Morgan Stanley CEO Ted Pick echoed similar concerns, adding to the market’s already fragile sentiment.

Going ahead, all eyes will remain on Nvidia as the chipmaker is set to announce its September quarter earnings show later today. Will the AI giant be vindicated or will Thiel, Burry, and the Softbank Group’s conviction pay off?

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.