Cipla will announce its Q2 FY26 results on October 30. Analysts expect a steady quarter supported by healthy growth in the India and South Africa businesses, even as the US segment continues to face headwinds from gRevlimid tapering and persistent price erosion in the base portfolio. Margins are likely to remain stable in the 24.5 to 26.5 percent range, aided by operating discipline and a favourable product mix.

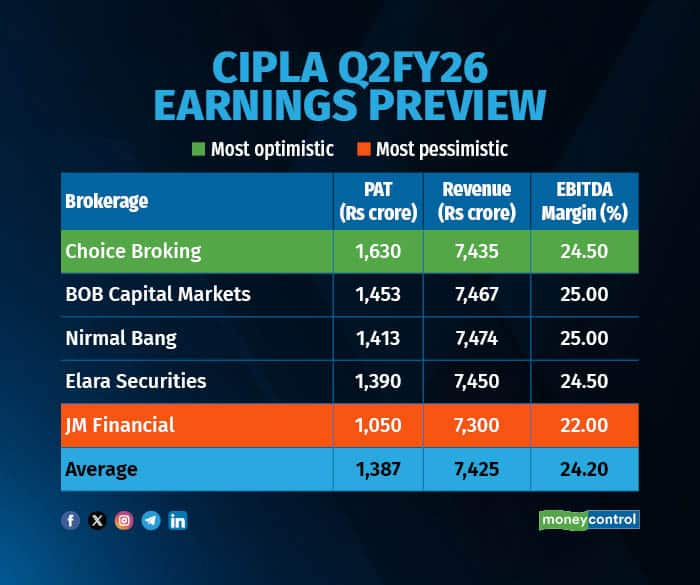

A Moneycontrol poll of five brokerages pegs Cipla’s revenue growth at 5 to 6 percent year-on-year to around Rs 7,300 to 7,450 crore. EBITDA is expected between Rs 1,824 and Rs 1,932 crore, implying margins of about 25 percent, broadly flat compared with the previous quarter. Net profit is seen in the Rs 1,266 to 1,630 crore range, depending on forex movement and tax adjustments.

Key factors driving Q2 earnings

Brokerages expect Cipla’s performance this quarter to be regionally mixed.

According to Nirmal Bang and BOB Capital Markets, the India formulations business likely grew 7 to 8 percent YoY, led by chronic and respiratory therapies, though the mid-September GST rate transition may have caused some temporary disruption in trade channels. The South Africa and other emerging market businesses are estimated to have grown in double digits, cushioning the impact of a softer US quarter.

The US business, which accounts for roughly a fourth of total revenue, is expected to decline 3 to 5 percent YoY to around USD 225 to 230 million, according to BOB Capital Markets. Analysts attribute this to lower gRevlimid sales (around USD 25 million in Q2) and continued base-portfolio price erosion. JM Financial notes that new launches such as Lanreotide and Abraxane, along with improved supplies of peptide-based products, may have partially offset the drag.

The API segment likely remained weak, contracting around 9 percent YoY, amid subdued global demand. Still, Choice Broking believes disciplined R&D spending, stable African growth, and cost control will help maintain margins near 25 percent, while Elara Securities highlights the resilience of Cipla’s India business despite near-term softness in US and API sales.

What to watch out for

Investors will closely track management commentary on the US recovery outlook, particularly the uptake of Lanreotide and Abraxane, and the progress of the complex generics and peptide portfolio.

Updates on India’s respiratory and chronic franchises, API recovery, and R&D spending trajectory will also be key focus areas. Any announcements on new product launches or regulatory approvals in the US could influence investor sentiment for the second half of FY26.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.