November 28, 2019 / 12:01 IST

Indian markets and the economy are moving in opposite directions but the time is right for selective stock picking as earnings’ recovery is round the corner, a BNP Paribas report has said. The Nifty and BSE-500 indices were up 11 percent in the past three months, a performance slightly better than that of other emerging markets (EMs). The upmove may be linked to ebullient conditions globally, but India also has had its share of market-moving news, including the corporate tax cuts that drove the bulk of the upside. “The 2QFY20 results were largely better than expectations, but the bar will move higher now with BBG consensus estimates calling for Nifty EPS growth of 11 percent in FY20 (for EPS positive cos) and 19 percent in FY21,” says the report released on November 25. The results were aided by lower tax rates which consensus forecasts may not have adequately captured, generally helpful raw material prices, and improving bank asset quality, especially for PSBs. BNP Paribas remains overweight on India and has placed a target of 40,500 for the Sensex by December 2019, suggesting a potential downside from the current levels. About 17-18 Nifty stocks are trading at a premium to their historical 5-year averages on a one-year forward P/B and P/E, compared to 10-14 stocks about two months ago. But, the risk-on mode in global markets will keep Indian markets ticking. “The biggest positive seems to be that even though global growth is slowing, accommodative central banks have kept the markets in a risk-on mode. We expect the FOMC (Federal Open Market Committee) to cut rates by a further 75bp through June 2020,” says the note. BNP Paribas also expects another 10bp cut by the European Central Bank (ECB) before the year ends and continued QE, and easing by most Asian central banks, including Reserve Bank of India by another 25bp.

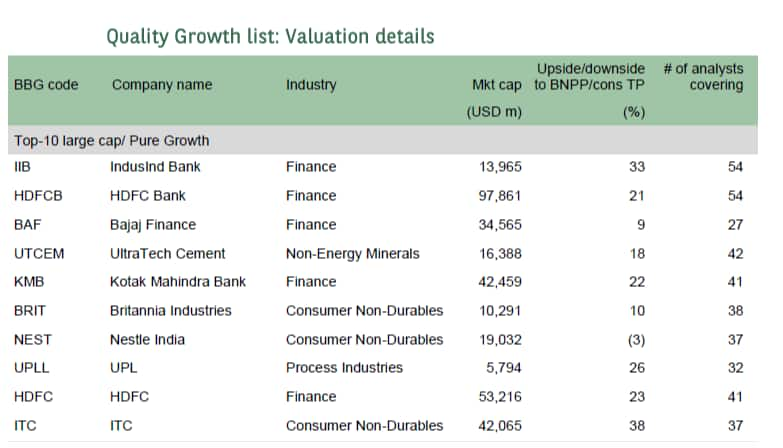

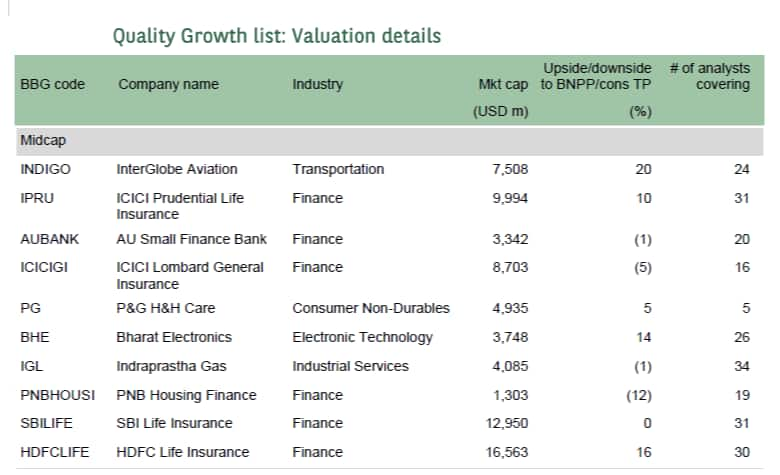

Model portfolio BNP Paribas model continues to favour private banks and insurance and recommends selective changes in both the lists. The global investment bank includes some more high-quality consumer-focussed names and dividend-paying PSUs. The prominent largecap additions are

HDFC,

NTPC,

UltraTech Cements, Sun Pharma and

Kotak Mahindra Bank, while the midcap ones are

P&G,

Bharat Electronics,

IGL, and

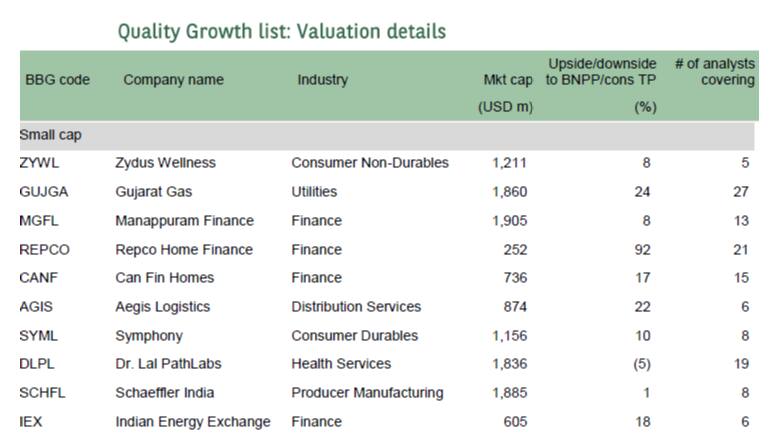

InterGlobe Aviation. The smallcap list remains unchanged. For the long term, BNP believes that it is important to back companies with proven competitive advantages and quality of earnings.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!