With Cipla's promoters, the Hamieds, looking out for potential buyers to divest their stake, one of the biggest India Inc takeovers is brewing.

Cipla's peers and private equity firms, including Blackstone and Baring Asia, are said to be jostling for the pharma jewel. While Torrent Pharma, a smaller rival, has emerged as a frontrunner, on the other side, Dr Reddy's Labs was reportedly approached by Bain Capital to make a joint bid for Cipla.

The promoters currently own a 33.47 percent stake in Cipla, which means acquiring their stake would trigger a mandatory open offer for an additional 26 percent stake, potentially resulting in the buyer holding majority ownership of up to 59.47 percent in Cipla. Considering Cipla's current market capitalisation, this transaction would carry a substantial value of over $7 billion, making it the biggest deal in the Indian pharmaceutical sector.

The news of the acquisition has also set in motion a slew of speculations over who could win the battle and what the future may look like for Cipla.

Given that the deal will likely take place at Cipla's current market price (CMP), analysts at Kotak Institutional Equities (KIE) feel that the ability of PE investors to derive a healthy internal rate of return (IRR) could be constrained. Hence, they see a higher possibility of a strategic investor acquiring Cipla is higher at its CMP.

Brushing aside the idea of PE investors taking over Cipla leaves two candidates in the race — Torrent Pharma and Dr Reddy's.

How will the economics work out for Torrent Pharma and Dr Reddy's?

The fact that Torrent Pharma is eyeing a majority stake in a company, which is 2.5 times its size in sales, is remarkable and daunting at the same time. While Torrent does have an impeccable track record of acquisitions in the recent past, like that of Elder Pharma, Unichem Labs and most recently, Curatio Healthcare, some analysts also have concerns about the risks that the debt burden may bring for the company.

A common thread tying together Torrent Pharma and Dr Reddy's in their quest to take over Cipla is the consequent rise in their near-term debt levels. Assuming the deal happens at CMP, the buyer would need $7.3 billion to acquire Cipla promoters’ entire stake and complete the 26 percent open offer (assuming 100 percent subscription).

If Torrent wins the race, foreign brokerage Jefferies believes that the company will be used as a vehicle to acquire Cipla rather than the former's promoters buying out the latter's promoters stake. KIE also does not consider the possibility of Torrent's or Dr Reddy's promoters directly acquiring Cipla as that would significantly limit any synergy benefits.

With the assumption that Torrent Pharma can raise equity from promoters, PE or other equity investors worth $2.8-2.9 billion to the extent that their promoter stake dilutes to 51 percent from the current 71 percent, it will still need to raise debt to fulfil the remaining $4 billion. This would take Torrent's debt-to-EBITDA to 3.5 times.

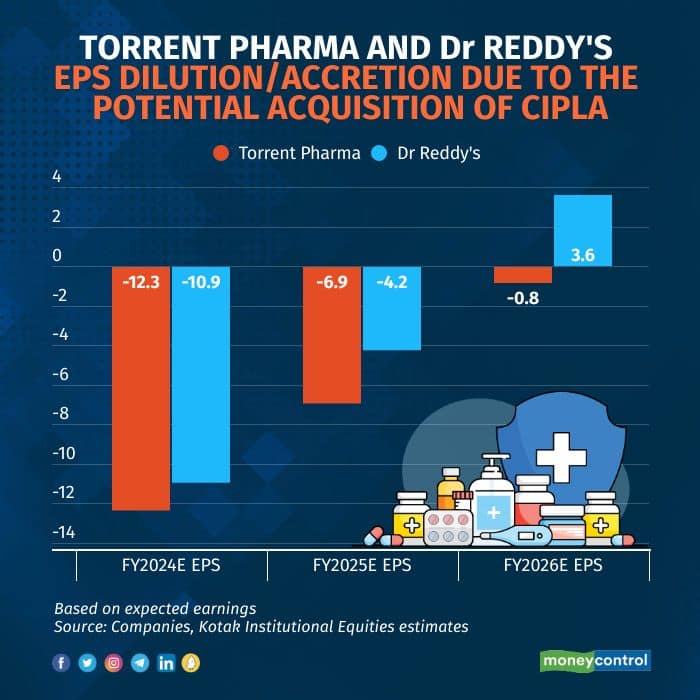

As for Dr Reddy's, the debt-to-EBITDA is likely to come around 1.5 times, based on the same calculations. Based on these assumptions, KIE expects a 7 percent and 4 percent earnings-per-stock dilution in FY25 earnings for Torrent Pharma and Dr Reddy's, respectively, if either acquires Cipla.

Irrespective of which firm manages to gain control over Cipla, Jefferies believes that the combined entity will generate considerable free cash flows, and hence, both companies in the race should be able to handle the stretched balance sheet.

Some pockets in the market also have a contrarian take on this. YES Securities for example believes that the Cipla deal would be an upfront negative for Torrent's ROCE (Return on Capital Employed)/ROE (Return on Equity), which coupled with the debt burden would have a bearing on their view if at all it becomes a reality.

Also Read | Cipla’s stake change: different scenarios for the investor

Regardless, analysts at KIE feel that a higher promoter shareholding in Torrent Pharma (71.25 percent as against 26.7 percent in Dr Reddy's) provides the company with a higher flexibility as it gives another avenue for fundraising for the promoters.

With that said, culturally, it is Cipla and Dr Reddy's that are more aligned with each other. "Unlike Cipla and Dr Reddy's, where the involvement of promoters in day-to-day operations is limited, the promoter family is actively involved in the day-to-day operations of Torrent Pharma," KIE noted.

Nonetheless, the takeover of Cipla by either of the two companies will lead to the emergence of a merged entity that will be a market leader in the domestic pharma market.

Limited portfolio overlaps, a trigger for future growth

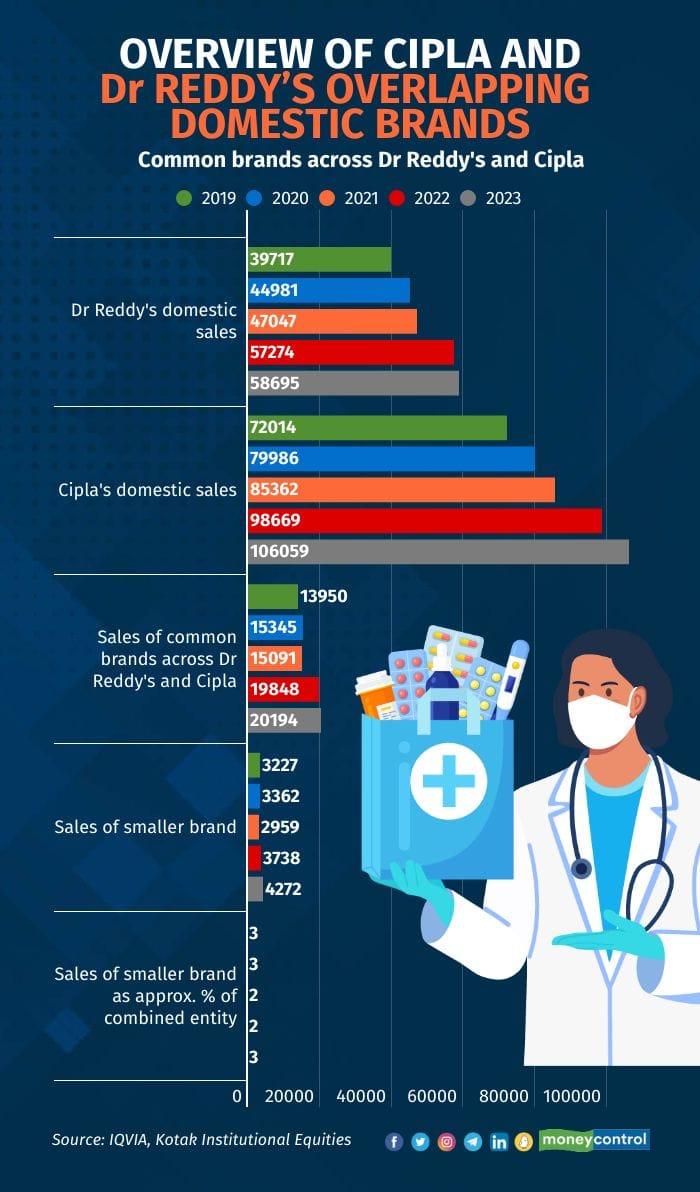

Another common thread tying Torrent Pharma and Dr Reddy's is the limited overlap of less than 3 percent and 7 percent market share with Cipla, respectively, in their domestic portfolios. KIE noted that the combined market shares of brands in an overlapping molecule are in the range of 1-18 percent and 1-22 percent for Torrent Pharma and Dr Reddy's, respectively, which limits the risk of divestments.

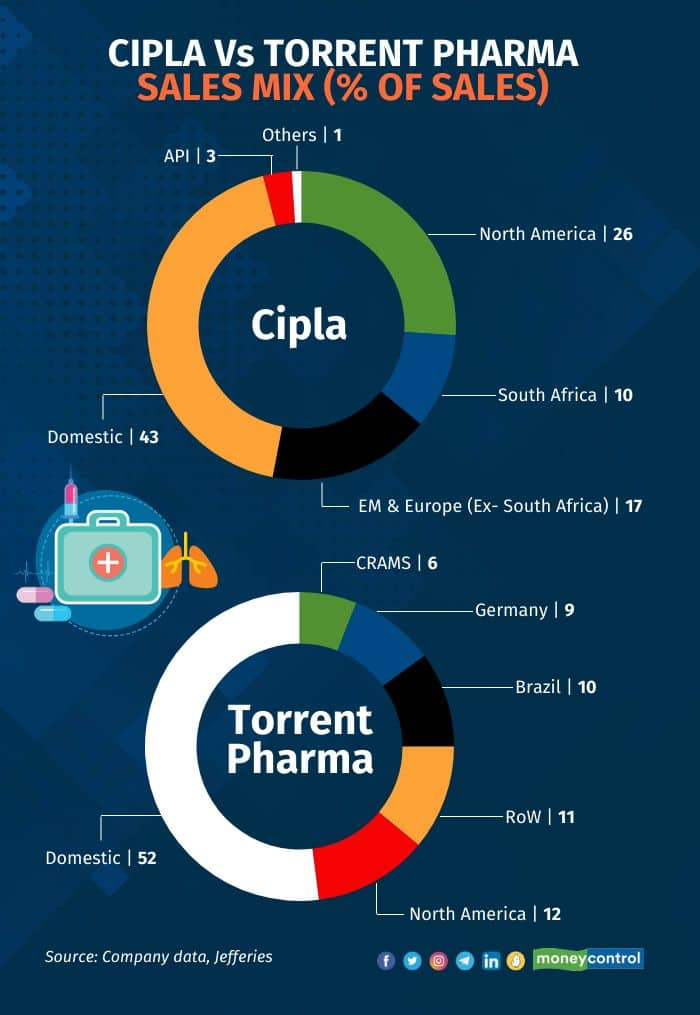

The India business was the biggest contributor for both Cipla and Torrent in FY23, while the North American market seized the deal for Dr Reddy's.

Coming to the international market, there is barely any overlap in the portfolios of Cipla and Torrent Pharma. However, there is a slightly higher overlap for Dr Reddy's, especially within international markets, specifically in US generics, which brokerages believe is unlikely to yield meaningful synergies.

Cipla and Torrent Pharma — what are the synergies?

Cipla's robust presence in South Africa complements Torrent Pharma's strong presence in Brazil, KIE highlighted. In emerging markets, getting product registrations and establishing an 'on the ground' presence is difficult and hence, Jefferies believes that for the combined entity cross-selling of products in target emerging markets can lead to faster scale-up of operations.

In the domestic market, Torrent has a strong presence in cardiac, neuro, vitamins and minerals while Cipla is well-oiled in respiratory and anti-infective segments. Cipla also has a well-established trade in the generics segment (about 20 percent of India sales) and a recently established Consumer Health division.

YES Securities seconded the view as it believes Cipla and Torrent's complementary presence would also bring a larger US business into the latter's fold, a not-so-keen geography for its management.

According to brokerage firm IIFL Securities, Cipla’s acquisition would make a great strategic fit for Torrent as it would catapult the merged entity to a numero uno position in the Indian market, strengthen its acute portfolio, particularly in therapies of respiratory and anti-infectives, and also provide access to Cipla’s diversified US pipeline of inhalation and complex injectables.

Cipla and Dr Reddy's — what does the merged entity look like?

The case is completely different for Dr Reddy's as it has a slightly higher domestic and international overlap with Cipla. However, unlike Torrent Pharma, where there is a meaningful difference in scale, KIE does not expect any major operational challenges for Dr Reddy's in managing Cipla’s US operations, considering its US business is about 1.7 times that of Cipla’s in the segment.

As for other geographies, Dr Reddy's has a prominent presence in Russia and the Commonwealth of Independent States (CIS). However, Cipla has a negligible presence in this region. Both these companies are active in Europe, which could provide some scope for rationalisation in the region, KIE believes.

Moreover, there is one space where neither Dr Reddy's nor Cipla have a marked presence, that is biosimilars and specialty, where peer Sun Pharma leads. Based on that, KIE feels the combined entity will have a higher ability to pursue biosimilars and specialty forays in developed markets.

Also, Cipla’s acquisition would propel Dr Reddy's into a leader in the domestic pharma market, aligned with its stated ambition of being among the top five players in India.

Overall, KIE sees synergies for both Torrent and Dr Reddy's with Cipla, driven by the rationalisation of Medical Representative costs, marketing and promotional expenses, as well as the optimisation of corporate and manufacturing overheads.

Despite the various permutations and combinations being put out, the deal is yet to reach its course. And the ball can land in anyone's court.

Also Read | Why PE firms may find Cipla acquisition a different ball game

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.