Jitendra Kumar GuptaMoneycontrol Research

Demand for ferro chrome, a key ingredient which gives a strong, shining and non-rusty surface to the steel, has grown faster because of newer applications of stainless steel like automobile, aviation, construction, home improvement and many more.

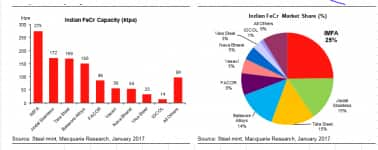

Indian Metals & Ferro Alloy (IMFA), the largest Indian integrated player (having its own ore mines with reserves of about 21 million tonnes or 35 times its current mining production at about 6 lakh tonnes) in this space, has been a key beneficiary of this steel cycle. Over the last 12 years, it has grown its revenues at 16 percent annually.

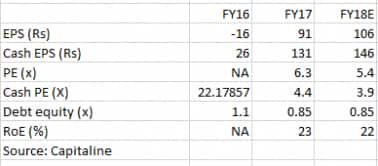

It is also one of the quality players in the metal space. In FY17, it generated over 23 percent return on equity and 32 percent operating margins with debt to equity ratio at a comfortable level of less than one time and interest coverage of 5 times.

However, investors need not get carried away by these numbers given the cyclical nature of the business. However, there are enough reasons to turn bullish now.

Cash-Rich

Apparently, as demand and pricing environment improve, the business generates more and more cash. The company today is sitting on cash equivalent of close to 250 crore, which is expected to touch Rs 660 crore or about 43 percent of current market capitalization, at Rs 1525 crore by FY18.

Core Advantages

Globally, South Africa, which has got the largest chrome ore mines, is the lowest cost producer in the world. India is slightly higher on the cost curve but still, is amongst the cheapest producer, which can also be vouched from the fact that in the last 15 years (comprising at least 4 down cycles), barring FY16, the company never incurred a loss.

An integrated player like IMFA makes an operating margin in the region of 30-40 percent, as it is backwardly integrated with its own mines and also generates power from captive mines at less than Rs 4 a unit.

Besides the cost advantage that IMFA enjoys, the Indian player also enjoys a distinctive advantage of supplying to some of the South Asian markets because of the low freight cost compared to its competitors in South Africa. This is precisely the reason why IMFA supplies to some of the biggest players in South East Asia like POSCO, a South Korean steel giant, and others in Taiwan, China and Japan on a long-term basis.

Normalcy after the disruption of FY16

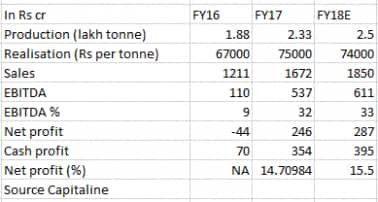

In FY16, the company suffered a huge blow because of the shutdown of its facility for about three months as well as a decline in chrome prices. Chrome realisations fell to about Rs 67000/tonne in FY16 as against Rs 70000/tonne in FY15, but since then it has recovered to around Rs 75000 a tonne currently. Similarly, the production that had dropped to 1.88 lakh tonnes in FY16 from 2.05 lakh tonne in FY15 has now recovered to 2.33 lakh tonnes. “This year the production has recovered and we are expecting to produce close to 2.4-2.5 lakh tonnes, which is near our full capacity. In fact, we are not able to supply to some of our clients,” said Prem Khandelwal, CFO, IMFA.

Both higher volumes and realisations will have a huge impact on profitability and cash flows. Even at 2.5 lakh tonnes and current chrome prices (around Rs 74000 a tonne), the company will be making close to Rs 290 crore of net profit and a cash profit of around Rs 400 crore. This is precisely the reason why by the end of FY18 it will be sitting on cash of about Rs 660 crore, which will partly be used for reduction in debt and for further expansion.

The company is looking to add another 1 lakh tonne capacity, which is yet to be finalised. If it is able to deploy cash in core business (core RoE of 30 percent) it will only add more value.

Valuation

In the last 12 years, it has never had a negative cash flow from operation. Since operating cash has always been higher than the reported profits, the quality of the earnings has been good. On a conservative basis, in FY18 the company will be making a cash profit of about Rs 400 crore. Taking that into account, at the current market capitalisation of Rs 1,525 crore, it is trading at less 4 times its cash profit and 5 times its net profit, which is quite reasonable considering the earnings growth, strength of balance sheet and liquid investments in the book.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.