With wealth managers declaring that it is a stock picker’s market now, investors are looking at Apar Industries.

The electrical conductor maker’s stock has risen 58 percent in the past three months. It is up 244 percent in the past year and has rallied 455 percent in the past three years. Most of the stock’s performance is on account of a strong demand outlook, said market participants.

What does the company do?

Apar Industries is the largest aluminium and alloy conductor manufacturer in the world and the third-largest transformer oil maker. It offers over 350 grades of speciality oils, the largest range of speciality cables, lubricants, speciality automotive and polymers.

How did it perform financially?

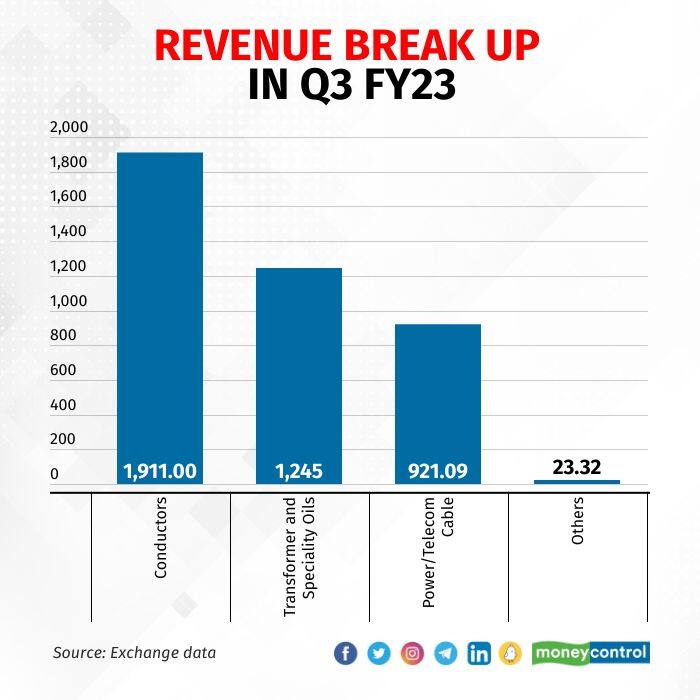

Apar’s revenue from operations rose 76 percent to Rs 3,942.37 crore in the third quarter of FY23 from a year earlier. Conductors were the highest revenue contributor, followed by transformer and speciality oils, and power and telecom cables.

Net profit came in at Rs 170 crore, up 210 percent. The company clocked a record top line and earnings in the third quarter.

Net profit came in at Rs 170 crore, up 210 percent. The company clocked a record top line and earnings in the third quarter.

The company’s operating margin expanded 360 basis points on a YoY basis, driven by better product and geography mix, analysts said.

The company’s operating margin expanded 360 basis points on a YoY basis, driven by better product and geography mix, analysts said.

Why the optimism?

Market participants said Apar Industries stands to benefit from the government’s increased focus on infrastructure and segments such as the railways, defence and renewable energy.

The conductors and cables business is likely to witness strong traction from exports, led by increased infrastructure spending in the key markets of the US and Europe, said Prabhudas Lilladher.

The company said on its earnings conference call that capital expenditure is expected to be about Rs 300 crore over the next 15 months, majorly for greenfield expansion in the cables and conductors business.

Product premiumisation and geographical mix are expected to drive growth for cables, the company added. Cable sales soared 89 percent YoY.

Revenue in the conductors segment doubled to Rs 1,912 crore YoY, led by strong volume growth, higher share of premium products and exports. There is strong traction from the US, Australia, and Latin America for its conventional conductors and the segment is expected to grow 15-20 percent over the next couple of years, the company said.

A higher contribution from exports augurs well for the company because export orders help improve the company's margin, said some analysts.

The share of exports in revenue was 47 percent in the nine months ended December compared with 38 percent a year earlier.

The company expects decent growth in speciality oil, its second-largest revenue-contributing segment. The specialty oil segment may grow 5-7 percent for the next couple of years.

Also Read | Adani crisis continues: Norway wealth fund says it has sold its stakes in group

“APR’s (Apar’s) focus towards value-added products and exports business will drive strong top line and profitability in the long run,” Amit Anwani of Prabhudas Lilladher said in a research note.

The brokerage firm maintained its ‘buy’ rating on the stock with a 23 percent hike in target price to Rs 2,260, valuing it at a PE of 14 times FY25.

“The stock just experienced a vertical jump and is currently in a strong upswing. We can anticipate profit booking from here because often, this kind of move results in profit booking or a short-term trend reversal,” said Santosh Meena, head of research at Swastika Investmart.

On the downside, Rs 1,870 will operate as a strong and quick support level, and during any significant decline, Rs 1,450-1,400 will be a crucial demand zone, he added. The Apar Industries stock price fell 0.3 percent to Rs 2,214.50 at the close on the BSE.

The management said it was confident of meeting its revenue guidance of Rs 3,000 crore for FY23 and grow 25-30 percent going forward, driven by healthy demand from the railways, the defence sector and wind energy.

Apar Industries provides a wide range of cables to industries such as railway locomotives and coaches, shipping, mining, defence, solar and wind. It is one of the leading suppliers of cables for solar and wind energy companies in India.

The promoter shareholding in the company was steady at 60.64 percent as of December end. Foreign institutional investors increased their stake to 6.7 percent as of the December quarter from 5.8 percent as of March 2020.

Domestic institutional investors trimmed their stake while public shareholders increased their holdings.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.