The de-dollarisation camp, which believes that the end of the US currency is near, may have drawn the conclusion too soon, an economics researcher and a PhD scholar at Stanford University has said.

Jon Hartley, who completed his post-graduate studies at The Wharton School and from the Harvard Kennedy School, posted a Twitter thread explaining why. The thread was retweeted by economist and professor at Stern School of Business Nouriel Roubini.

Along with his argument, Hartley also announced the launch of a website called De-Dollarization Facts, which will track the status of the US dollar and “provide facts in the ‘de-dollarisation’ debate which often ignores just how dominant the US dollar is”.

Also read: BRICS raging against the dollar is an exercise in futility

Hartley tweeted, “There are an almost endless number of commentators saying it's the end of the dollar (many from crypto/CBDC communities and intl political interests opposed to the US); most recently with JP Morgan, Goldman Sachs, State Street analysts jumping on this train. Not so fast.”

He has presented data on forex reserves of central banks, forex trading volumes from the Bank for International Settlements (BIS) and currency denomination of global debt securities to make his case.

As he points out, much of the "de-dollarization" discussion began around the coronavirus pandemic, the Russian invasion of Ukraine in 2022, US sanctions on Russia's central bank and recent anti-dollar bilateral trade deals. But, as data presented by him shows, through 2022 and 2023, the US currency has held up strong.

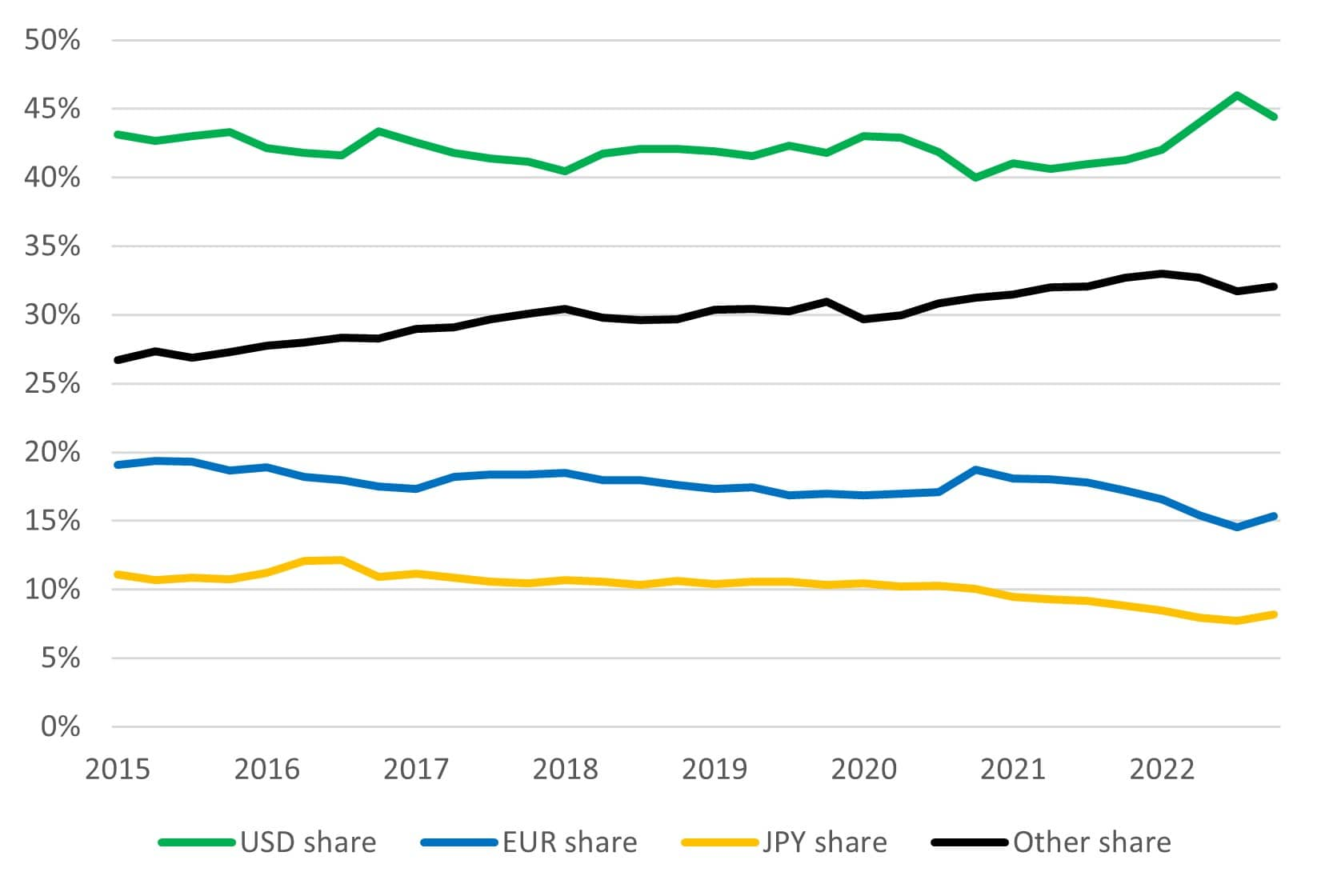

Hartley starts with a chart on the share of currency reserves that central banks hold from the first quarter of 1999 through the first quarter of 2022.

The chart shows the dollar share of forex reserves falling roughly 70 percent to 60 percent from 1999 (beginning of IMF COFER quarterly data) to 2022. The chart has been “cited over and over by the ‘de-dollarization’ doomsayers”, he says.

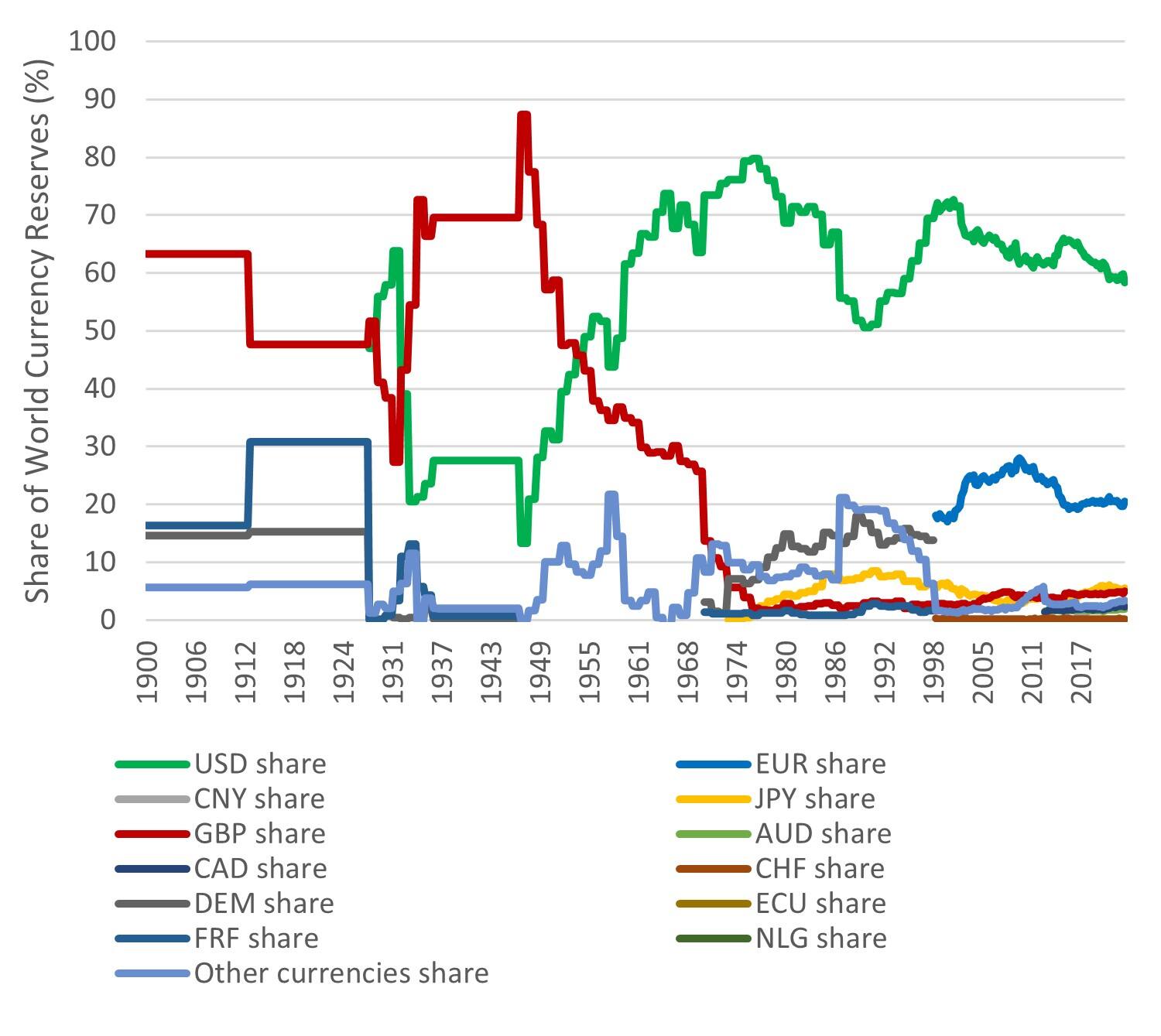

But he asks us to take a step back and see the data from 1900. He points out that the dollar’s share in the reserves has been much weaker than now and that recovered.

Hartley writes, “Combining it (the commonly cited chart) with the central bank FX reserves data from the 20th century put together by @B_Eichengreen (Barry Eichengreen, Professor of Economics and Political Science at the University of California, Berkeley) and others tells a very different story”.

“The dollar share was at a lower point in 1990 (around 50% of reserves) compared to around 60% in 2022,” he adds.

Hartley then presents FX trading volumes from BIS.

The chart “shows the share of dollar transactions remains near all time highs (with US dollar involved in nearly 90% of all FX transactions as of 2022) even through the 2022 Russian invasion of Ukraine (due to FX pairs, scale sums to 100%, max=50%)”, he says.

Also read: Dedollarisation efforts will make only a small dent in the greenback’s dominance

His thread adds, “Next, turn to the currency denomination of all global debt securities which is calculated by the BIS; the share of global debt securities denominated in dollars has actually increased since the 2022 Russian invasion of Ukraine to around 45% of global debt securities.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.