June 08, 2022 / 15:23 IST

RBI would pause for breath after December on hikes, says QuantEco’s Shubhada Rao

After Wednesday’s 50 basis points hike in the repo rate, the Reserve Bank of India still have 75 bps to go, Shubhada Rao, founder of independent research firm QuantEco Research Ltd. Rao pointed out that the RBI has raised its inflation forecast by a massive 100 bps, which shows that the central bank has anticipated every possible adverse effect. While the cash reserve ratio was untouched, she feel, it is still on the table to be used. Her assessment is that in February policy, the RBI could take a pause to assess if the government’s fiscal position is changing. The new fiscal year budget would be out and the fiscal position for FY23 would be known. The RBI would want to assess how the government’s fiscal position for the next year would be. It could resume its rate hiking cycle in April.

June 08, 2022 / 15:04 IST

Market at 3.00 PM

Indices remain under pressure after repo rate hike, Sensex trading lower by around 200 points, Nifty below 16,400

The Sensex was trading lower by 209.38 points or 0.38% at 54,897.26 and the Nifty was down 57.35 points or 0.35% at 16,359.3. About 1541 shares have advanced, 1734 shares declined, and 124 shares are unchanged.

Source: BSE

June 08, 2022 / 14:51 IST

ISMA increases 2021-22 sugar output estimate to 36 MT

Indian Sugar Manufacturers Association (ISMA) increases 2021-22 sugar output estimate to 36 MT. The country had achieved a sugar output of 35.7 MT till June 6 as compared to 30.7 MT during the same period last year. ISMA has inked contracts to export around 9.5 MT sugar for 2021-22 out of which 8.5 MT of sugar was exported during the period of October to May.

June 08, 2022 / 14:39 IST

Repo Rate Hike To Impact Home Loan Borrowers

"The repo rate hike by RBI will impact the home loan borrowers, both the existing as well as the new ones. The hike is positive for the banks and the NBFCs but it is a burden for the borrowers. RBI has raised its inflation forecast for FY23 by 100 basis points to 6.7%, citing supply shocks emanating from the Russia-Ukraine war and the consequent surge in commodity and oil prices. This is very worrisome,"KunalValia, Chief Investment Officer – Listed Investments at WaterfieldAdvisors said.

The rise in inflation will impact the purchasing power. Simultaneously, the borrowing cost has gone up too. This dual phenomenon will lead to a slowdown in the economy. Having said that, the repo rate is still lower than the pre-pandemic level of 5.15 percent. There is room for RBI to increase the repo rate up to 5.5%, he added.

June 08, 2022 / 14:32 IST

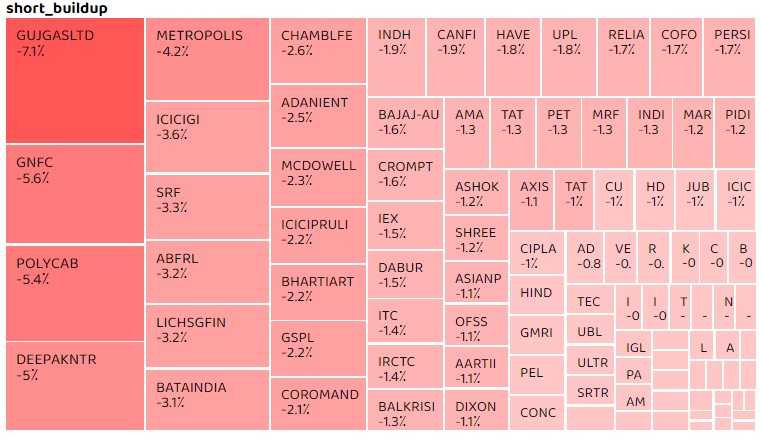

Short Build-Up

Based on the open interest future percentage, Gujarat Gas, GNFC, Polycab India, Deepak Nitrite, Metropolis Healthcare, ICICI Lombard, SRF, LIC Housing Finance, Aditya Birla Fashion & Retail and Bata India saw highest short build-up.

An increase in openinterest, along with a decrease in price, mostly indicates a build-up of short positions.

June 08, 2022 / 14:09 IST

Market Update

The market wiped out all gains in afternoon to trade lower with the Nifty50 falling below crucial support of 16,400 mark and the BSE Sensex shedding around 200 points, dragged by Bharti Airtel, Reliance Industries, ITC, IndusInd Bank, Asian Paints, Axis Bank, HUL, ICICI Bank, and Infosys.

However, Tata Steel, SBI, Bajaj Finance, Titan Company, Maruti Suzuki, Bajaj Finserv, TCS and HCL Technologies are top gainers.

June 08, 2022 / 14:04 IST

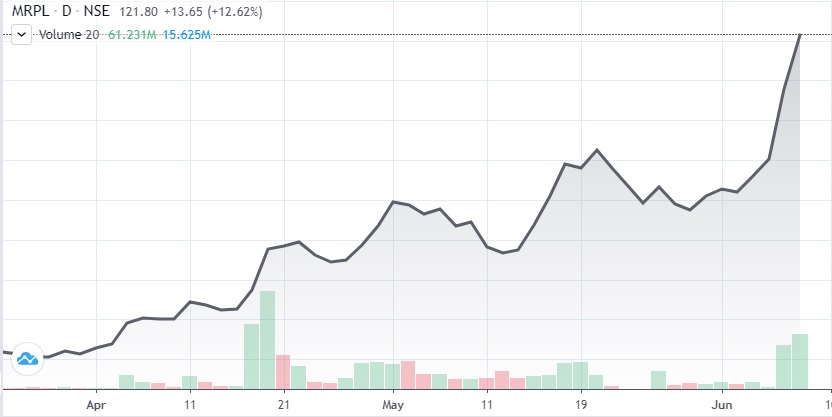

MRPL Gains 200% in 2 Months

Mangalore Refinery and Petrochemicals (MRPL) has been gaining strength since the end of March this year despite intermittent correction. It has rallied 200 percent in last more than two months.

June 08, 2022 / 13:56 IST

Fund Raising by Ujjivan Small Finance Bank

Ujjivan Small Finance Bank informed exchanges that the board has approved the proposal for raising of funds by way of issuance of non-convertible debt securities upto Rs1,500 crore on a private placement basis, in one or more tranches, within a period of 1 (one) year from the date of seeking shareholders' approval.

June 08, 2022 / 13:49 IST

Lupin Receives Tentative Approval from USFDA for Ivacaftor tablets

The pharma major said it has received tentative approval from the United States Food and Drug Administration (FDA) for its abbreviated new drug application (ANDA) Ivacaftortablets which are available in150 mg strength. This drug is a generic equivalent of Kalydecotabletsof Vertex Pharmaceuticals Incorporated.

This product will be manufactured at Lupin’s Nagpur facility in India. Ivacaftortabletshad estimated annual sales of $109 million in the US(as per IQVIA MAT March 2022).

June 08, 2022 / 13:46 IST

Expert's Take on RBI Policy

"The outcome of the MPC meet was in line with most of our expectations except that the repo rate hike came in at 50 bps vs 40 bps expected by us,"DhirajRelli, MD & CEO at HDFCSecuritiessaid.

While a revisit of the pre Covid repo rate of 5.15% over the next 1-2 meets is a given (vs 4.90% currently), most economists expect this to go above 5.15%. A lot in this regard will depend on how soon the inflation peaks out and begins to fall and when do the global Central Banks feel that they are done with the rate hikes for now, he added.

June 08, 2022 / 13:23 IST

Naveen Kulkarni, Chief Investment Officer, Axis Securities

Post the off-cycle announcement of a rate hike in May’22, paving the way for a series of rate hikes in the following meetings, the RBI increased the repo rate by 50bps. The MPC has decided to focus on calibrated withdrawal of accommodation while supporting growth. May’22 witnessed pro-active measures by the central government in the form of excise duty cut on petrol and diesel, a ban on wheat export, and other similar measures easing domestic inflationary pressures. However, keeping in view the ongoing geopolitical tensions, rising crude oil prices, and global inflationary input cost pressures, the regulator has increased its inflation estimate for FY23 to 6.7% vs 5.7% earlier. RBI has retained its growth estimates at 7.2%. We believe the market had already discounted a rate hike of 40-50bps, and the key monitorable was a commentary on inflation. We may witness another rate hike, probably of a similar quantum, in the next monetary policy to manage inflationary pressures.

June 08, 2022 / 13:16 IST

Positive sentiments help broader indices trade positive

Souces: BSE