The market clocked a nearly 1.6 percent rally for the week ended October 10, extending the upward journey for the second consecutive week, thanks to buying interest in all key sectors. The renewed FIIs buying interest, easing geopolitical tensions with Israel-Hamas' ceasefire plan, and signs of progress in a likely India-US trade deal lifted sentiment, while gold continued to gain strength as global uncertainties persist, hitting a record high of $4,081 before closing the week with 2.34 percent gains.

However, this week, starting October 13, the market is expected to see some volatility, at least in the upcoming couple of sessions, due to a fresh US-China trade tariff war, and if that escalates significantly, then bears may get a strong hold over the market. However, if that does not happen, then the overall week is expected to be stable despite initial volatility, with focus on a further set of corporate earnings, India and China inflation numbers for September, Fed officials’ speeches, FIIs' mood, and further updates related to the US-China trade war and the US shutdown, experts said.

The Nifty 50 rallied 391 points (1.57 percent) for the week to 25,285, and the BSE Sensex soared 1,294 points (1.59 percent) to 82,501, while the Nifty Midcap and Smallcap 100 indices gained 2.08 percent and 1.43 percent, respectively.

"Looking ahead, Q2 earnings from sector weights IT, banking & FMCG will weigh on investor sentiments," Vinod Nair, Head of Research at Geojit Investments, said.

Along with this, "global geopolitical developments and inflation data from the India and China will remain key triggers influencing central bank policy expectations and overall market sentiment," he said.

However, in the near term, investors will continue to favour consumption-led themes supported by accommodative fiscal and monetary policies, he added.

Here are 10 key factors to watch this week:US-China Trade ConflictGlobally, the focus will be on a fresh trade war between the world's largest economies, as after China imposed new export controls on rare earth minerals, US President Donald Trump on Friday slapped additional 100 percent tariffs on imports from China, effective November 1. China defended its move on rare earth minerals, saying it is a legitimate measure under international law. This raises clouds over the upcoming meeting between Trump and Chinese leader Xi Jinping, as Trump on Friday threatened in a social media post to cancel his upcoming meeting with Xi, scheduled on the sidelines of the Asia-Pacific Economic Cooperation forum during the last week of October in Gyeongju, South Korea, according to CNBC reports.

"While most of China’s new restrictions are not scheduled to take effect until December 1, markets remain hopeful for last-minute negotiations. Nonetheless, the renewed trade tensions are likely to fuel volatility," Kaynat Chainwala of Kotak Securities said.

All eyes will also be on the US government shutdown that is now stretching into another week, with potential federal layoffs looming as Congress remains deadlocked. With no Senate vote expected until Tuesday, concerns continue to grow amid already fragile consumer sentiment, experts said.

If the US shutdown gets extended further, then the key data releases such as retail sales, PPI, jobless claims, and housing Starts scheduled this week could get delayed.

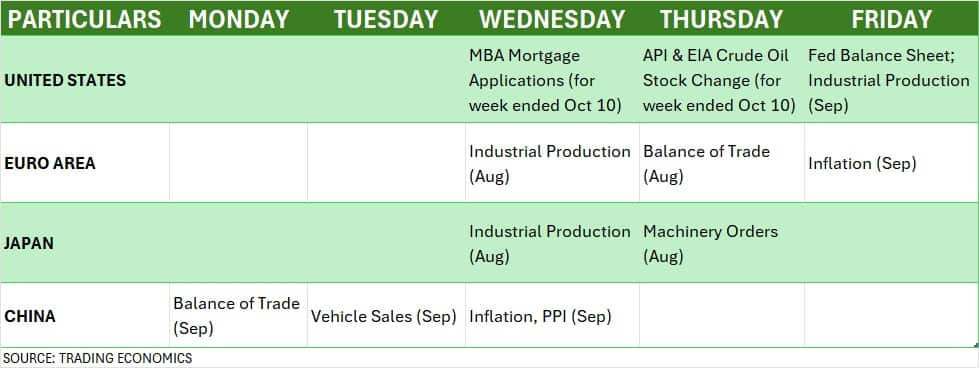

Global Economic Data and IMF-World Bank MeetingFurther, globally, all eyes will also be on the Chinese inflation data and the IMF-World Bank annual meetings for insight into broader macroeconomic trends and risks. The 2025 Annual Meetings of the World Bank Group and the International Monetary Fund are scheduled between October 13 and October 18.

Additionally, the speeches from Fed Chair Jerome Powell and other FOMC officials, including Miran, scheduled this week will also be watched.

Back home, the market participants will focus on CPI inflation for September, releasing on October 13, which is one of the important data points for the RBI MPC to take a decision over the interest rates. Most economists expect CPI inflation to fall below 2 percent in September, against 2.07 percent in August.

Further, WPI inflation will be released on October 14, followed by the unemployment rate & balance of trade data for September, and minutes of the recent RBI monetary policy meeting scheduled on October 15.

Bank loan and deposit growth numbers for the fortnight ended October 3, and foreign exchange reserves for the week ended October 10, will be announced on October 17.

Q2 EarningsApart from economic data, the market participants will keep an eye on the further set of corporate earnings. Most of the index heavyweights are scheduled to release their quarterly results this week, including Reliance Industries, Infosys, HCL Technologies, Tech Mahindra, Axis Bank, HDFC Life Insurance Company, Jio Financial Services, Nestle India, Wipro, JSW Steel, HDFC Bank, ICICI Bank, and UltraTech Cement.

Among others, ICICI Lombard General Insurance Company, ICICI Prudential Life Insurance Company, HDB Financial Services, HDFC Asset Management Company, Indian Renewable Energy Development Agency, Bank of Maharashtra, Persistent Systems, Leela Palaces Hotels & Resorts, L&T Finance, Indian Bank, Ivalue Infosolutions, JSW Infrastructure, Kajaria Ceramics, LTIMindtree, Zee Entertainment Enterprises, Dixon Technologies, Havells India, JSW Energy, L&T Technology Services, Polycab India, Poonawalla Fincorp, PVR Inox, Tata Technologies, Federal Bank, IDBI Bank, IDFC First Bank, IndusInd Bank, RBL Bank, and Yes Bank will also announce their earnings scorecard this week.

FII FlowThe focus will also be on the mood of institutional investors, as FIIs (foreign institutional investors) and DIIs (domestic institutional investors) both supported the market last week. Easing valuation concerns and improving earnings and growth prospects may be some of the reasons for renewed FIIs buying interest in the passing week, but going forward, their flows will depend on further updates over a fresh US-China trade war (started over the weekend).

FIIs have turned net buyers in Indian equities after several weeks, purchasing Rs 2,975.53 crore worth of shares during the week, while DIIs have made Rs 8,391.11 crore worth of buying in the same period.

Meanwhile, the rupee closed at 88.73 against the US dollar, weakening by 0.02 percent during the week, sustaining tad below the all-time low of 88.87 for another week. The US Dollar index remained below 100 zone since June, climbing 1.17 percent during the week to 98.85.

IPOOn the primary market, there will be no major action barring one IPO launch only from the mainboard segment after significant launches seen in the past few weeks. Midwest, the producer and exporter of Black Galaxy Granite, will open its Rs 451-crore public issue on October 15 and close on October 17, with a price band of Rs 1,014-1,065 per share.

Canara HSBC Life Insurance Company, Canara Robeco Asset Management Company, and Rubicon Research will close their initial public offerings (IPOs) this week, while in the SME segment, the public issues by SK Minerals & Additives, Sihora Industries, and Shlokka Dyes will close on October 14.

On the listing front, Tata Capital, LG Electronics India, Canara HSBC Life Insurance Company, Canara Robeco Asset Management Company, and Rubicon Research will make their market debut this week. In the SME segment, Mittal Sections, SK Minerals & Additives, Sihora Industries, and Shlokka Dyes are scheduled for listing this week.

Technical ViewTechnically, the 24,900 (the midline of Bollinger bands on the weekly charts, and 50-day EMA) is expected to act as a crucial support for the Nifty 50 this week, as closing decisively below can activate bears. Overall, the trend is still up, given the healthy technical and momentum indicators. On the higher side, 25,400-25,450 is the zone to watch out for, as surpassing the same decisively can drive a strong rally going ahead despite intermittent consolidation and correction.

F&O CuesThe weekly options data suggested that the Nifty 50 is expected to be in the 25,000-25,650 range in the short term. The maximum Call open interest was seen at the 26,000 strike, followed by the 25,500 and 25,400 strikes, with the maximum Call writing at the 25,450, 25,650 and 25,350 strikes.

On the Put side, the 25,200 strike holds the maximum Put open interest, followed by the 25,000 and 25,100 strikes, with the maximum Put writing at the 25,300, 25,250, and 25,200 strikes.

Meanwhile, the fear index, India VIX, remained in the lower zone and sustained below all key moving averages (though it has risen 0.42 percent during the week to 10.10), indicating a continued comfort zone for the market.

Corporate ActionHere are the key corporate actions taking place this week:

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.