Jitendra Kumar GuptaMoneycontrol Research

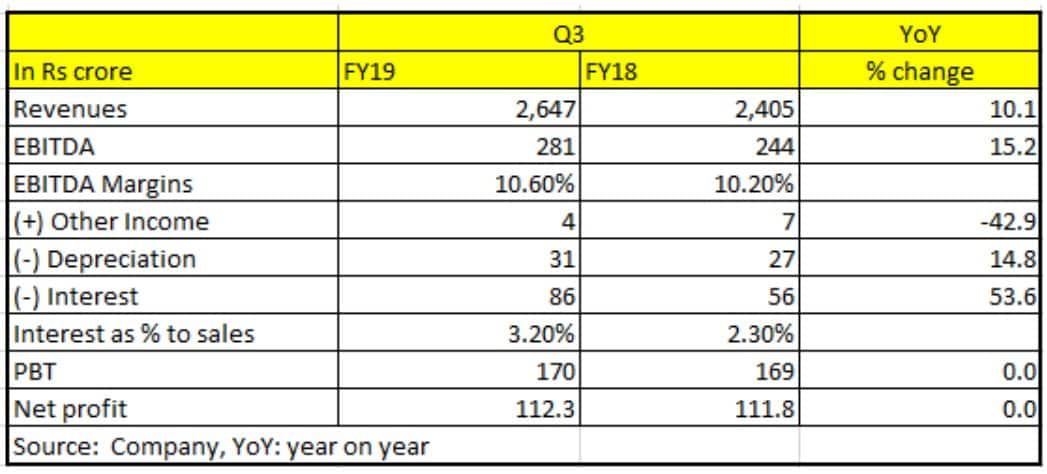

Courtesy the slowdown in international projects and delays in execution pertaining to few private clients, KEC International reported a moderate 10.1 percent year-on-year (YoY) revenue growth during the quarter ended December 20018. This, along with the higher interest cost hit profitability. Profit grew a mere 0.5 percent YoY to Rs 112.3 crore.

Key negatives

The main T&D business revenues that grew only 2 percent was responsible for moderate growth. The business of international tower subsidiary (7 percent of total revenue), reported a steep 39 percent revenue decline. The company did not recognise revenue for some of its international projects as a result of delay in approval and this led to a decline in sales. However, it is hopeful of getting them on the books over the next quarter or so.

Key positive

Other segments such as railways and civil business came to the rescue. Railways segment posted strong 105.7 percent YoY sales growth on strong execution and project completion. Similarly, civil and water segment reported 27 percent YoY revenue growth to Rs 110 crore. Both these segments contributed about 25 percent to its total revenues.

Because of higher contribution from these segments the company was able to increase its overall earnings before interest, tax, depreciation and amortisation (EBITDA) margins by about 40 basis points leading to a growth of 15.3 percent in the EBIDTA to Rs 281 crore.

Key observations

With the core business now on a weaker footing, the area of focus would be working capital and debt in the light of the capital intensive nature of the business. The company has a debt of about Rs 3,000 crore and during the quarter, interest cost, which is still comfortable at about one-third of its EBITDA, rose by 54 percent.

Company is hopeful of maintaining working capital in the light of money from the international projects that is now getting realised. The company received over Rs 200 crore from one of its sticky customer in Saudi Arabia.

That apart, the management indicated a possible source of funds as a result of the divestment of assets. It has entered into an agreement with Adani Transmission to sell its entire stake in KEC Bikaner and Sikar Transmission. With these initiatives, it aims to reduce its debt by about Rs 500 crore and to end the year with a consolidated debt of about Rs 2,500 crore.

Outlook

The next two quarters will be crucial as execution may remain muted with private clients facing issues pertaining to credit flow leading to slower execution. That apart, order inflows are slowing and expected to dip further ahead of the elections this year. In light of this, the company’s ability to manage working capital, debt and protecting its margins would be tested. Thankfully, at the end of the December quarter, the order books were up 20 percent at Rs 20,592 crore or about two times its annual sales, providing good growth visibility.

The stock though has fallen over 40 percent this fiscal. It is currently trading at 12 times it FY19 estimated earnings. Valuations are reasonable but remain on the higher side if one accounts for the short to medium term earnings uncertainty. Earnings estimates may get revised downward and investors should tone down their expectations as well.

For more Research articles, visit our Moneycontrol Research Page.

(Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.