Valiant Laboratories, whose IPO opened for subscription on September 27, has set its eyes on more than doubling revenue by diversifying into specialty chemicals business, according to Managing Director Santosh Vora.

The company’s public issue was subscribed 33 percent at the close of day 1 of bidding. The Rs 152-crore IPO has a price band of Rs 133-140 per share.

Specialty chemicals business to boost revenue

The company specialises in Paracetamol production, and is now looking to diversify its product portfolio to speciality chemicals, Vora told Moneycontrol in an interview. The plan is to establish a greenfield project to achieve this diversification, with the full capacity expected to be ramped up and operational by FY26.

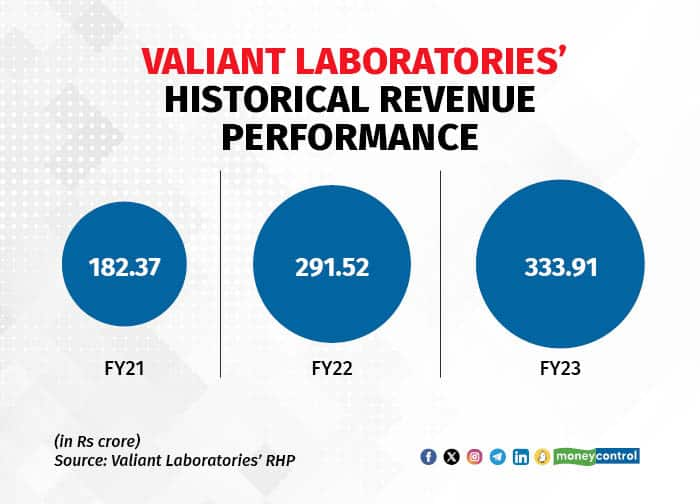

The new project is projected to contribute Rs 650 crore to revenue, nearly twice the size of its existing business, which generates around Rs 330-350 crore, Vora said.

Valiant Laboratories' Revenues

Valiant Laboratories' Revenues

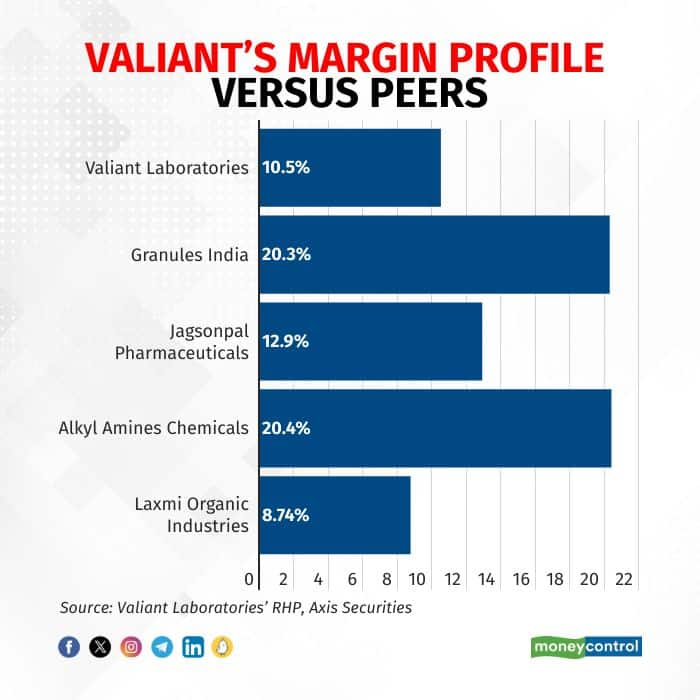

Valiant Laboratories’ operating margins are far lower than its peers. At 10 percent, the company’s operating margins are at almost half as compared to other companies such as Granules and Alkyl Amines Chemicals.

Valiants' Margins

Valiants' Margins

Plans to improve operating margins:

The company currently operates in non-regulated markets, but plans to expand into regulated and export markets in the long term. This shift is expected to lead to higher profit margins, Vora said.

While competitors like Alkyl Amines and Lakshmi Organics, which deal in specialty chemicals, enjoy greater margins, Valiant Laboratories believes that its new chemistry initiatives, particularly the greenfield project, will substantially enhance its profit margins, compared to its current business.

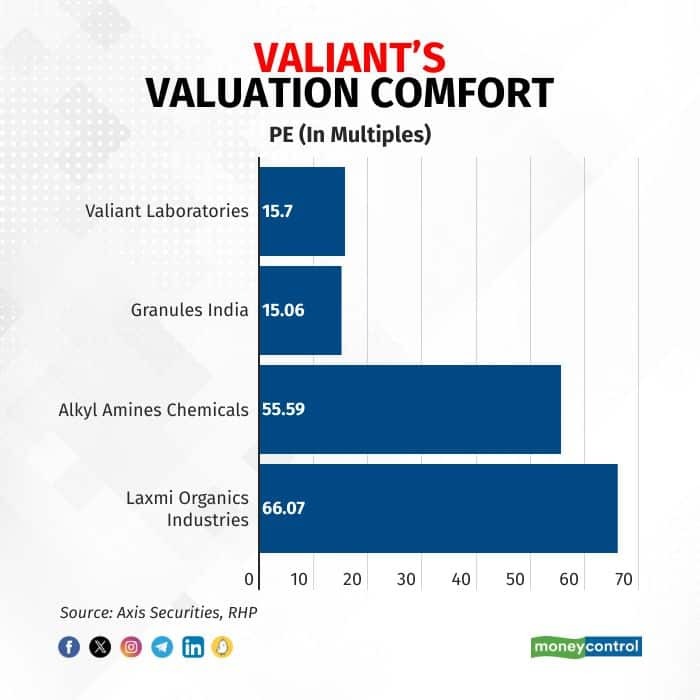

Valuation comfort:

At present, Valiant Laboratories commands a PE of 15.7 times, which is in line with Granules India and lower, compared to Alkyl Amines Chemicals and Laxmi Organic Industries.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.