Scoda Tubes IPO allotment Updates: Here's step-by-step guide to check share allotment status online

IPO News Today (June 2): The IPO allotment for Scoda Tubes Ltd is likely to be finalised soon. The stainless-steel tubes and pipes manufacturer received an enthusiastic response from investors during its subscription window. With the bidding now closed, all eyes are on the allotment date, which is anticipated to be today, June 2.

-330

June 02, 2025· 16:07 IST

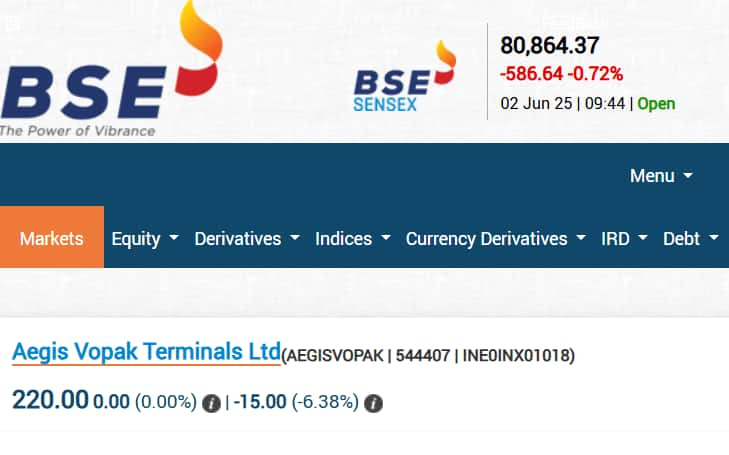

Aegis Vopak Terminals share price: Stock recovers all listing losses; hits 10% upper circuit

The shares of Aegis Vopak Terminals jumped 10% to hit the upper circuit at Rs 242 apiece. The shares have closed over 2 percent higher than the IPO price of Rs 235 apiece. This comes after the stock saw a muted debut, listing at a discount of over 6% over the IPO price at Rs 220 apiece.

-330

June 02, 2025· 16:03 IST

Leela Hotels share price: Stock makes strong recovery post muted market debut, shares close 7% higher

After the weak market debut, the shares of Schloss Bangalore saw significant volatility. The shares of the operator of luxury hotels and resorts chain under The Leela brand soared nearly 7 percent to close slightly below the IPO price at Rs 433.80 apiece.

-330

June 02, 2025· 14:38 IST

Trump's plan to hike steel tariffs to have 'minor' impact on India, says minister

- India estimates a "minor impact" from U.S. President Donald Trump's plan to increase tariffs on steel and aluminium products as the South Asian country exports low volumes to Washington, the federal steel minister said on Monday.

- Trump said last week he intends to increase tariffs on imported steel and aluminium to 50% from 25% currently, spurring declines on Monday in steelmakers' stocks in South Korea and Vietnam - major Asian exporters to the U.S. - Reuters

-330

June 02, 2025· 13:14 IST

Scoda Tubes IPO allotment Live Updates: All you need to know about Scoda Tubes IPO - key points

- IPO Timeline:

- Scoda Tubes IPO opened on Wednesday, May 28 and closed on Friday, May 30.

Allotment date is expected to be June 2 (Sunday).

Listing date is tentatively scheduled for Wednesday, June 4.

Issue Details: - The IPO is a fresh issue worth ₹220 crore, comprising 1.57 crore equity shares.

The price band was fixed at ₹140 per share.

Subscription Status: - The IPO was subscribed 53.78 times overall.

Retail investors' portion was subscribed 19.40 times.

Non-institutional investors (NII) subscribed 113.03 times.

Qualified institutional buyers (QIBs) subscribed 69.51 times.

Key Participants: - Monarch Networth Capital Ltd acted as the book-running lead manager.

MUFG Intime India (formerly Link Intime) is the IPO registrar.

-330

June 02, 2025· 11:40 IST

Scoda Tubes IPO allotment Live Updates: How to check Scoda Tubes IPO allotment status on the MUFG Intime website

- Step 1: Visit the IPO registrar’s portal at https://in.mpms.mufg.com/Initial_Offer/public-issues.html

- Step 2: In the 'Select Company' dropdown, choose Scoda Tubes IPO Limited.

- Step 3: Select your preferred search option — PAN, Application Number, DP ID, or Account Number.

- Step 4: Enter the required details based on the option you selected.

- Step 5: Click on Search.

- Your IPO allotment status for Scoda Tubes will be shown on the screen.

-330

June 02, 2025· 11:30 IST

Scoda Tubes IPO allotment Live Updates: Here's step-by-step guide to check share allotment status online

- Step 1: Go to the BSE IPO allotment page using this link – https://www.bseindia.com/investors/appli_check.aspx

- Step 2: Under ‘Issue Type’, select Equity.

- Step 3: From the ‘Issue Name’ dropdown, choose Scoda Tubes Limited.

- Step 4: Enter your Application Number or PAN.

- Step 5: Check the box for ‘I’m not a robot’ and click Search.

- The allotment status for your Scoda Tubes IPO application will then appear on the screen.

-330

June 02, 2025· 11:29 IST

Scoda Tubes IPO allotment Live Updates: Scoda Tubes IPO allotment in focus today

Scoda Tubes Ltd is expected to finalize its IPO allotment shortly. The company's public offering, which drew strong investor interest during the subscription period, has now closed for bidding. Attention has now shifted to the allotment status, which is likely to be announced today, June 2.

-330

June 02, 2025· 11:03 IST

Business news live: Gold prices climb as tariff jitters lift safe-haven demand

- Gold prices climbed on Monday as an escalation in the Russian war in Ukraine and U.S. President Donald Trump's fresh threat to double tariffs on imported steel and aluminum prompted investors to seek refuge in safe-haven bullion.

- Spot gold was up 0.7% at $3,311.33 an ounce, as of 0416 GMT. U.S. gold futures rose 0.6% to $3,335.40. - Reuters

-330

June 02, 2025· 10:57 IST

Sensex falls 600 pts, Nifty below 24,600: Tariff tensions, other key factors behind market decline

The benchmark equity indices fell sharply on Monday, with the BSE Sensex tumbling nearly 600 points and the NSE Nifty slipping below the 24,600-mark as global tariff tensions, weak cues from Asian markets, and heavy selling in IT and metal stocks spooked investor sentiment. The Sensex nosedived 573.69 points or 0.70 percent to 80,877.32, while the broader Nifty dropped 162.75 points or 0.66 percent to 24,587.95. IT and metal shares led the decline, while foreign fund outflows and geopolitical tensions also weighed on the mood. Market breadth remained mixed, with 1,783 stocks advancing, 1,565 declining, and 165 remaining unchanged on the BSE. (Read More)

-330

June 02, 2025· 10:02 IST

Weak market debut: Leela Hotels shares list at 7% discount to IPO price

The shares of Schloss Bangalore, the operator of luxury hotels and resorts chain under The Leela brand, were listed on NSE at Rs 406 apiece. This marks a discount of 6.67 percent over the IPO price of Rs 435 apiece. On BSE, the shares of the company listed at Rs 406.50 apiece, marking a discount of nearly 6.55 over the IPO price. (Read More)

-330

June 02, 2025· 09:51 IST

Leela Hotels IPO Listing Live: Ahead of listing, Leela Hotels trade at Rs 406 in BSE pre-open - What you should do?

-330

June 02, 2025· 09:46 IST

Aegis Vopak Terminals shares trade at this level ahead of listing

-330

June 02, 2025· 09:38 IST

Leela Hotels IPO Listing Live: Ahead of listing, Leela Hotels trade at Rs 399 in BSE pre-open - What you should do?

-330

June 02, 2025· 09:34 IST

NSE's valuation jumps 60% to $58 billion ahead of IPO

Growing hopes for a listing of the world’s biggest equity-derivatives bourse have pushed the valuation of the National Stock Exchange of India Ltd. to $58 billion in private markets, according to people involved in recent transactions. Wealthy investors and institutions anticipating an initial public offering as early this year have been buying the unlisted shares aggressively, two of the people said, asking not to be identified as the deals are private. With demand far outstripping supply, the stock has changed hands for as much as Rs 2,000 ($23) recently. Its valuation had already doubled in just four months to as much as $36 billion in September. (Read More)

-330

June 02, 2025· 09:27 IST

Leela Hotels Share Price: Check pre-open levels

-330

June 02, 2025· 09:19 IST

Rupee check

Rupee rises 6 paise to 85.49 against US dollar in early trade.

-330

June 02, 2025· 09:13 IST

Sebi, stock exchanges discussing revamp of rules for market makers of SME IPOs

Capital market regulator Sebi is considering reviewing various norms for SME IPO market makers, or brokers who provide act as facilitators to provide liquidity for the newly-listed securities on the platform by quoting both buy and sell rates, people familiar with the development told Moneycontrol. Market making is a mandatory function for all securities listed and traded on the SME Exchange. (Read More)

-330

June 02, 2025· 09:09 IST

Aegis Vopak Terminals shares to list shortly - should you buy, sell or hold?

Shares of Aegis Vopak Terminals Ltd, a subsidiary of Aegis Logistics, are set to debut on the exchanges shortly after its initial public offering (IPO) garnered 2.09 times subscription by the close of bidding on Wednesday. (Read More)

-330

June 02, 2025· 08:47 IST

Primary market action next week: 10 listings scheduled along with 1 new IPO launch

After healthy activity last week, the action is expected to be muted in the primary market as the mainboard segment will be quiet with no new IPO launch, while the SME section will see single new public issue opening next week starting from June 2. Ganga Bath Fittings is the only new IPO hitting Dalal Street next week on June 4, with price band of Rs 46-49 per share from the SME segment. The company intends to raise Rs 32.65 crore via public issue, and the offer will close on June 6. (Read More)

-330

June 02, 2025· 08:09 IST

Stocks to Watch Today

Tata Motors, M&M, Niva Bupa, Alembic Pharma, IRCON, Godrej Properties, Titagarh, AstraZeneca, Genus Power, Nykaa in focus on 2 June (Read More)

-330

June 02, 2025· 07:54 IST

Business news live: India rupee, bonds expected to move higher in run-up to RBI policy decision

- The Indian rupee is likely to kick off the week on a positive note, boosted by stronger-than-expected economic growth data, and, alongside government bonds, will be influenced by the central bank's monetary policy decision, due on Friday.

- The rupee closed at 85.5075 against the U.S. dollar last Friday, down 0.4% in a week dominated by choppy price action across forex markets.

- Data after the market close on Friday showed India's gross domestic product (GDP) grew 7.4% in the January-March quarter, the fastest in a year, and above economists' expectations of 6.7%. - Reuters

-330

June 02, 2025· 07:49 IST

Leela Hotels Share Price: Anand Rathi Wealth has this forecast for Leela Hotels Listing

“At the upper end of the price band, the company is valued at a P/E ratio of 266.8x, a P/S ratio of 11.2x, and an EV/EBITDA multiple of 30x. Considering these high valuation metrics, we expect the stock to see only limited upside on listing,” said Narendra Solanki, Head of Fundamental Research (Investment Services) at Anand Rathi Wealth Ltd.

-330

June 02, 2025· 07:48 IST

Leela Hotels Share Price: Leela Hotels shares may list at marginal gains, say experts; recommend 'long-term hold'

Shares of Schloss Bangalore Ltd, the company behind the Leela Palaces, Hotels and Resorts chain, are expected to debut with modest gains when they list on the stock exchanges on Monday, June 2, according to market analysts. However, overall sentiment suggests that the listing may see a muted start. (Read More)

-330

June 02, 2025· 07:13 IST

Aegis Vopak Terminals Share Price: What you need to know about company - Quick profile

- Aegis Vopak Terminals Ltd. is a strategic joint venture between Aegis Logistics Limited (India) and Royal Vopak (Netherlands).

- The company operates a network of 20 tank terminals across six major Indian ports: Haldia, Kandla, Pipavav, JNPT (upcoming), Mangalore, and Kochi.

- It has a liquid storage capacity of 1.7 million cubic meters and 201,000 metric tonnes (MT) for LPG.

- The terminals play a vital role in the storage and transportation of:

- LPG

- Crude and refined oil

- Liquid chemicals

- Petrochemicals

- Industrial gases

- Bitumen

- Vegetable oils

-330

June 02, 2025· 06:56 IST

Aegis Vopak Terminals Share Price: All you need to know about Aegis Vopak Terminals IPO

Aegis Vopak Terminals launched a 100% book-built IPO, valued at Rs2,800 crore, which opened for bidding on May 26 and closed on May 28—mirroring the timeline of Leela Hotels. On the final day, the IPO was subscribed 2.20 times overall, indicating relatively lower investor interest compared to the stronger demand seen for Leela Hotels. The bulk of the subscriptions came from qualified institutional buyers (QIBs), who subscribed 3.47 times their allotted quota. However, the non-institutional and retail investor categories did not see full subscription. The offer was priced at Rs 235 per share.

-330

June 02, 2025· 06:32 IST

Leela Hotels Share Price: Why Schloss Bangalore Ltd is seen as a strong long-term opportunity? Mehta Equities explains

- At the upper price band of Rs435 per share, the IPO values the company at a market capitalisation of Rs14,527 crore.

- Based on projected FY2026 earnings and the fully diluted post-IPO equity, the enterprise value (EV) to EBITDA ratio stands at 21x.

- This valuation is considered fair when compared to industry peers.

- The company’s portfolio includes strategically located assets and enjoys premium brand positioning.

- Backing from a global institutional investor adds further credibility and strength.

- Overall, Schloss Bangalore Ltd is seen as a strong long-term opportunity in India's growing luxury and tourism market. – Rajan Shinde, Research Analyst, Mehta Equities

-330

June 02, 2025· 06:08 IST

Leela Hotels Share Price: Mehta Equities says this about Leela Hotels IPO

- The company holds a strategically located portfolio of luxury properties in both business and leisure destinations with high barriers to entry.

- This positioning allows it to maintain premium pricing and strengthen its brand equity over time.

- Its comprehensive luxury ecosystem supports a well-diversified revenue stream.

- A significant portion of room revenue comes from direct bookings, with around 47% of guests being international—demonstrating strong global appeal.

- Non-room revenue also plays a substantial role, enhancing overall income diversification.

- Schloss, the parent brand, is backed by Brookfield—an alternative asset manager with US$1 trillion in AUM and a strong operational footprint in India, offering strategic and financial backing.

- Financial performance highlights:

- Revenue growth of 35.8% in FY2024 and 14.7% in FY2025.

- Turnaround from a net loss of Rs 2.12 crore in FY2024 to a profit of Rs 47.65 crore in FY2025. - Rajan Shinde, Research Analyst, Mehta Equities

-330

June 02, 2025· 06:07 IST

Leela Hotels Share Price: What to expect from listing of Leela Hotels IPO

Gaurav Garg from Lemonn Markets Desk commented on the Leela Hotels IPO, stating, "The Grey Market Premium (GMP) stayed steady throughout, indicating cautious market sentiment and modest expectations for listing gains. However, those looking at medium to long-term investments should consider subscribing."

-330

June 02, 2025· 06:06 IST

Leela Hotels Share Price: What's latest GMP for Leela Hotels IPO

According to Investor Grain, the latest grey market premium (GMP) for Leela Hotels' IPO stands at Rs 2. Given the IPO price band of Rs 435, the estimated listing price is projected at Rs 437 (cap price plus the current GMP). This implies a potential gain of approximately 0.46% per share.

-330

June 02, 2025· 06:05 IST

IPO Listing Live Updates: Know about Leela Hotels IPO

Leela Hotels launched a 100% book-built IPO valued at Rs 3,500 crore, which was open for subscription from May 26 to May 28. Share allotment occurred on May 29. The issue was priced at Rs 435 per share. The IPO saw robust investor interest, being oversubscribed 4.72 times by the final day. Notably, qualified institutional buyers led the charge with a subscription of 7.82 times their allocated portion, while the non-institutional segment subscribed 1.08 times.

-330

June 02, 2025· 06:03 IST

IPO Listing Live Updates: Aegis Vopak Terminals vs Leela Hotels on BSE, NSE today

Good morning and welcome to our live coverage of latest business news today. It's a busy Monday in the primary market as two mainboard IPOs are set to list on both BSE and NSE at 10 am today. We have Leela Hotels and Aegis Vopak Terminals locking horns for listing showdown. Stay with us as we bring you latest on GMP, guidance from the experts and much more.