The ongoing Indian Premier League (IPL) T20 cricket tournament is expected to boost sales of smart TVs, with growth of at least 10 percent anticipated in March and April. This comes after a challenging 2023, which saw the departure of prominent brands OnePlus and Realme from the Indian market.

During the IPL season, the sale of smart TVs is projected to surge by over 10 percent, particularly in larger screen sizes, such as 55 inches and above, experiencing a more than 30 percent increase in sales in March and April, said Anshika Jain, a senior analyst at Counterpoint Research, highlighting the preference for larger screens for an enhanced viewing experience.

Xiaomi, Sony, LG, Haier and Super Plastronics Pvt Ltd (SPPL) expect a surge in demand during the IPL and have rolled out offers to boost sales further.

Xiaomi, for instance, is offering discounts of up to 40 percent on its 4K TVs, expecting a surge in demand for larger screens suitable for group viewing during the IPL season.

Super Plastronics' CEO, Avneet Singh Marwah, told Moneycontrol that the company expects a 10 percent surge in TV sales during the IPL.

SPPL sells TVs under the Kodak, Thomson, Blaupunkt, and Westinghouse brands.

Sony India is rolling out offers such as extended warranties, cashback deals, and zero-down payment financing options during the IPL to capitalize on the cricketing event. Ranvijay Singh, Head of the BRAVIA television business, emphasized the positive market sentiment driven by IPL, particularly for large-screen televisions.

Abhiral Bhansali, Business Head of Home Entertainment at LG India, said that the company is witnessing good growth in sell-outs, especially large-screen TVs (65 inches and above). "In this category, growth is around 40 percent."

Haier Appliance India President NS Satish also expects a positive response for the company's premium TVs. He said the brand is seeing a consistent demand for 55-inch, 43-inch, and 32-inch screen sizes.

Arjun Bajaj, Director at Videotex, said that the company experienced a 50 percent increase in sales of 43-inch TVs compared to increased demand for 32-inch TVs this season. "As demand gravitates towards enhanced viewing experiences, shipments for 55-inch and larger sizes have surged by almost 10-15 percent, particularly for the 4K segment."

Videotex makes TVs for Toshiba, Lloyd, Vise by Vijay Sales, BPL & Reconnect by Reliance group, Hyundai and more than 20 Indian and international brands.

Market to grow in 2024

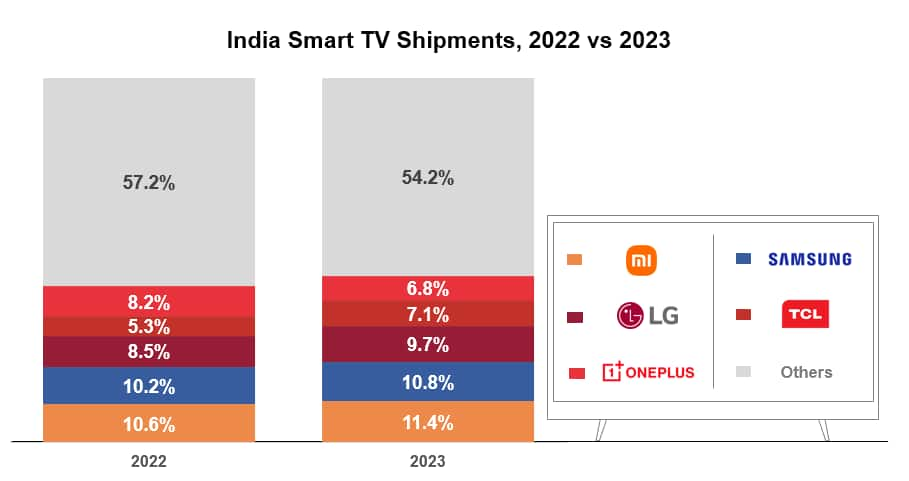

India’s smart TV shipments declined 16 percent year-over-year in 2023 due to a slow start in the first half of the year, macroeconomic challenges, and excess inventory. According to Counterpoint data, an increase in panel prices and reduced demand for smaller screen-size smart TVs also led to the exit of certain long-tail brands in 2023.

However, smart TV penetration reached 93 percent of the overall TV shipments during the year, and the share is expected to continue rising.

Smart TV sales will remain flat in the January-March quarter of the 2024 calendar year, but sales could increase in the April-June quarter with new models and offers likely from leading TV brands.

Smart TV sales will remain flat in the January-March quarter of the 2024 calendar year, but sales could increase in the April-June quarter with new models and offers likely from leading TV brands.

Jain said the overall market is expected to grow by nine percent in 2024, adding that consumers will upgrade their TVs and move to premium products with better features in the year.

Navkendar Singh, AVP of devices research at IDC Asia Pacific, echoed similar sentiments, anticipating market growth in 2024 with a temporary boost from IPL in the first half of the year. He said smaller brands might see an opportunity to attract attention from budget-conscious consumers while the average selling price rises.

TV prices to go up from April

Both Singh and Jain, however, cautioned that the open cell price increase that started in 2022 will continue to rise, driving up average TV prices, which can dent demand.

Open cells are one of the main components in television sets and account for 60-65 percent of the manufacturing cost. Industry executives said that four to five companies in China control the production of open cells globally, so the pricing power of open cells remains in their hands.

The Indian TV industry has been grappling with price increases following the pandemic, with open cell prices rising by 45-50 percent over the past year. Manufacturers anticipate this trend continuing, with open cell prices expected to rise further in April and May.

Marwah said that open cell prices increased by 7-10 percent in March, and a similar increase is expected in April and May. “By the end of March, most brands will have cleared stocks from last year, and new pricing for TVs will come out in April. We don’t have any choice but to increase prices since we can’t take a lot of burn and have to pass it on to consumers in April.”

Bajaj said India's dependency on specific countries and companies for open cell exposes Indian companies to significant price fluctuations. "The recent rise in prices can be attributed to production cuts implemented by open-cell manufacturing companies to generate scarcity in the market, which has led to a 3-8 percent increase in television manufacturing costs."

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.