Everyone seems to be talking about the oil price rise.

While there is reason to worry, there are indicators that point the other way. Let’s take India’s bond yields. They are said to be highly sensitive to oil-price spike. But, this time around, bond markets have been somewhat calmer. Perhaps it is discounting it all as “transitory?” Then there is the fiscal maths, which looks somewhat comfortable, given that Budget 2022-23 had already accounted for higher borrowing amidst conservative revenue and output projections.

Given all that, it is still worthwhile to spend time analysing how fiscal maths changes with the rise in oil prices.

First, let’s see what the rise in crude prices mean for fiscal maths.

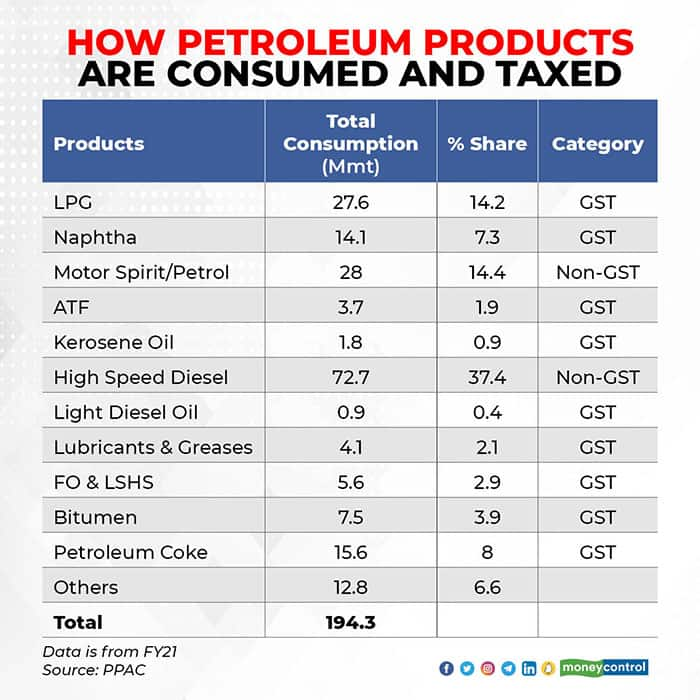

India consumes close to 200 MMT of petroleum products every year of which 52% is petrol and high speed diesel. For taxation purposes, the government divides petroleum products into GST goods and non-GST goods. Let’s look at the numbers here-

The taxation on these differs. For Non-GST goods, there are two broad categories–i) Customs and ii) Excise duties. Centre’s fiscal deficit numbers will largely be impacted by the change in excise duties.

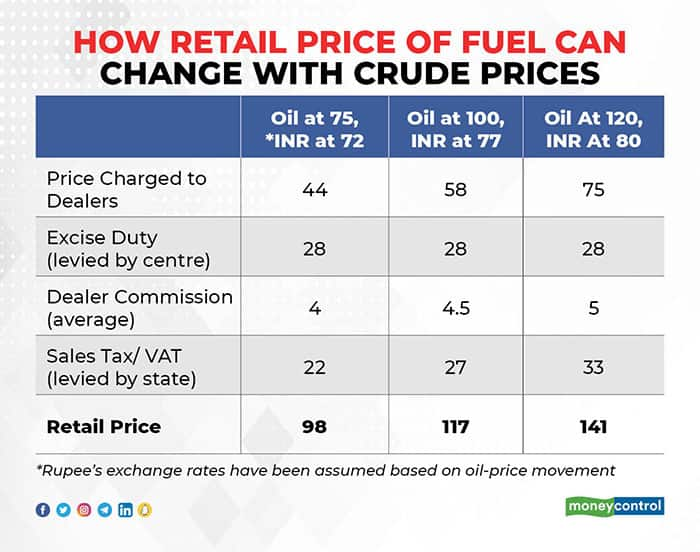

Now let us also look at how a change in global crude prices affects the final retail price to the consumer.

Clearly, there are many moving factors when we look at the impact of global crude prices on the prices borne by the final consumer, with of course global prices and exchange rate being the key drivers.

Hypothetically, if oil stays at $100/barrel for a year, pump petrol prices could be near to Rs 117 to Rs 120/litre. If oil goes further up to $120/barrel, pump prices could be close to Rs 140-145/litre. This is when any sharp movements in dealer’s commission/state VAT is not assumed.

Now how much of it will be absorbed by the Centre is key, to determine how it will impact the fiscal-deficit target and the final consumer. If the government passes the increased oil price entirely to the consumer, then there is no direct impact on government’s revenue. However, the oil demand itself could fall when the prices are high and that could reduce the excise collections. We could lose ~4% of petrol demand if the all India prices soar up by another Rs 20/litre.

Of course, again higher oil prices reduce the income available for consumption and therefore negatively impacts output. Roughly oil price averaging at $100/barrel for the year could hurt growth close to 90 bps. An Rs 20/litre spike in pump prices can increase inflation by 5bps(directly) and close to 10bps indirectly.

Read also: Oil shock should be mitigated through fiscal actions

But what could hurt the fiscal maths the most is if the central government decides to cut excise to protect the retail prices. For every Rs 5 cut in excise on petrol and diesel, the fiscal cost is roughly Rs 550 billion annually. Since India consumes close to 28MMT of petrol but more than 72MMT of diesel, the cost is more for reduction of excise for diesel than it is for petrol.

Here’s the more interesting bit though: in fuel maths, 1+1 does not always equal 2. Even if global crude prices are up, the exchange rate, change in demand and the overall economic sentiment all plays a vital role.

For FY22, the fiscal maths appears to be on track since the damage from high crude prices is only at the fag end of the year. Plus, nominal GDP could be higher at about Rs 236 trillion from the budgeted Rs 232 trillion again creating some space. At the same time, LIC IPO being moved to the next year reduces some of the divestment revenues. Overall, FY22 budgeted fiscal deficit of 6.9% is likely to be met with a good enough chance of it being even lower by 20bps.

If oil averages $100/barrel

For FY23, it is known that GoI budgets were made with oil average of $75/barrel. The current spike in oil could well be transitory and FY23 average could be lower, therefore requiring no change in GoI revenues. However, if oil averages $100/barrel next year and excise is cut by Rs 10 on both petrol and diesel, it will cost the fiscal approximately Rs 1.10 trillion or roughly lose 0.4% of GDP, ceteris paribus.

Unlike the Centre, the state governments levy VAT on the final sales value of the oil and they could in fact benefit from the higher oil prices. It is estimated that states could gain close to 0.1% of GDP. Therefore, net impact on overall fiscal is likely to be close to 0.3% of GDP.

As far as the government borrowing is considered, it is highly unlikely that they will borrow more than budgeted from the market. Some it could be financed via huge cash balances and more issuances of treasury bills instead.

However, all of this depends on the trajectory of oil hereon. The maths will go out the window when the condition of “ceteris paribus” is done away with. After all, in the real world, nothing is constant.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.