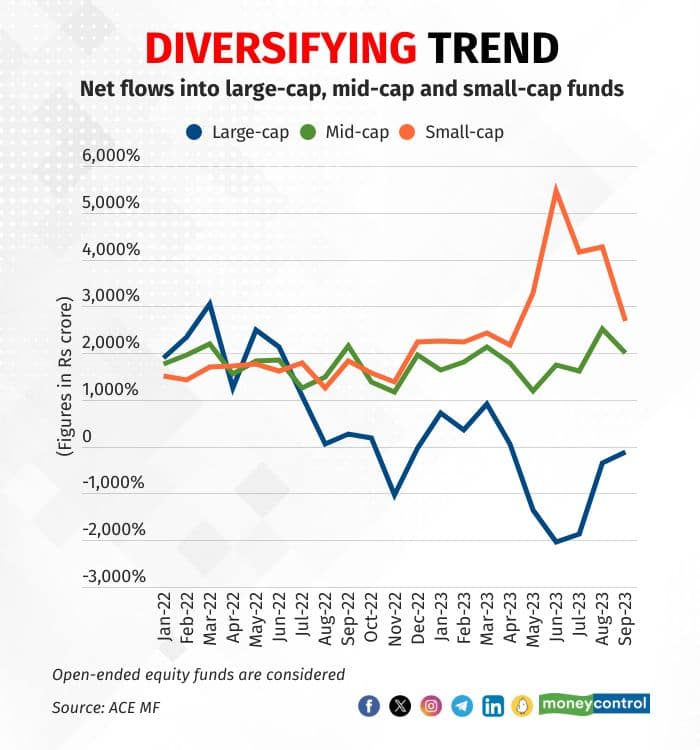

Inflows into equity mutual funds dropped by over 30 percent to Rs 14,091 crore in September, with large-cap funds still experiencing outflows, as per data from the Association of Mutual Funds in India (AMFI) released on October 11.

Open-ended equity mutual funds had recorded a 165 percent surge in net inflows to Rs 20,245 crore in August driven by heavy demand in small-cap and sectoral funds.

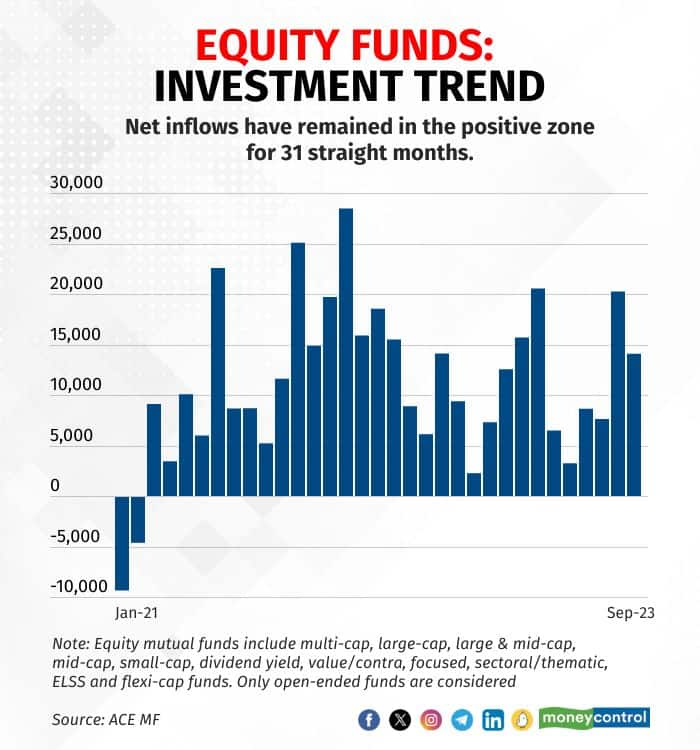

Despite the volatility in the local equity markets, net inflows into equity funds have continued to remain in positive territory for the 31st consecutive month, starting from March 2021. During September, the BSE benchmark Sensex recorded a 1.5 percent increase, with NSE Nifty 50 also rising by 2 percent, while BSE MidCap and SmallCap saw gains of 3.7 percent and 1.1 percent, respectively.

Meanwhile, smallcap and midcap funds saw a dip in inflows in September amid huge volatility in local equities and rich valuations. The net inflow in midcap and smallcap saw over 20 percent dip to Rs 2,000 crore, and a 37 percent decline to Rs 2,678 crore, in September.

Read: SME IPOs: How they are rigged and why in September?

"People took some profits from large and mid-cap stocks, but small-cap stocks are still popular. September was a good month for mutual funds because the market was doing well," said N. S. Venkatesh, Chief Executive, AMFI.

Melvyn Santarita, Analyst – Manager Research, Morningstar said, investors, be aware that midcap and small-cap investments can bring good returns but come with high volatility. For these, think long-term. Consider SIP investing to manage risk and average out returns over time.

Total assets under management (AUM) of open-ended funds at the end of September stood at Rs 46.58 lakh crore, slightly lower than the previous month's figure of Rs 46.63 lakh crore, while the equity AUM contribution increased to Rs 19.08 lakh crore from the previous month's Rs 18.6 lakh crore.

AMFI data also showed that the contribution via systematic investment plans (SIPs) hit a fresh all-time high of Rs 16,042 crore in September. Also, in August, the SIP book was at a record high of Rs 15,245 crore. The number of SIP accounts hit an all-time high of 7.13 crore in September. New account additions were 36.77 lakh and matured accounts stood at 20.69 lakh during the month.

Debt funds outflow

Debt-oriented schemes experienced a second consecutive month of net outflows, with September witnessing an outflow of Rs 1.02 trillion, compared to Rs 25,873 crore in August.

Read: Top smallcap funds add these stocks despite high market valuations

Liquid and money market funds saw outflows of Rs 74,176 crore and Rs 9,157 crore, respectively. Among the various schemes, Gilt funds and long-duration funds attracted inflows, while all other schemes, including Ultra Short Duration Fund, Low Duration Fund, Short Duration Fund, Medium Duration Fund, Medium to Long Duration Fund, Dynamic Bond Fund, Corporate Bond Fund, Credit Risk Fund, Banking and PSU Fund, and Gilt Fund with a 10-year constant duration, experienced outflows.

"Debt-oriented schemes had anticipated outflows, possibly due to the quarter-end and half-year-end in September. Corporates withdrew funds for half-yearly taxes, while banks needed extra capital for these funds," added Venkatesh.

Moreover, Santarita said investors mostly avoided debt investments, with outflows in most categories except Long Duration and Gilt Funds. These two categories gained popularity as investors anticipated a change in interest rates. Additionally, a late September equity market correction may have encouraged investors to shift to equities in hopes of higher returns.

Gold ETF

Domestic gold exchange-traded funds saw net inflows of Rs 175 crore in September compared to Rs 1,025 crore in August. Venkatesh said gold ETF inflows have dropped due to a stronger dollar. However, in times of global tensions, people may invest in gold, although not significantly, but it will still bring in a good amount of money, he added.

In other categories, hybrid funds saw net inflows of Rs 18,650 crore, up 9.2 percent on a month-on-month basis, driven by heavy demand in arbitrage funds (Rs 10,175 crore) and multi-asset allocation funds (Rs 6,324 crore).

"Hybrid funds experienced an uptick in net inflows on a month-on-month basis. This trend reflects the prevalent risk-off sentiment in the market, with investors seeking to diversify their investments while maintaining a focus on capital protection” said Akhil Chaturvedi, Chief Business Officer, Motilal Oswal Asset Management Company.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.